Spotlight Series - Venice ($VVV): What You Need to Know

Decentralized & Private AI, Tokenomics Analysis, & More

Quick note before we get into today’s edition - we receive positive feedback on the content we put out, but it’s important to stay in touch with our evolving audience, especially in crypto.

To help us optimize our content on this newsletter, X, our platform, and more, please take a couple of minutes to a quick survey we put together…

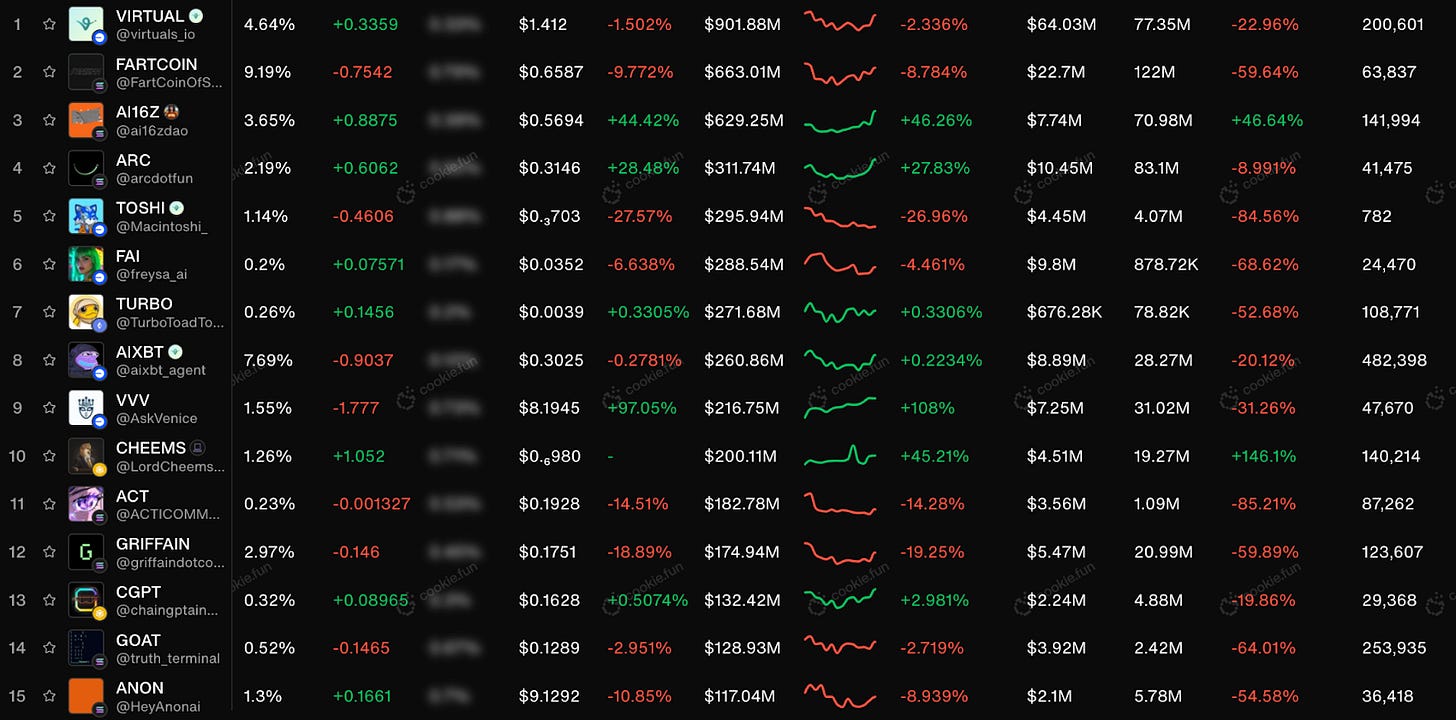

The AI agents market has seemingly stagnated, with the creation of agents using Virtuals and other platforms/frameworks slowing considerably. The total sector marketcap is up significantly in the past couple of days, but gains within the past week are not spread equally, with some seeing much more of a rally than others.

Some agents, including $ARC, $AI16Z, and others, have seen tremendous strength, while others have not had a notable relief rally as of yet. Of the leading agents by marketcap, Venice ($VVV) is actually up the most, its marketcap increasing over 100% in the past 7 days. Venice is most known for being led by Erik Voorhees, and getting listed on Coinbase immediately after TGE. This led critics to point out inconsistency from the Coinbase listing team for not listing tokens like $VIRTUAL.

In the noise, the premise of Venice may have been lost. In this Spotlight edition, we’ll go over Venice’s decentralized AI capabilities, how it’s integrating the most powerful LLMs currently on the market, and more…

Stay informed in the markets ⬇

Background on Venice

Venice aims to provide private, uncensored AI. The goal of Venice is to use leading open-source LLMs, like Llama and DeepSeek, to provide uncensored output. One of the beneficial attributes of open-source models compared to models produced by the likes of OpenAI is that users can run them locally, and verify output, bypassing some content restrictions that might be present in the official website or app. Some biases in models might be baked into the training data, still affecting output even when run locally or used through a provider. The value of open source is undeniable; users can finetune models to their own customization, access AI for a cheaper cost, and more.

While the problem of censorship and meddling in output has seemingly gotten better, there are still many instances where Google Gemini or OpenAI models simply refuse to answer a prompt, or give some level of biased output.

This is the censorship issue that Venice aims to circumvent. The other half of the equation is privacy. Whether it be OpenAI, Google, or Chinese companies like DeepSeek, some people are concerned about data privacy. More specifically, companies and organizations may feel uncomfortable having their internal data accessible by centralized companies. Open-source models can help here, enabling finetuning in an organization's own environment. Venice allows access to these models via end-to-end encryption, without data stored on centralized servers, in any country.

Venice takes two pain points in AI today, privacy and censorship, uses leading open-source models to address these issues and provides a simple platform and API for users to access. Venice can generate different types of output, including typical text answers, code generation, as well as image generation, by incorporating Llama, DeepSeek, and Stable Diffusion models. The platform’s business model is its pro plan, which grants access to more advanced models than free users have access to, with other features such as the ability to interact with pre-built characters via text.

Venice has grown substantially, with 450K+ registered users as of February, and more using the platform as a guest. The platform reportedly sees 50K DAU, with 15K inference requests each hour, on average.

$VVV Tokenomics

Let’s face it; a project having a token makes users all the more likely to learn about it and even use it. Venice is perhaps no different, and its TGE put a lot of new eyes on the project. This also happened as the market was being impacted by the advent of DeepSeek, which may have heightened attention for a product integrating DeepSeek and other opensource models.

When it comes to tokenomics, 50% of the total $VVV supply (100M tokens in total) went toward a community airdrop. If you are an avid or early user of several Base protocols we have frequently mentioned in our coverage, like Virtuals and Aerodrome, you likely received some $VVV. Besides the airdrop, 35% of supply is allocated toward ecosystem development (10M tokens given to team specifically), 10% toward an incentive fund, and the remaining 5% used for liquidity purposes.

Of the tokens airdropped, not all are claimed and some tokens have been staked, resulting in a current circulating supply of ~26M tokens. Marketcap sits at $212M, with an FDV of just over $800M.

Like most tokens, $VVV is used for protocol governance, but there are some more interesting functions of the token. The utility of $VVV is that it can be staked for a few benefits. One is that it is used to forego API costs, which could be appealing to some power users. Users can access the API in proportion to how much they have staked.

Additionally, $VVV stakers earn an annual yield. The official annual inflation rate of $VVV is 14%, however, the allocation of this that goes toward stakers is dependent on the usage of the Venice platform itself. The remaining tokens are allocated toward Venice.

The goal is for Venice to be a proper revenue-generating business; its yearly plan costs $150. It’s unclear if token holders might be able to see a cut of revenue or not, this seems unlikely for now considering Venice is not a DeFi protocol, and it collects its revenues probably mostly via traditional payment rails.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.