Our coverage on all important areas of crypto is pretty expansive; this includes the massive stablecoin sector. While centralized industry favorites like USDC and USDT have native deployments on more and more chains, as stablecoin utility evolves, the demand for decentralized stablecoins grows. Most recently, the advent of native yield stablecoins has seen a lot of attention, as popularized by USDB on Blast.

In today's edition, we’ll be focusing on Stable Jack, which offers a yield-bearing stablecoin, a stable swap service, and more. Stable Jack is a protocol native on Avalanche, a chain that we admittedly haven’t covered as much. This chain shouldn’t be overlooked; AVAX holds $1.85B in stablecoin TVL, according to DefiLlama, in comparison to ~$800M in DeFi TVL. Stable Jack recently announced a $1M angel round raise toward the end of last month, making it an interesting and emerging project on Avalanche to keep an eye on.

Stay alert, stay informed ⬇

Background on Stable Jack

Stable Jack is an AVAX-native protocol, backed by Avalanche DeFi giants in YieldYak as well as the founders of Benqi. Stable Jack provides more than just a stablecoin; its offerings include an AVAX LST and a leverage token in JACK.

Stable Jack’s stablecoin design in and of itself may draw some eyes considering its use of LSTs. The native stablecoin, dubbed aUSD, is designed to be as capital efficient as possible, with no liquidation risk or funding fees. The protocol is backed by staked Avalanche, deposited by users, enabling the native yield of the aUSD stablecoin. This yield is actually quite high, at around 12-15%. Natively staked AVAX offers a higher rate than than that of Ethereum, sitting at ~8%. The LSTs used to provide yield for aUSD also have their own additional incentives layered on top which increases the anticipated APR figure.

Listen to Ep.1 of our new Podcast: DeFi Revelations, ft. Arjun of Everclear!

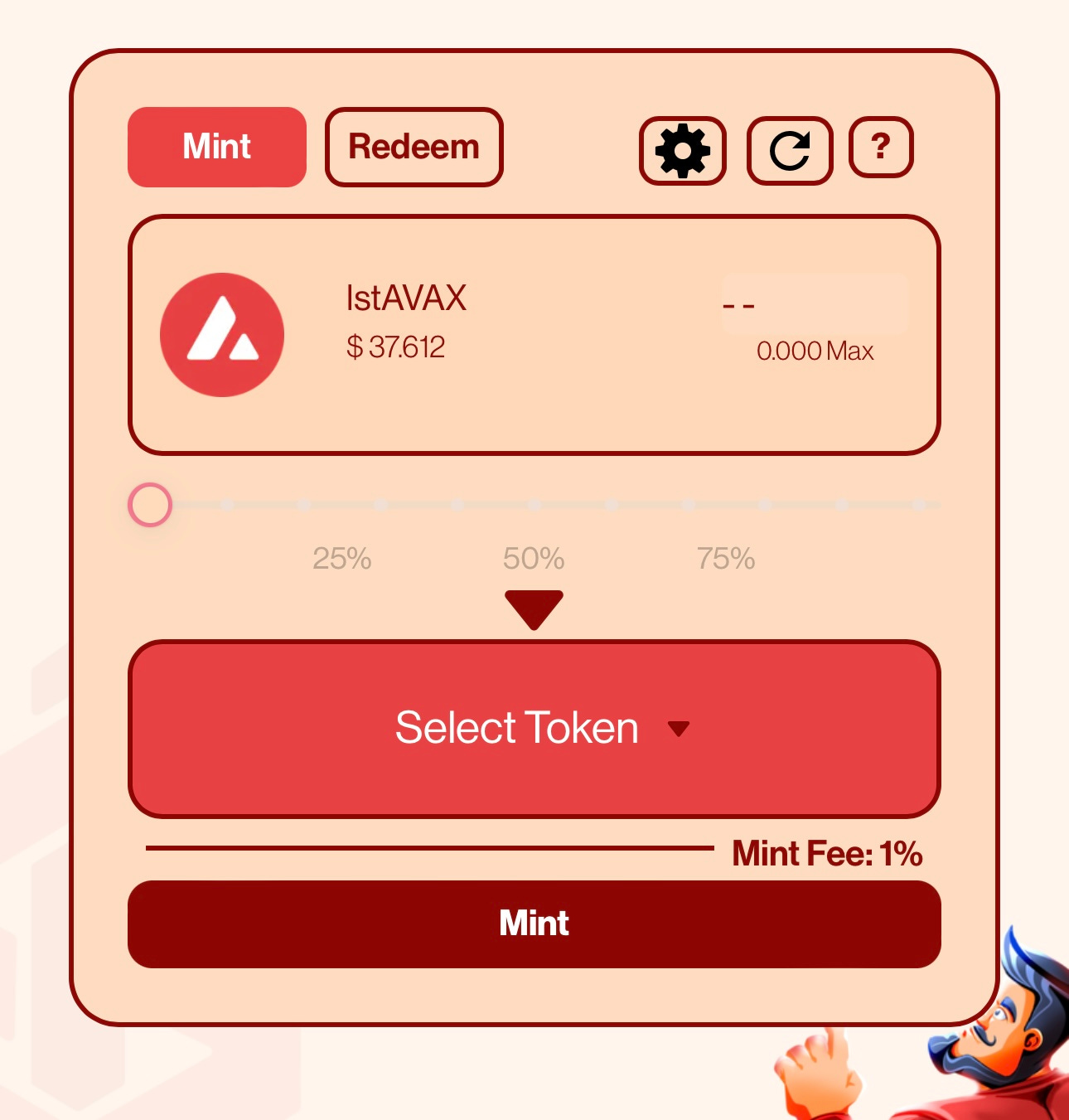

The protocol's leverage offering is xAVAX. This part of the protocol is pretty simple; users can deposit AVAX LSTsto mint xAVAX. xAVAX is a volatile AVAX token representation, functioning as a sort of tokenized perpetual contract minus the liquidation risk and funding fees. Another way to view it is like a tokenized looped AVAX position on a pending market. The actual leverage applied to xAVAX is variable but will roughly stay in the 1.5x to 2x range.

Both aUSD and xAVAX can be minted by depositing lstAVAX. Note that lstAVAX is the current placeholder token for the testnet which can be received from a faucet. Upon mainnet launch, the protocol will accept AVAX LSTs. This AVAX can be earned back upon redemption of the two aforementioned tokens.

Stableswap Product

Another aspect of the Stable Jack protocol is the stable swap AMM product. This will allow for single-sided LPing, meaning no IL, as well as very low slippage for a number of top stable assets on Avalanche including aUSD, as well as LSTs and even LRTs.

The differentiating factor of this stable swap is its asset liability management (ALM). Liquidity provision is single-sided; depositors receive a receipt token which represents a share of the stable pool as a whole, specifically the token deposited by the user. Assuming a liquid system, users will be able to withdraw exactly the same amount that they initially deposited, which may increase in value over time. The ALM allows each token within the pool to still grow organically after being deposited. Unilateral liquidity is provided. The Stable Swap also uses the single-variant slippage function.

As a part of their upcoming launch, Stable Jack is also introducing a Liquidity Commitment Program. This initiative is designed mostly for whales, funds, or LPs with size. Participants can get 50% to 80% discount ticket boosters which can be applied to purchases of JACK, the native governance token of the platform. 10% of the total JACK supply is dedicated toward the seed launch. To qualify, participants should aUSD and xAVAX in the Avalanche DeFi ecosystem. The team is branding this airdrop program sort of similar to Tapioca’s option airdrop, emphasizing the improvements that offering token discounts can offer as an alternative to airdrops. As a concept, the liquidity commitment program aligns native token holder interests with the interests of actual users, since participants literally must use the protocol to get access to token discounts.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs