Variational: OLP and the Perps Capital Rotation

Volume + OI growth, Incentive-driven capital, OLP RFQ engine, and More

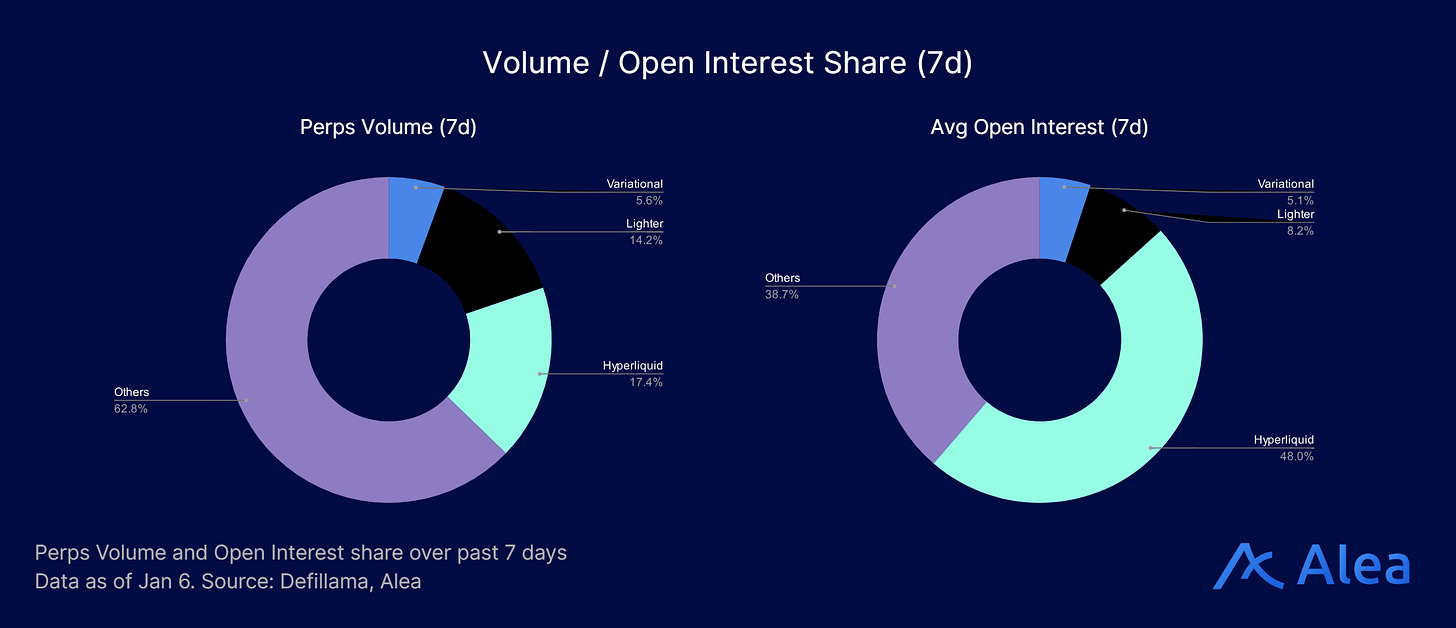

Monthly perp volumes have sustained over $1T the last 3 months, with DEX-to-CEX perp ratios hitting all time highs of 19%. This is the clearest indicator that Perp DEX venues are moving from a niche alternative market to a value class of its own.

However the market structure now still shows a meaningful share of flow is incentive-driven, not loyal. The same wallets that chased Hyperliquid, then Lighter, continue to scan for the next points program, looping the same strategy. Those rotations temporarily distort volume, open interest, and perceived PMF.

Variational potentially sits at a position as the “next farming venue”. They pitch a structurally different perp venue of using an RFQ + a vertically integrated market maker (OLP) while running a points program.

In this edition, we’ll look into incentive-driven perps rotations, Variational’s OLP design, and what to monitor for “real” liquidity quality.

Introduction to Variational

Variational was founded by Lucas Schuermann and Edward Yu (hedge fund, quant backgrounds), raising $10.3M in a seed round and a $1.5M strategic round with backers such as Coinbase Ventures, Bain Capital, Dragonfly and more.

They are an infrastructure layer providing offchain and onchain infrastructure to price, settle and clear trades done via apps built on top of Variational including:

Omni - retail-facing RFQ perps venue where users requests a quote from the Omni Liquidity Provider (OLP), receives a price, and accepts if it’s good enough.

Pro - serves institutions with customizable OTC‑style derivatives. (waitlist)

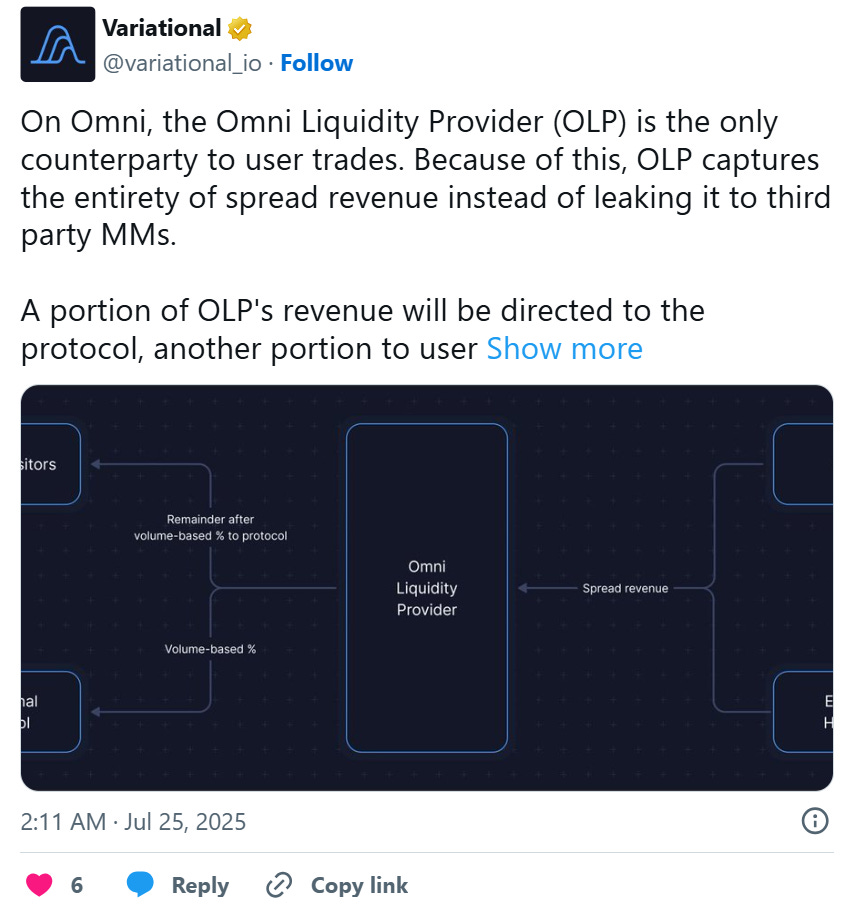

The OLP is essentially a vault of capital that serves as the market making and risk-management engine. It internally executes trades and then hedges exposures on external venues, capturing the full bid–ask spread minus hedging costs. OLP deposits are currently team-seeded, but it is part of the roadmap to open deposits to users.

The clearest difference with Omni’s OLP vs Hyperliquid’s HLP or Lighter’s LLP is that the OLP is the sole counterparty. With HLP/LLP, these vaults participate and serve as the backstop on the orderbook, but are not the universal counterparty.

The core benefit that Omni offers are:

Zero maker/taker fees because the protocol profits from spreads.

Tight spreads on long-tail assets as OLP aggregates CEX, DEX, and OTC liquidity.

All spread revenue flows to protocol, not external MMs. This is where loss refunds come from too.

Risk controls. OLP rejects quotes in extreme volatility (last-look), ring-fences risk via independent settlement pools, uses dynamic hedging.

The Current Regime: Incentive‑Driven Capital Rotation

Perps are increasingly a distribution game. Every platform competes on lower fees, and fees are already near-zero (if not already zero as in the case with Omni), the remaining variables are

execution quality (spreads + slippage),

product offerings

incentives which attract both takers and makers, paying someone to keep spreads tight. When those subsidies fade, markets often discover their “true” liquidity quality.

This is why the current perps wars matter more than headline volume. Weekly volume can be gamed but spread stability and OI persistence are harder to fake. Even the category leaders are being judged through this lens.

Funding and ownership narratives are also part of this competition. Hyperliquid’s “0 VC + community rewards” framing is a major contributor to its momentum, and a reason challengers may struggle to replicate its reflexive loyalty loop. Variational and Lighter by contrast have raised funds. For allocators, this doesn’t make it bad, but it does change the tokenholder dynamics once points incentives turn into tokenomics.

Strategic Incentives

Since OLP serves as the sole in-house liquidity provider, the ideal case is that more value is retained and can be redeployed into trader-facing benefits (0 fee trades, loss refunds, tier bonuses, etc.).

The strategic bet is for OLP to eventually quote competitively across many markets, meaning users get scalable market coverage without begging third-party MMs to support long-tail pairs.

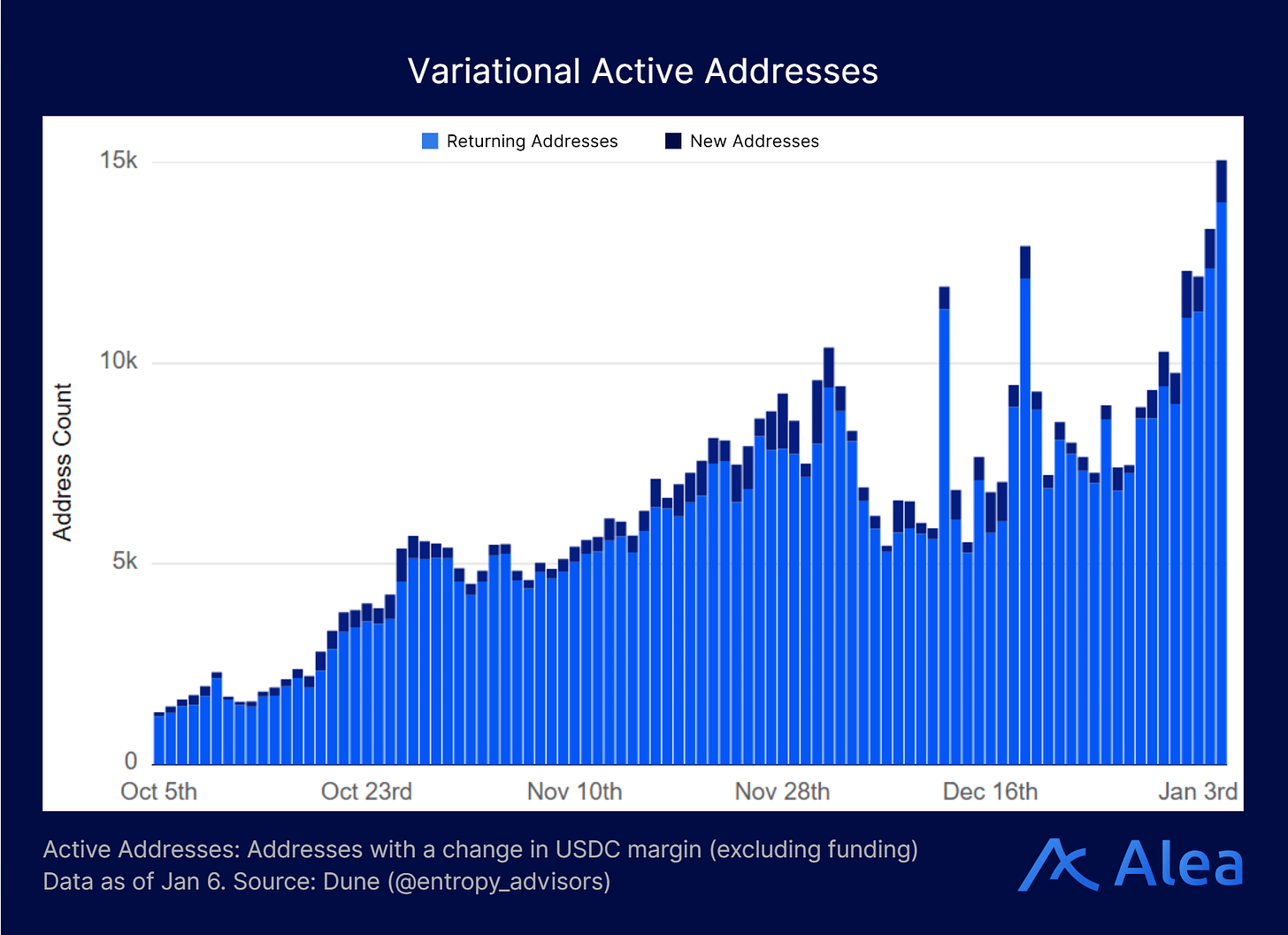

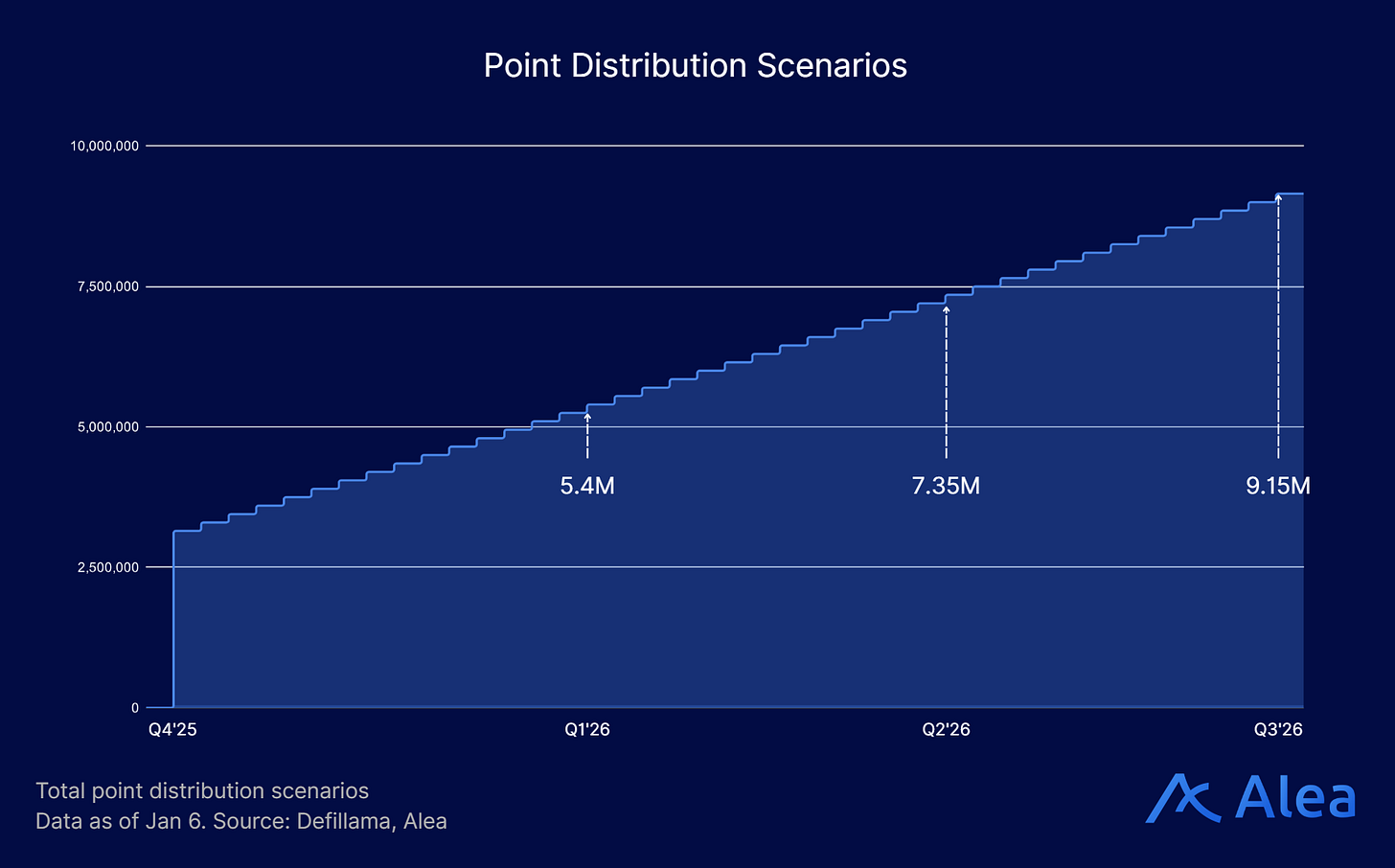

Omni’s points distributions officially kicked off in December 2025, retroactively distributing 3M to existing traders, with 150K per week up to Q3 2026 (latest). This places Variational directly in the current capital rotation meta: attract flow now, then prove retention later.

In terms of $VAR token, which has already been soft launched in the docs, states that $VAR utility is expected to be driven by using a minimum of 30% of protocol revenue to purchase and burn $VAR, and that the team plans to distribute ~50% of tokens to the community (does not indicate entirely airdrop).

Variational At a Glance

Open Interest: ~$900M (Rank 5 on Defillama)

Avg Daily Volumes: $1.7B

Active Addresses: 15K

(However, 3M retroactive points were dropped to 27K addresses)

Points Distribution: 3M retroactive; 150K/week starting 15 Dec, 2025, ending no later than Q3 2026.

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.