River - Time‑Encoded Airdrop and Chain‑Abstraction

Dynamic Airdrop, Cross‑ecosystem Stablecoin Liquidity, Vault Architecture, and More

Chain abstraction allows users to deposit collateral on one network and mint stablecoins wherever liquidity is needed, without bridges or wrappers. River also introduced a time-based airdrop system that ties token supply to time and behaviour.

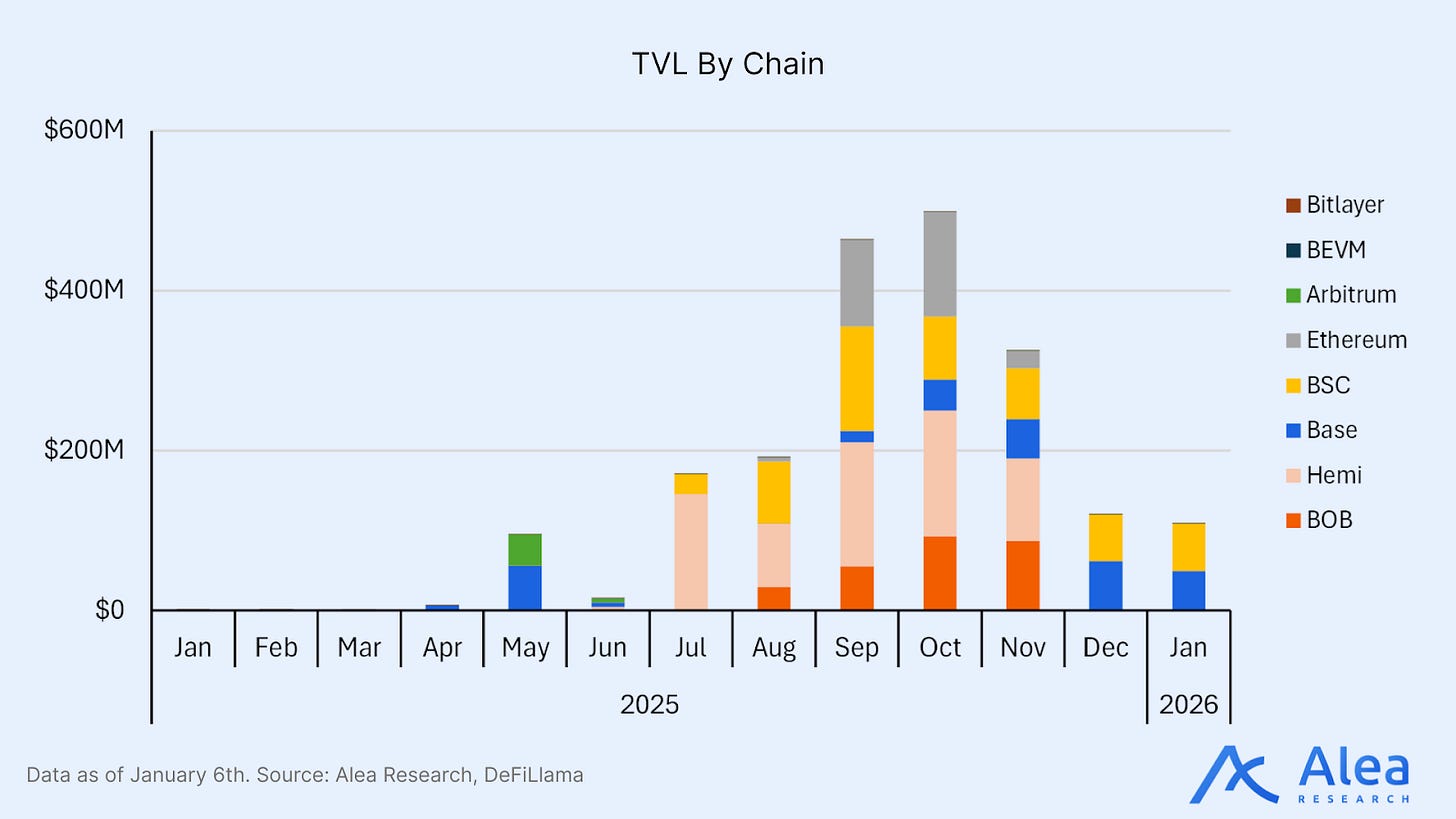

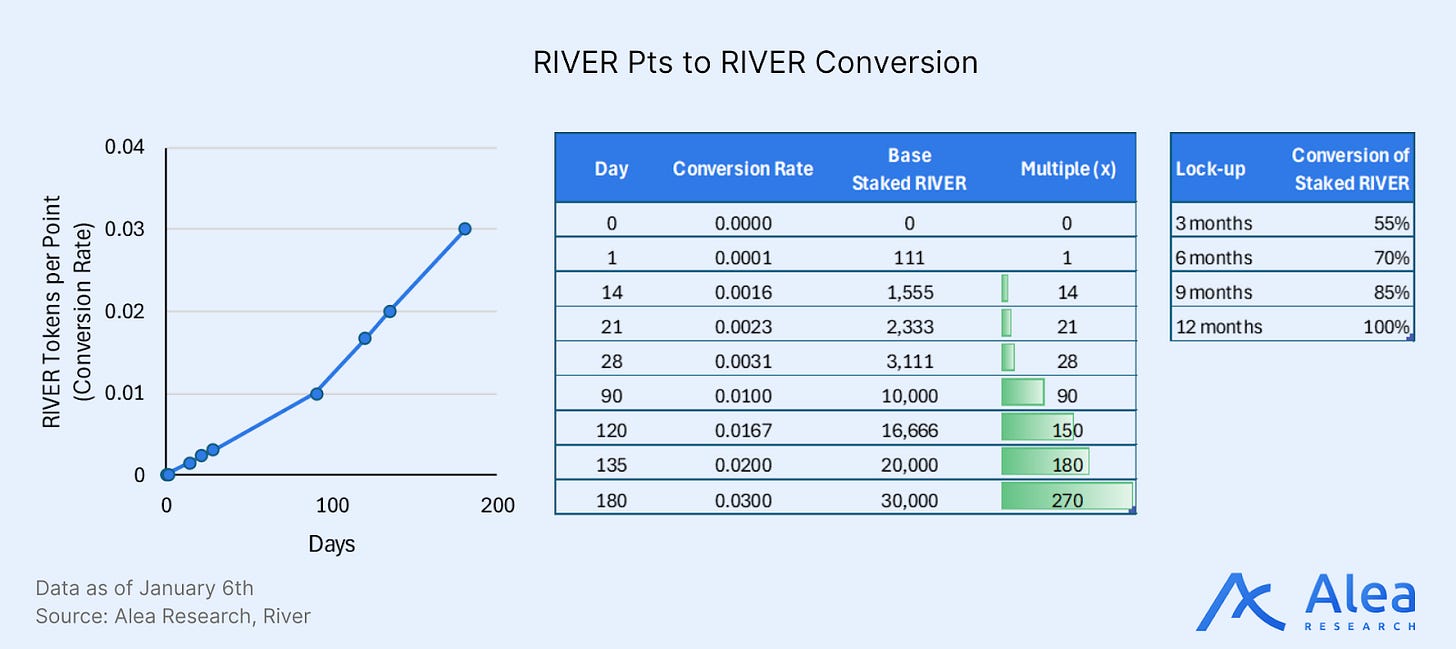

Instead of a one‑off airdrop, River allocates 1 billion River Points (River Pts) that can be converted into up to 30M RIVER (30% of supply) over a 180‑day window. The longer holders wait, the more tokens they receive. Within months, River’s omniCDP system gained traction across multiple chains.

In this edition, we’ll examine how River’s chain‑abstracted stablecoin and vaults work, unpack the mechanics behind its time‑encoded airdrop, and the Conversion 2.0 upgrade.

River’s Omni‑CDP and Vault Stack

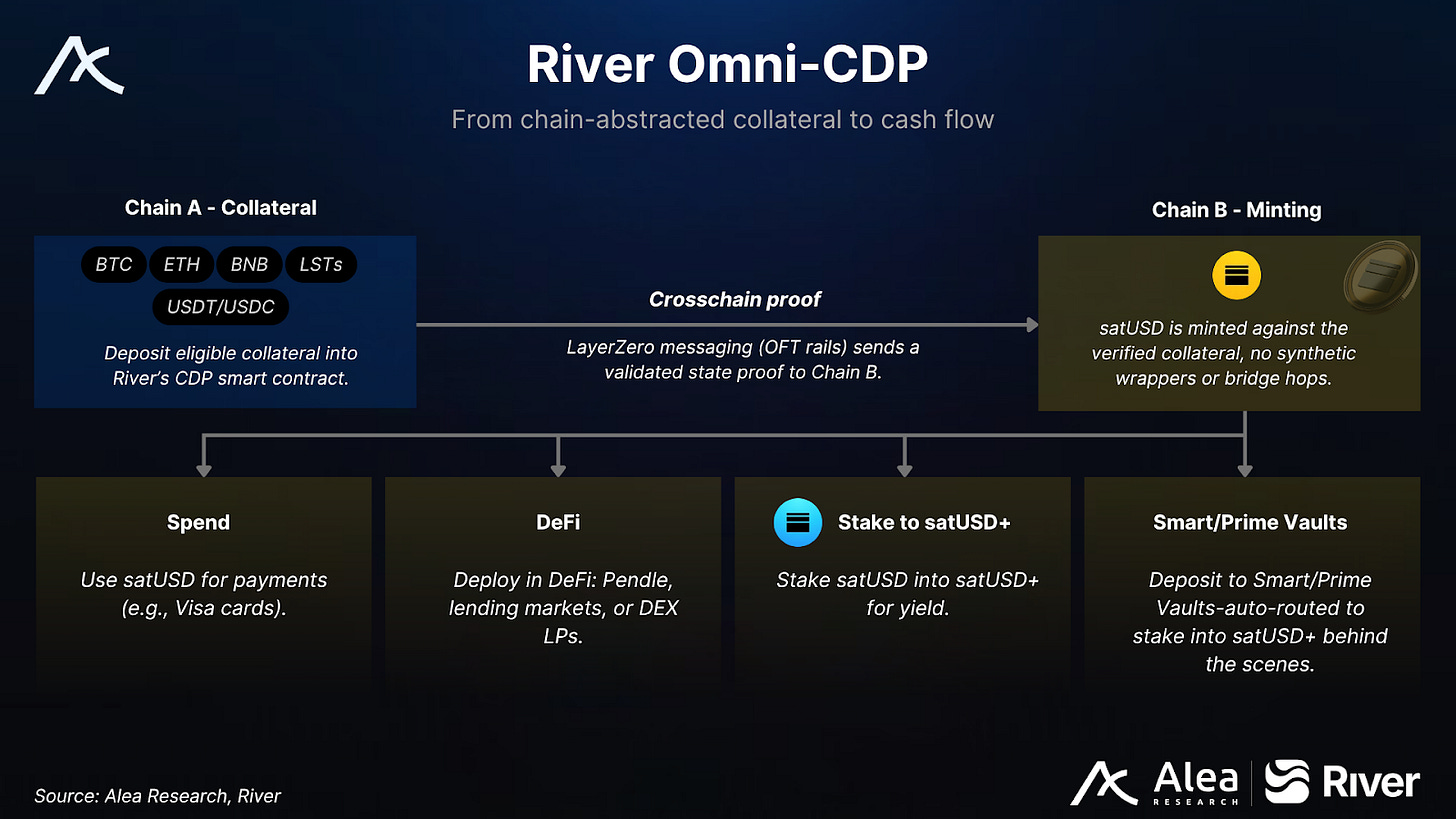

At its core, River is building a chain‑abstraction stablecoin system. Users deposit collateral (BTC, ETH or stablecoins) on one chain and mint satUSD on another using LayerZero’s omni‑fungible token (OFT) standard. This removes bridge hops and wrapper risk, addressing the liquidity fragmentation that plagues multichain DeFi.

The stablecoin can be staked into satUSD+ to earn protocol revenue, turning it into a yield‑bearing asset. The system is live across 8+ chains including BNB Chain, Ethereum, Base, and recently Sui with $320M+ TVL and 200M satUSD in circulation.

River’s product stack extends beyond the base stablecoin:

Smart Vaults deliver one-click, no-liquidation yield. Users can deposit once and the system mints and stakes satUSD under a pre-set policy without users monitoring collateral health.

Prime Vaults provide custody-oriented rails connecting River’s yield to external custodians and institutional controls for larger treasuries.

River’s Multichain Traction

DeFi’s multichain era has exposed a structural problem: assets live on different chains, and moving them via bridges introduces smart contract risk and liquidity fragmentation.

River’s chain‑abstraction design addresses this by minting satUSD natively on destination chains. This makes satUSD a portable stablecoin that can be minted on networks like Base, BNB Chain and Sui, used in local DeFi markets, and redeemed elsewhere without wrapping.

River has secured Tier-1 CEX listings and Binance perps, OKX perps and boost, and Kraken spot, operates across 8+ chains, and sustains $320M+ in TVL with 200M satUSD in circulation across integrations such as Pendle and MEV Capital curated vaults. They also recently listed on XLayer.

The BuildKey TGE in Binance Wallet set a new record in its IDO history with $100M in BNB committed in less than 2 hours from 30k+ users (993x oversubscribed).

Conversion 2.0: Tackling Airdrop Farm and Dumps

River’s Dynamic Airdrop Conversion is a response to the typical “farm and dump” problem. Most airdrops deliver a large one‑time wealth transfer, concentrating supply in weak hands and inviting immediate dumping.

River’s approach ties emissions to time and behaviour, turning airdropped points into a kind of call option. This includes actions like minting and using satUSD, staking, or engaging through River4FUN. They are tokenized as River Pts ERC20 tokens that can be converted into staked RIVER at the prevailing exchange rate or traded on secondary markets, opening up arbitrage opportunities as a result.

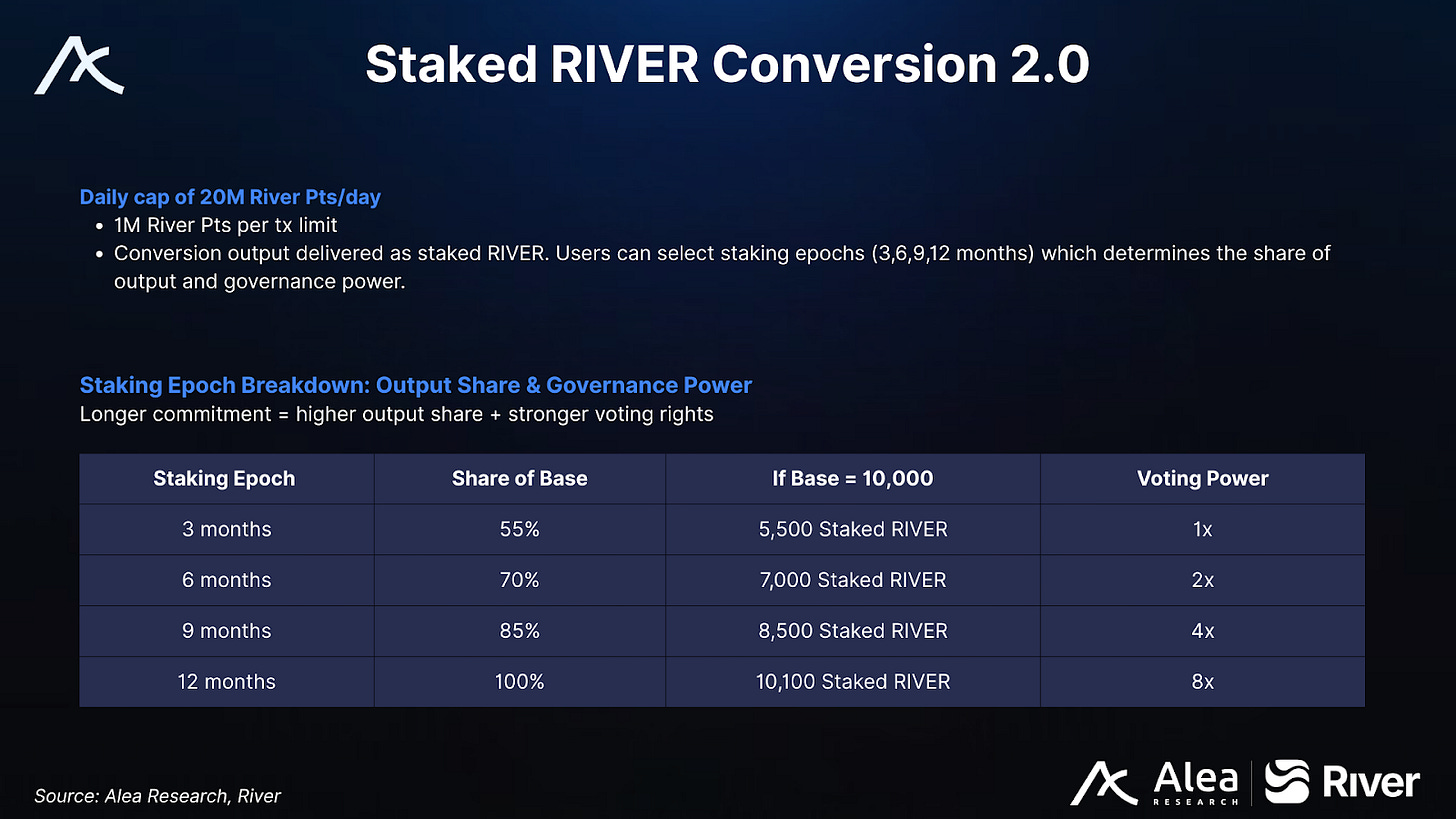

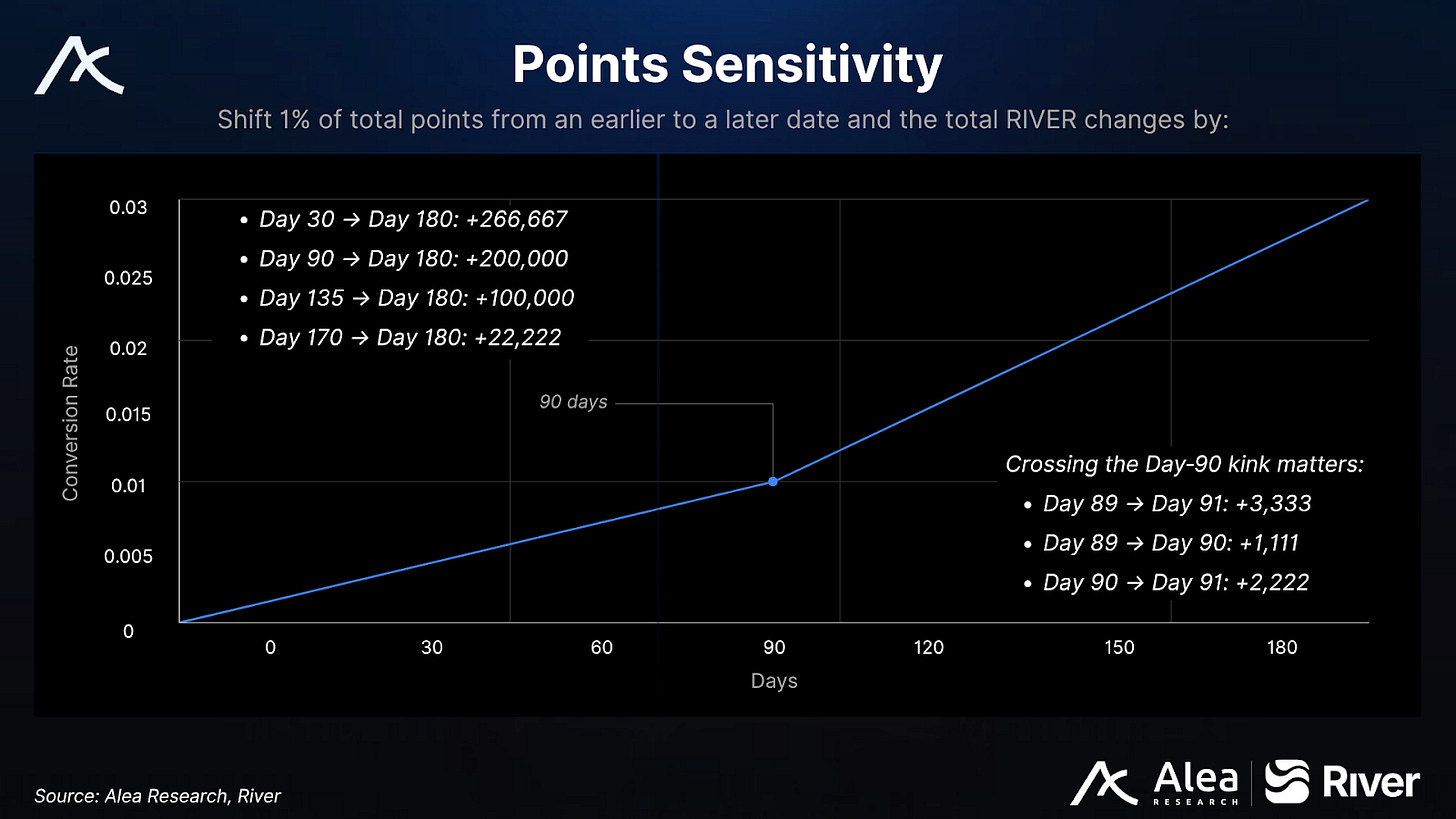

The later points are converted, the greater the exchange rate. A total of 1B River Pts correspond to up to 30M staked RIVER over the 180-day window. Staked RIVER redemption comes with epoch selection (3 months captures 55% of base, 12 months captures 100%) so longer lock-ups compound the time-curve benefit.

Under Conversion 2.0, patience is rewarded as the time-based curve rises over 180 days, and the dynamic rate recovers after periods of heavy activity. If users exit early, they leave tokens on the table. Exit during a crowd, leave even more.

With conversion now past Day 70, key milestones ahead:

Day 90 (~Jan 24, 2026): Baseline slope doubles. Holding past this threshold yields ~222 RIVER/day per 1M Pts vs ~111 before.

Days 120-150: Post-kink accumulation zone. Baseline APR exceeds 480% by Day 120.

Day 180 (~Apr 24, 2026): Window closes. 20% converting on Day 180 mints 6M; 50% mints 15M.

River Pts are currently trading at a steep discount to epoch-adjusted parity (~96% below 3-month parity at current prices), suggesting the market is heavily discounting rate compression risk, Staked RIVER illiquidity, or residual mechanism uncertainty post-Conversion 2.0. This could represent either warranted skepticism or a significant mispricing for patient capital willing to accept lock-up periods.

Conclusion

River’s Dynamic Airdrop turns token distribution into a live market event. Over the 180-day window that began on September 22, 2025, the community’s collective timing choices will define how much of the 30M RIVER cap actually enters circulation, and when. The design rewards patience, but each user profile should optimize for different needs. These 5 metrics: claims, conversions, timing patterns, Pts pricing, and emissions vs cap, let users read participation, pace, and mispricing.

The next months are a live test of behavioral economics, each conversion impacting the game theory. River’s time‑based alignment could become a template for future launches.

Important Links

Disclosure

Alea Research is engaged in a commercial relationship with River as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.