Spectra Finance (formerly known as APWine) is an EVM-compatible yield trading protocol. APWine was founded in August 2020 by Jean Chambras, Gaspard Paduzzi, Antoine Mouran and Ulysse in France amidst DeFi summer when the concept of yield farming was still nascent in the crypto space. Today, Spectra allows anyone to deploy a pool for any interest-bearing token/vault compatible with ERC-4626 in an entirely permissionless manner.

APWine’s founders come from software engineering backgrounds and computer science-related degrees at EPFL in Switzerland. Together they co-founded Perspective, a software development company that serves as Spectra's core contributor, and also recently participated in strategic investment round in Yieldnest.

In March 2021, Spectra Finance raised $1M in seed funding with a round led by Delphi Ventures that was also backed by The Spartan Group, DeFi Alliance, Rarestone Capital, and many prominent builders and angels such as Julien Bouteloup and Mark Zeller from AAVE. Later in November 2022, they raised an additional $2.6M in an extended seed round led by Greenfield Capital.

In this edition, we'll discuss the thesis for Spectra's growth, analyze protocol performance metrics, and more…

Stay informed in the markets ⬇

Market Context

The market for DeFi yield trading and on-chain fixed income is expanding rapidly, underpinned by a large base of yield-bearing assets. Liquid staking is a major segment with over 13.66 million ETH (≈$25.16 billion) is locked in liquid staking token, reflecting huge demand for staking yield. Similarly, interest-bearing tokens from lending protocols form tens of billions in TVL (Aave alone manages ~$20B).

This provides a vast DeFi TAM for yield derivatives. Protocols that tokenize and trade yield tap into this base, for example, Pendle’s TVL exploded from ~$230 million to $6.7 billion in 2024, underscoring appetite for yield trading. New fixed-rate primitives are gaining relevance with Pendle now dominating with over $3.3 billion TVL, and Spectra as an emerging player (>$120 million TVL).

Spectra Overview

Spectra is an interest rate derivative (IRD) protocol deployed on the Base network that strips ERC-4626 interest-bearing tokens such as $USDO, $stETH, $USR and many more into its individual components, Principal Tokens (PT) and Yield Tokens (YT).

This provides users with more flexible yield strategies and risk management tools through a permissionless interest rate derivatives market. Strategies include yield trading, upfront yields, fixed rates and discounted assets.

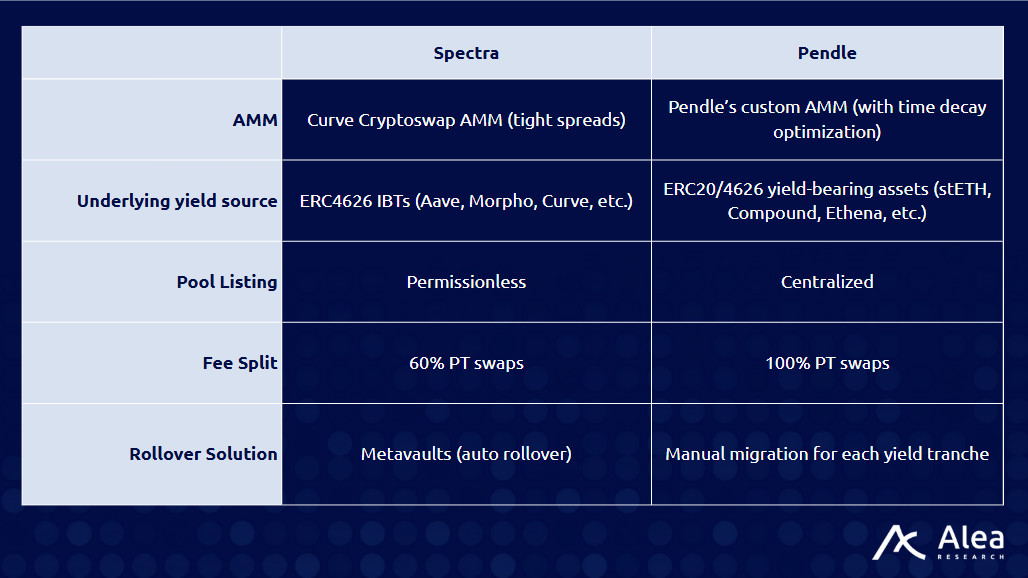

Spectra supports any ERC-4626-compliant IBTs, such as those from Aave, Morpho, Yearn, and others. The protocol tokenizes the underlying yield-bearing asset (the ERC-4626 tokenized vault), and enables yield trading. monetizes all upstream yield flows through PT/YT pairs and introduces downstream yields from trading volume in respective YT/PT pools. Pool creation for markets is entirely permissionless, without needing governance or centralized approval similar to how one would create an LP on Uniswap.

Spectra Protocol Growth

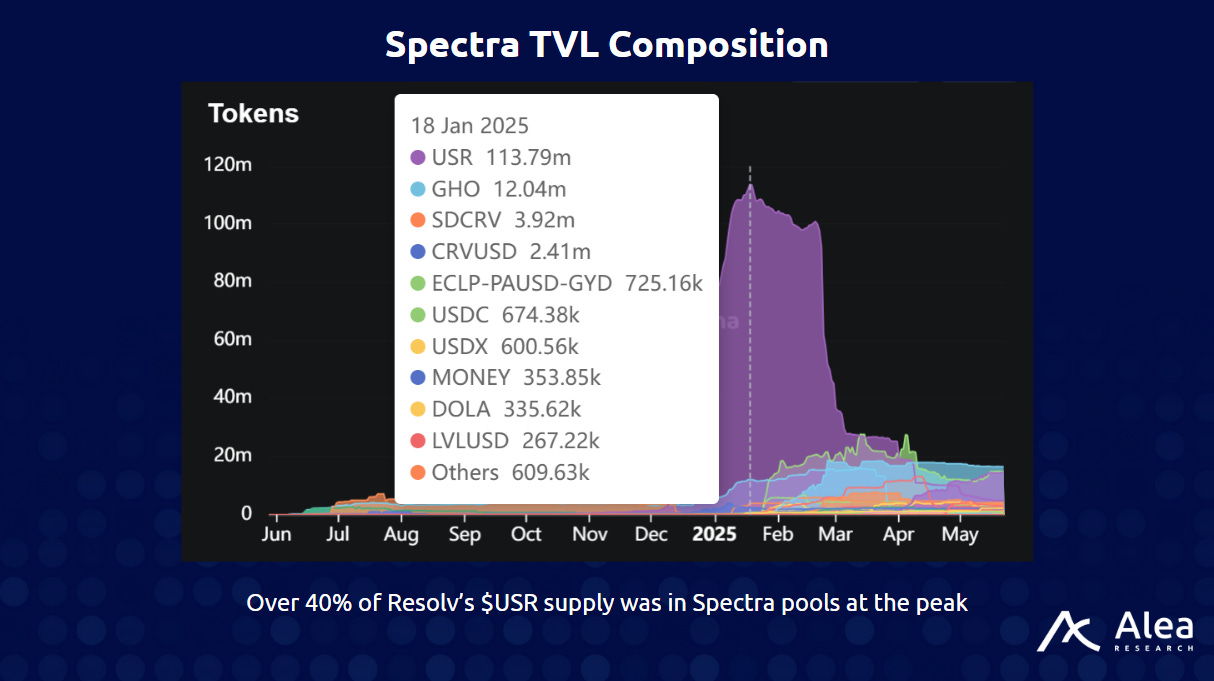

Spectra V1 (previously, APWine) hit a peak TVL of nearly $9M in 2022 prior to its rebrand. Spectra’s V2 officially launched in June 2024, garnering over $20M in TVL on launch, and now currently sitting at $135M.

Spectra was one of the first projects to launch markets for Resolv’s native $USR in December 2024, even before Pendle. This caused a massive surge in TVL.

Curve Cryptoswap AMM

Spectra’s pools are built on the Curve Cryptoswap AMM. Curve was built for near-pegged assets (tight spreads + low trading fees). This is well-suited for Spectra’s markets where PTs and the underlying IBTs have closely related values. Spectra deploys each IBT/PT pair as a Curve pool and inherits Curve’s invariant, rebalancing logic and fee sliders. The integration yields low slippage and high capital efficiency for swaps between YTs and PTs

Metavaults

Metavaults introduce automatic rollovers. They are ERC‑4626 vault contracts that auto-redeploy liquidity from an expiring pool into the next yield cycle, seamlessly “rolling” the position forward. LPs earn compounded yield (as fees and principal are redeployed), and the protocol benefits by keeping markets liquid. This way, LPs can rest assured that their liquidity will be redeployed to new pools when maturities expire. This reduces friction at the UX level and ensures LPs continue earning yield while also minimizing the risk of liquidity abandoning the protocol upon pool maturity.

$SPECTRA Tokenomics

The native token $SPECTRA was launched via a migration from the original APWine token $APW at a 20:1 ratio (1 $APW -> 20 $SPECTRA). For veAPW to veSPECTRA, the ratio is 1:10 since the max lock duration for veSPECTRA is 4 years, while it was 2 years for veAPW.

This re-denomination expanded the maximum supply cap to ~876.75 million $SPECTRA tokens, with some un-minted $APW previously being burnt before the migration.

As of writing, 349.93M $SPECTRA are circulating, with a total supply of 578.96M. Total locked $SPECTRA sits at 174.3M, representing a 33.25% lock rate. The distribution and emission schedule continues to follow $APW’s.

48% of the supply is planned to be minted following an inverse exponential curve ie. progressively decaying: in the initial weeks after launch a fixed amount of $SPECTRA is distributed as liquidity incentives, decreasing by ~1.1% per week thereafter, and eventually tailing off to ~1.8% per year in perpetual “tail emissions”. These tokens are distributed through a liquidity mining program on $SPECTRA pairs, along with incentives for liquidity providers on the AMM.

Ve (3,3)

This ve(3,3) model is similar to that on Curve or Velodrome. Users who lock SPECTRA for up to 4 years receive veSPECTRA, which gives them voting power over Spectra’s gauges earning voting APY. On top of that, veSPECTRA lockers earn 60% of IBT/PT swap fees.

29.63% of total supply is currently locked as veSPECTRA for an average 3.2 years.

Competitive Landscape

Spectra’s direct competitor is Pendle. Here are some core differences:

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.