State of Euler - Q1 Growth Analysis: What You Need to Know

$EUL Performance, Contributing Growth Factors, & More

Markets have just bounced back, with risk appetite immediately increasing from the moment Trump announced a 90-day pause of tariffs on all countries not named China. $BTC traded as high as $83.6K before slowly declining, while $SOL price scratched the $120 level.

One of the most consistent top-performing tokens during this market downturn, which began as early as late January, is $EUL (Euler). While the past two months have been catastrophic for most of the crypto market, $EUL is up ~70% in that same time frame.

In today’s edition, we’ll discuss the current state of Euler after its V2 lending market launch in September of last year. We’ll analyze protocol performance, contributing growth factors, & more…

Stay informed in the markets ⬇

Background on Euler

Recovering from a $197M exploit in 2023, Euler v2 was launched in Q3, 2024, with a modular design that challenges incumbent monolithic lending structures. After a short period of liquidity growth on Ethereum mainnet, it was in Q1 2025 when the protocol started growing more aggressively and deploying on other chains.

In Q1 Euler expanded market share with more vaults and strategic deployments on fast-growing chains like Sonic, Berachain, or BOB. The protocol’s capital efficiency has stood out and driven growth on core metrics such as fees, active loans, net deposits, and active users. Despite a general decline in the crypto market in the first quarter of the year, both in price and sentiment, Euler has achieved steep protocol growth throughout Q1, generating $410.28K in total revenue and over $4 million in fees, while active loans reached $423.107M with monthly active users growing and peaking at 12,300.

Much of this momentum is driven by Euler’s modular design, allowing it to rapidly adapt to evolving DeFi demands. New markets have emerged, including Resolv (delta-neutral stablecoin trading), Usuals’ Usual Stability Loan (fixed-rate borrowing against USD0++), Euler Yield (looping stablecoins with yield-bearing tokens), and Apostro BTC (leveraged BTC staking). This flexibility has positioned Euler as the go-to lending protocol for sophisticated strategies that you cannot find on other lending markets like AAVE, Morpho, or Fluid.

Looking ahead, a key upcoming catalyst for Euler’s next growth phase is EulerSwap, a novel AMM built to integrate deeply with Euler’s lending layer. While not yet publicly launched, EulerSwap is designed to address two core inefficiencies in DeFi today: fragmented liquidity and inaccessible yield.

While many protocols rely heavily on token emissions to bootstrap liquidity, Euler v2’s recent growth has been largely organic. As stated by Euler CEO Michael Bentley, $1,963,121.08 in rEUL incentives was reportedly distributed to drive the protocol’s current usage.

Key Takeaways

Over $1B in total deposits on Euler. TVL hit a new ATH and ended the quarter at $891.16 million (total user deposit), a 399.13% QoQ increase. Active loans grew 434.7% QoQ, reaching $423.11 million by the end of the quarter.

$4.39M in protocol fees were generated, with $3.99M going to lenders as interest/yield. Total revenue grew by 647.30% QoQ, ending the quarter with $410.28K. The P/F (price-to-fees) ratio improved from 17.05x to 4.61x.

The circulating market cap of $EUL increased by 17% QoQ in Q1 to $110.28 million on March 31.

In Q1 2025, Euler expanded its ecosystem to five new chains: Sonic Labs, Swellchain, BOB, Berachain, and Base. With 297 vaults live, and at the time of this report, Euler has over 992.97M supplied ($931.21M in Q1) in total supply and a total borrowed of $458.32M ($423.32M in Q1). In Q1 2025 alone, approximately 45.5% of the total supplied capital was utilized.

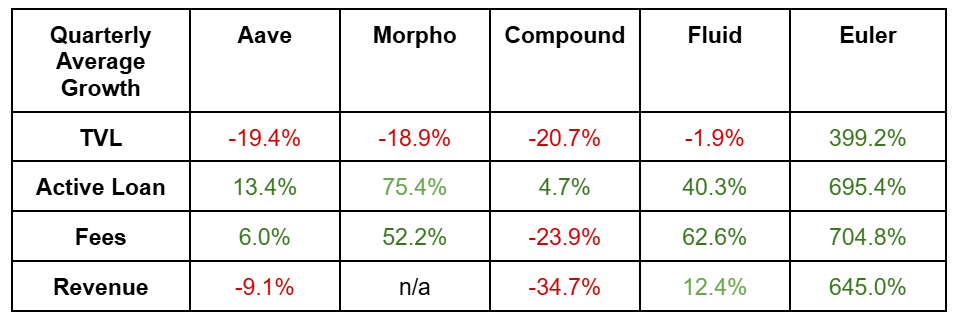

Outperformed major competitors in lending sectors for Q1 2025:

Euler’s V2 Implementation Strategy

Euler Finance, once demonstrating a promising future in DeFi lending with a steadily growing TVL of $263 million, suffered a major financial exploit in March 2023, leading to the loss of approximately $197 million in assets. The attack, which leveraged a flash loan vulnerability, significantly impacted Euler’s financial stability, user confidence, and liquidity standing. Following the exploit, Euler Finance initiated negotiations with the attacker, resulting in the return of the stolen funds.

As v1 was sunset, the team spent the next year refining their new version, implementing the lessons they learned in the past to enable a more capital-efficient lending market. Euler introduced v2 in the second quarter of 2024, with a modular design different from its predecessor and from other competitors. Rather than fragmenting liquidity across isolated markets, Euler focused on capital efficiency by tokenizing both collateral and borrowing vaults. This would be enabled by the Euler Vault Kit (EVK), allowing developers to tailor lending vault designs, and the Ethereum Vault Connector (EVC), a tool for linking ERC-4626 vaults with various smart contracts. This would allow the protocol to achieve interoperability within its ecosystem, allowing the use of vaults as collateral for borrowing. With the EVC, the protocol allows vaults to connect and interact seamlessly, acting as a coordination layer without requiring major modifications, making it ideal for integrating with DeFi systems.

If you found today’s newsletter interesting, we recently published a full-length report breaking down the State of Euler.

In it, we discuss $EUL token performance, fees & revenue analysis, and more. Access our State of Euler report for FREE, no account needed…

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.