State of the Market - Bybit Exploit Aftermath, Market Phases, & More

Market Structure, Upcoming Catalysts, & More

The recent Bybit situation fortunately has not proven catastrophic for the crypto market; it even resulted in a short-lived $ETH rally while other coins fell. This defiant price action has since eased up, after Bybit issued a statement claiming it had accumulated nearly enough $ETH in reserves to cover the $1.5B hole.

While it is positive news that no broader implications came from this exploit, it has made market participants pontificate on the state of the markets. $BTC has remained relatively strong, just 10% or so off of its highs. But $ETH has consistently underperformed, and $SOL has just dove nearly 45%+ in a little over a month. In today’s edition, we’ll discuss changes in the current market structure that might be important to take note of.

State of the Market

The current market has blurred the lines between a ‘bear’ and ‘bull’ market, and it looks like this trend might be the default state for crypto for the time being. On the one hand, $BTC has emerged as a true macro asset, rising along with Gold, equities, and even other assets like Chinese bonds.

On the other hand, demand for non-$BTC assets is not particularly elevated; there are no marginal buyers collectively willing to push up the price of majors like $SOL significantly past ATHs. A situation has emerged where alts are trading like it’s already a bear market, with very few outliers, while $BTC remains strong.

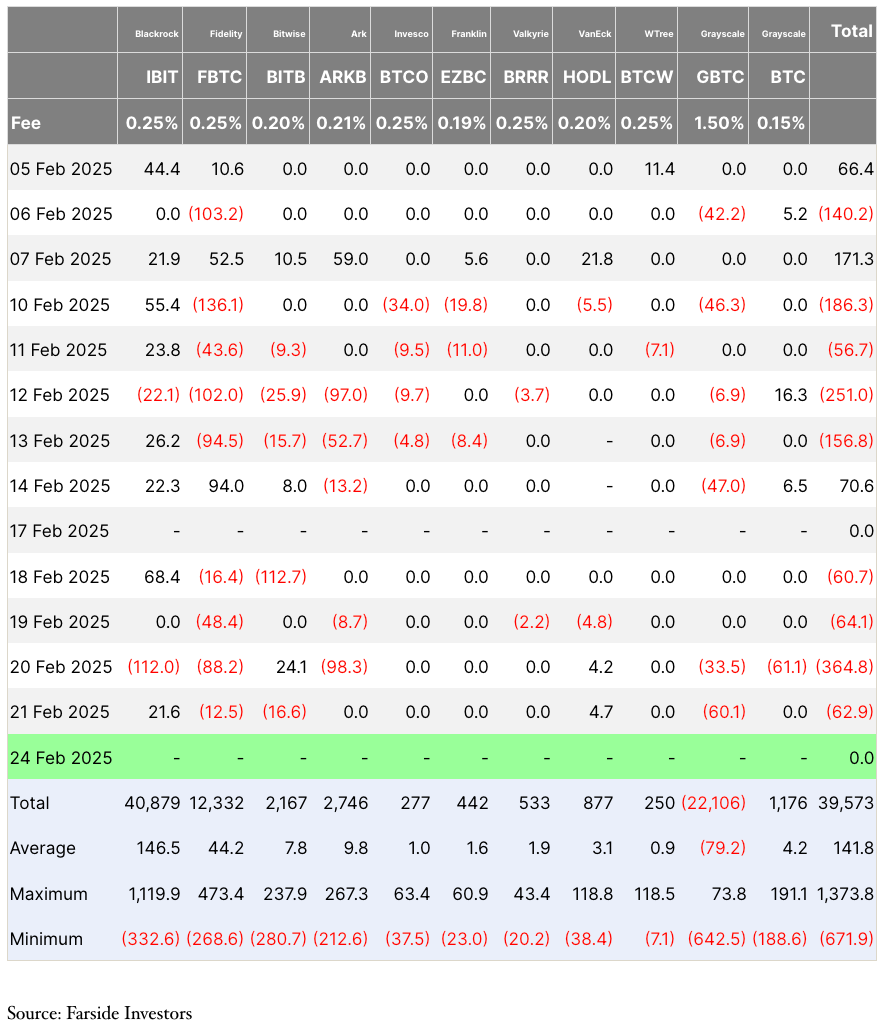

This is due to the structural flows that $BTC has. Capital from buyers including individuals, organizations, and even nation-states purchasing via the ETFs, has proven to be sticky liquidity, with a lot of these flows sticking around. In total, there are nearly $40B in total $BTC ETF inflows. Notably, this net figure includes the ~$20B in outflows from Grayscale.

The rest of the crypto market does not have any structural flows, and is subject to short, volatile spikes upward based on narrative changes. Unlike risk assets like U.S equities, there are no consistent drivers of liquidity into crypto. Stocks have drivers including pensions, marketcap-weighted indexes, and other large, renewing pools of capital that can be counted on to find their way into the market, with the speculative, hot money making up a much smaller percent of the total compared to crypto.

Some factors that could change this market dynamic include significant changes to the crypto ETFs. If Ethereum ETFs that include staking can roll out, this could maybe draw more demand than the current ETFs, which have seen just ~$3B in total inflows.

There is also the matter of Solana ETFs. Franklin Templeton recently filed for a Solana ETF, with an approval deadline set for October, 2025. With a friendlier SEC, having these ETFs in place looks like much more of a reality, though it could take some time. This could potentially see flows from TradFi and other areas into crypto majors, ideally driving a wealth effect for alts, specifically those on Solana.

Beyond ETFs, Robinhood has been relying on crypto more and more, with ⅓ of their Q4, 2024 revenue (~$358M) stemming from crypto. This is an 8x growth rate YoY, and the organization has invested in its crypto business significantly, recognizing the importance of crypto. While Robinhood removed listings of most tokens during the 2022 bear market, this trend has reversed, with the company adding 7 new listings in Q4 alone.

Not to mention Robinhood’s pending acquisition of Bistamp, which aims to bring new functions and new unpenetrated markets to Robinhood that were previously out of reach. If other large, retail-focused platforms take note of this and begin enhancing their crypto offerings, this could also drive more sustainable flows into crypto.

There are other areas of growth, including stablecoin adoption, and institutional use of blockchain that may also be on the horizon. However, it is unclear if usage rates in these areas will have a trickle-down effect for the speculative DeFi, AI, and other areas of crypto that are part of the alts market. This has been observed with the lack of liquidity leaving $BTC and flowing into alts; for things like tokenized treasuries and RWAs, a similar situation might unfold. Still, these areas of growth can seek to legitimize the asset class as a whole, which can potentially bring in new users…

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.