Sonic Ecosystem - Shadow Exchange & flyingtulip: What You Need to Know

x(3,3), Andre Cronje DeFi Innovation, & more

It’s been a little while since we’ve seen innovation in DeFi, or even iterative progress. For the most part, people have found what does and doesn’t work when it comes to DeFi primitives. Instead, more focus and resources have been allocated toward interconnectivity and spreading these established protocol designs across chains.

Last cycle, Fantom was home to many interesting experiments in DeFi. Some were proven completely unsuccessful, like Tomb Finance. Others, like Solidly, were actually instrumental in changing the way teams approached DEX design. We might be seeing a new wave of DeFi innovation on Sonic. In today’s edition, we’ll discuss a couple of protocols gaining traction in the Sonic ecosystem: Shadow Exchange and flyingtulip…

Stay informed in the markets ⬇

Background on Shadow Exchange

Most of our readers are probably familiar with ve(3,3), the DeFi primitive which originated last cycle and birthed a new genre of DEXs across chains. While Solidly itself fizzled out, Aerodrome and other DEXs would validate the viability of this model, especially as market conditions improved.

Shadow Exchange is the newest iteration of the ve(3,3) concept, introducing x(3,3). This model does away with multi-year locks, which are the norm in ve(3,3) DEXs to earn a share of protocol revenue. Instead, Shadow gives optionality: users can lock their SHADOW tokens for xSHADOW, with the option to instantly unlock 50% of the position at any time. 6 months is the maximum time to exit xSHADOW with no penalty. Users can settle for smaller penalties by exiting after several months.

The Shadow DEX itself operates concentrated liquidity pools, making it comparable with DEXs like Aerodrome or even Uniswap V3. This gives users and LPs optionality, beyond tokenomics. Shadow models its concentrated liquidity system after a traditional orderbook, enabling pockets of deep liquidity while still functioning as an AMM.

So far, Shadow has been able to capitalize on Sonic’s rise. Despite declining market sentiment and declines in asset prices, Sonic has held strong at roughly $1B in TVL over the past few weeks. Should market conditions stabilize, this will likely increase, given the rate at which new capital has found its way to the chain. Shadow now stands out as the leading DEX on Sonic, earning ~$8M in revenue per month since February off of ~$3.6B volume processed.

Background on flyingtulip

Founded by Andre Cronje, flyingtulip is a Sonic-native trading platform. Trading and perps haven’t traditionally been one of Sonic’s strong suites, but demand for onchain trading venues has dramatically increased. This makes it important for an emerging ecosystem to have such a venue at its disposal to minimize capital outflows looking for this type of risk.

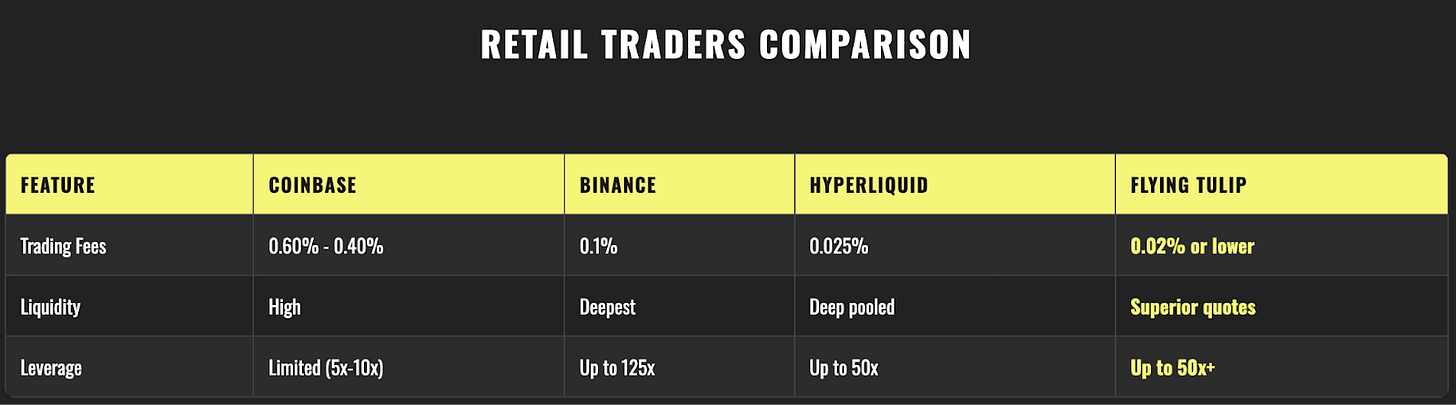

flyingtulip adds a host of features and implementations in an attempt to provide a better trading experience all-around. Using an adaptive curve AMM enables a maximum fee rate of 0.02%, which is only reached during times of peak volatility. Oracle data is used by the protocol to monitor volatility and adapt pricing accordingly. This also allows for decreased slippage, by as much as 42% compared to other AMMs.

Besides improved performance for traders, flyingtulip also hints at its enhanced fee sharing for LPs and hybrid compliance. More details will emerge as the project rolls out, only leaving stealth mode in late February. What’s more, is that flyingtulip looks beyond crypto for asset selection, mentioning forex and securities as things it might look to list. The protocol has even teased its integrated money market, and options trading. Even UX is optimized, with flyingtulip operating as a DEX but without the need for users to connect their wallet.

Flyingtulip is an ambitious project, with some of its feats more fleshed out than others. As documentation is made public and the application launches, users will get to grade the protocol and compare it to competitors. The upcoming launch of Andre’s new primitives can prove to be inspirational and unlock new innovation by building on top of his projects. This bodes well for the Sonic ecosystem as a whole. There is the potential for Sonic to establish itself as a hub for teams to test ideas against each other in production, seeing what works and what doesn’t.

Important Links

Become a Premium member to unlock all our research & reports, including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.