The other week, we released a Market Intel on AAVE, which on the surface, might seem like a surprising token to take a likening to. However, the OG DeFi asset had performed pretty favorably until this week, still up around 16% in the past month. AAVE stands as a staple in a world where every day there are new cars for the dogs in the market to chase. Aave isn’t just resting on its laurels, its V4 primarily introduces a unified liquidity layer to enable more composability and use cases for the project, including isolated lending.

In today’s edition, we’ll discuss a bit about the isolated lending space, specifically, Silo Finance as the protocol has gained a bit of traction lately. Silo Finance is an Isolated lending markets protocol based on the EVM, specifically live on Ethereum mainnet, Arbitrum, and Optimism. Traditional platforms like Aave and Compound use a shared pool model where all assets are treated the same and can be cross-borrowed. This model provides efficiency but also risks, as a bad asset can jeopardize the entire pool, even with risk caps in place. Shared pool models offer liquidity presence across all markets simultaneously, which can be advantageous.

The native SILO token is actually performing quite well, up ~8% in the past week, and nearly 50% in the past 2 weeks. Silo is working on a v2 tokenomics model where users can stake their $SILO for $veSILO. This staking mechanism will offer a boost on rewards, governance rights, and the potential for revenue sharing. Additionally, the platform itself has its own incentives program, dubbed SuperFest, ongoing on Optimism looking to obtain new users…

Stay informed in the markets ⬇

Background on Silo Finance

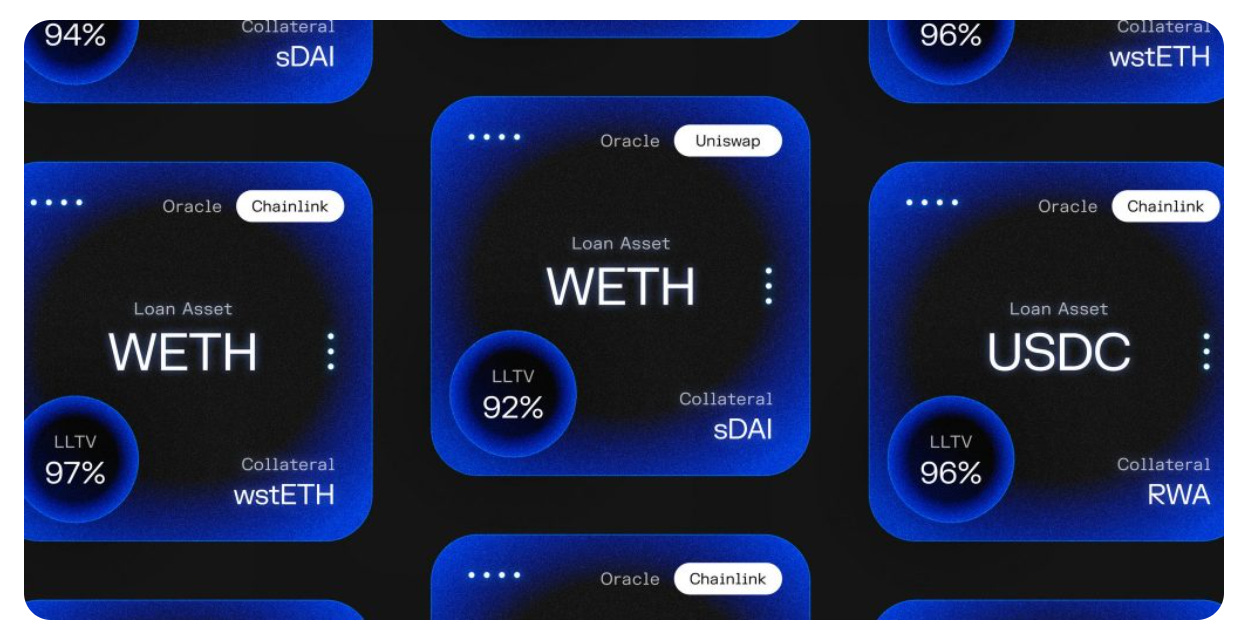

Silo Finance is a lending protocol that operates with isolated markets, meaning each asset has its own separate market. For example, the Wrapped Staked ETH market is entirely separate from the ezETH market. This architecture ensures that if one asset market is compromised, the others remain unaffected. Each row in Silo’s interface represents a distinct market with its own assets and borrowing capabilities. Advanced market participants can create auto-rebalancing strategies in Silo to achieve similar efficiencies as found in shared pool protocols. The main drawback of Silo’s model is that liquidity isn’t inherently pooled, requiring participants to actively decide to engage with each market. So this is somewhat comparable to managing concentrated liquidity, returns can be greater but at the expense of less passivity.

Silo’s approach allows for greater flexibility and safety, as adding a new market (e.g., for a new asset like Pepe) does not impact existing markets. Silo isn’t the only protocol to implement isolated pools of course. Most notably, Euler Finance, whose rollout was significantly delayed, as well as Morpho Blue are projects that we have covered extensively, implementing isolated pools to great effect. This evolution is marked by the adoption of permissionless money markets built on top of an immutable base layer, with risk management through isolated pools being managed on top by specialized parties, diverging from traditional uniform and one-size-fits-all approaches.

Another key feature of Silo: independent borrow rates for each market. For example, borrowing $ETH in the $ezETH market may have a different rate than in the Wrapped Staked $ETH market. This allows Silo to set interest rate curves that accurately reflect market conditions for specific assets, avoiding the issue seen in shared pool models where high borrowing rates for one asset can push out users of other assets. Protected deposits also allow users to disable borrowing on their deposits, forfeiting interest but safeguarding their collateral from being borrowed and potentially exposed to risk. This feature is particularly useful for large holders who don’t want their assets shorted or exposed in the market. It was instrumental in handling significant loans like during the CRV debt situation, where Silo’s design prevented bad debt accumulation during a market downturn

Serious lenders can tailor their risk exposure more effectively with Silo compared to traditional shared pool models. The shape that more sophisticated lenders take is likely to be whales; many institutions are extremely hesitant to engage with Defi lending protocols, especially those outside of the norm even if they seem very secure.

Still, the team touts the robustness and security of Silo’s platform, noting its extensive audits, formal verification, and two years of battle-tested operation. The protocol indeed has been audited extensively, with audits from ABDK, Quantstamp, Certora, and Immunefi on the protocol’s resume.

Additionally, ilo uses various interest rate models to target optimal utilization and profitability for users. These models are adjusted based on market dynamics and the staking rates of specific assets. For example, borrowing rates for $sfrxETH are set slightly below the staking rate to make it profitable for users to loop. This model is adaptable in maintaining liquidity and profitable loops for users.

Currently, the team is developing a new interest rate model for their v2, which will include parameters to create different types of rates such as kink, double kink, dynamic, and fixed rates. When it comes to rewards and incentives, on Optimism, all markets except Worldcoin are currently incentivized. The team has two incentive programs running: one from an Optimism grant with 250,000 OP streaming over 5-6 months and the other from their Superfest initiative. The ezETH market is particularly attractive due to generous deposit incentives from the Renzo team and additional rewards from Contango and Superfest.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs