TreadFi: Automating Market-Making for All - What You Need to Know

Market Maker and Delta Neutral Bots, Efficient Point Farming, and More

Deposit programmes and points races have become the meta of late 2024 to 2025. Hyperliquid, Lighter, and other perp venues are offering points for trading volume, while MegaETH’s raise and a host of other DeFi projects are handing out boosts to early depositors.

Yet most of these programmes assume traders already have the tools to generate steady flow without taking directional risk. TreadFi responds to that by providing a professional‑grade algorithmic trading terminal that turns any connected account into a high‑frequency market‑maker.

By automating liquidity provision across both centralized and decentralized exchanges, TreadFi allows retail and professional users to farm points and earn spread while minimizing directional exposure.

In this edition, we look at what TreadFi does, how its market‑maker and delta‑neutral bots work, and where it fits into the current incentive‑driven trading landscape.

Stay informed in the markets ⬇️

The Rise of Retail HFT

Protocols are in the middle of a points‑driven funding war. Hyperliquid, Aster and other perps are awarding leaderboard rewards in which volume plays a part. TreadFi rides this wave by providing an execution engine that automates volume generation without taking on directional risk.

Instead of manually clicking through multiple venues, traders can run the Market‑Maker Bot to farm points on Hyperliquid or other exchanges using relatively small capital. For those seeking funding‑rate arbitrage instead of maker spreads, the Delta‑Neutral Bot offers a way to capture funding income across pairs or venues.

At the same time, the gap between CeFi and DeFi remains a bottleneck. CeFi venues dominate liquidity, but on‑chain protocols can’t verify CeFi positions or volume. TreadFi is building vCeFi (verifiable CeFi). vCeFi aims to change that by producing cryptographic attestations of CEX trading data and publishing aggregated metrics onchain.

If successful, DeFi protocols could condition rewards or risk parameters on provable CeFi behavior, rather than self‑reported volume. This matters in an environment where deposit programmes rely on trust and where CeFi failures have repeatedly burned onchain participants.

How TreadFi Works

TreadFi positions itself as a unified crypto trading terminal and order/execution management system (OEMS). The core platform is built for traders who want to:

Automate order execution using advanced algorithms.

Minimize market impact when placing large orders.

Execute across multiple venues, including both centralized and decentralized exchanges.

Optimize fees by prioritizing maker orders

At its core, TreadFi leverages smart order routing and time‑weighted execution to reduce slippage and maximize maker fills. Traders can connect their CEX and DEX accounts via secure API keys and then execute through either the web interface or a REST API. By abstracting away venue‑specific nuances, the terminal lets users focus on strategy (what to trade and when), while TreadFi’s engine handles the backend order placement.

TreadFi also exposes its execution engine through a Telegram bot, allowing traders to place orders, check balances, pull price charts and cancel trades using simple slash commands.

TreadFi Bots

TreadFi currently has 2 primary bots, the market-maker bot and the delta-neutral bot:

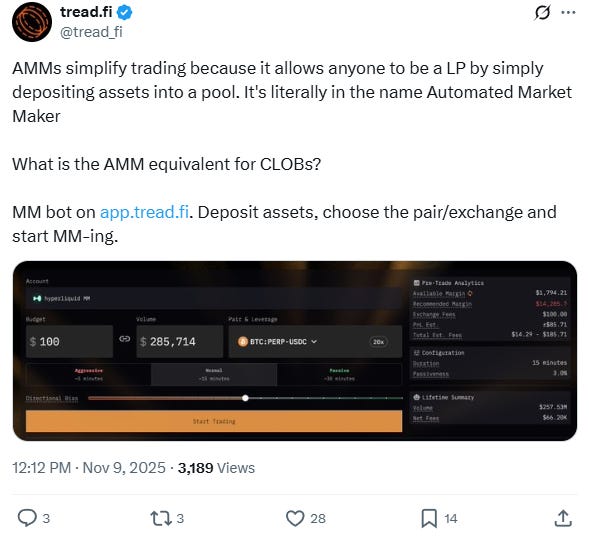

Market‑Maker Bot – This tool simultaneously places buy and sell limit orders around the current market price, splitting the notional equally between the bid and ask. It uses a TWAP (time‑weighted average price) order and only places maker orders to capture spreads and avoid taker fees. Traders can choose aggressive, normal or passive execution modes with different participation rates and minimum durations. Because buy and sell orders are matched against other traders’ market orders, users generate volume without exposure to price swings. In doing so, small accounts are able to generate millions in volume, supply liquidity to earn points and reduce fees via placing maker orders on perp platforms.

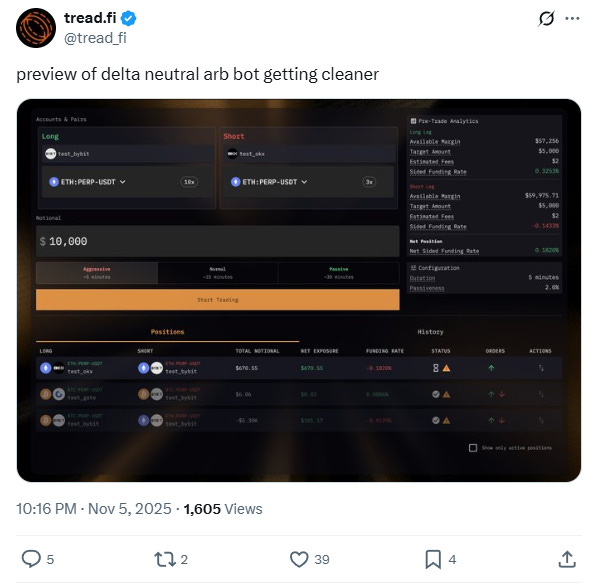

Delta‑Neutral Bot – This bot opens simultaneous long and short positions using a TWAP trajectory to capture funding rate differences across platforms. Users choose the account, pairs, notional size and execution speed, and the bot balances the two legs to neutralize price risk. It supports different pairs for each leg, enabling cross‑asset arbitrage. A built‑in warning system flags unbalanced positions when net exposure exceeds 1%, prompting users to rebalance.

TreadFi recently launched Season 1 of their points program, allowing users to earn points by trading and providing liquidity with a fixed pool of 100K points allocated per week. This will run until May 2026.

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.