Resolv - True Delta Neutral Stablecoin: What You Need to Know

Trustless $USR Stablecoin, $RLP, & More

Who said nobody wants stablecoins in a bull market? While $BTC and other tokens might catch more attention, a frothy market can often see rates rise across the board in DeFi, as demand for leverage grows. Last week, we saw the total stablecoins marketcap climb to the $180B figure, a $2.5B WoW increase. Yesterday, Tether also minted a fresh $2B worth of $USDT, not to mention Y-Combinator adding stablecoins to their 2024 ‘Request for Startups’ list. So while there is a lot of noise in the markets, stablecoins present all sorts of opportunities as well…

We’ve entered a new cycle, and along with it comes fresh iterations on top of previously proven concepts. Resolv hits the nail on the head when it comes to stablecoin iteration, providing a stablecoin backed by a True Delta Neutral (TDN) Architecture. In today’s edition, we’ll focus on Resolv’s core offerings, as well as some recent news and integrations our readers might find interesting.

Stay informed in the markets ⬇

Background on Resolv

Resolv is the protocol behind $USR, a stablecoin fully backed by $ETH and pegged to the U.S. Dollar. Specifically, Resolv introduces a unique True Delta-Neutral (TDN) architecture, tokenizing on-chain assets with fully hedged derivatives positions to achieve market neutrality. This design provides resilience against crypto market volatility and removes the liquidation risks often associated with Collateralized Debt Positions (CDP).

Resolv also features $RLP (Resolv Liquidity Provider), which acts as an insurance layer, absorbing systemic risks to protect $USR holders. With a yield from staking $ETH and perpetual futures, Resolv distributes competitive returns to $stUSR and $RLP holders. $RLP is basically a tokenized representation of the value of $ETH backing each unit of $USR.

Moreover, the protocol is designed to generate a fiat-independent yield, distributing competitive returns to its holders and reinforcing the protocol economy. Resolv generates this yield from staking $ETH rewards and maintaining perpetual futures positions. Staking is performed entirely on-chain. Resolv uses both CEXs and DEXs for perpetual futures positions to get the best of both worlds.

At its simplest, Resolv provides the $USR stablecoin, which is sort of similar to Ethena, except that the stablecoin is backed by spot $ETH, and only short positions are used to hedge. This creates a dynamic where, in bullish times where funding is distinctly positive, these short positions can earn a sizable yield from the increased funding fees the short position earns. As mentioned above, the $ETH which backs $USR is also staked, earning an additional constant yield. To get a portion of this yield, users must stake their $USR for $stUSR.

On the flip side, during a more bearish market period, the value of the short $ETH position rises. This can offset the value of the $ETH collateral dropping, though the associated yield will naturally be lower at this time, with the staking yield providing a greater share.

Beyond the primary stablecoin, $USR, there is also $RLP. $RLP serves as a leveraged delta-neutral strategy token, backed by both CEX-custodied assets as well as onchain assets. $RLP is more volatile, as it is used as a protective buffer for $USR holders. Essentially, $RLP functions as an additional backing for $USR, utilizing the excess collateral from the $ETH portfolio, which maintains over 100% backing for $USR. Holders of $RLP are compensated for assuming more risk with a higher share of profits from the collateral pool.

The protocol allows for the minting of $USR or $RLP tokens by locking up an equivalent value of assets, net of minting costs. This system eliminates the need for over-collateralization typically required in other stablecoin frameworks, enhancing liquidity and operational efficiency.

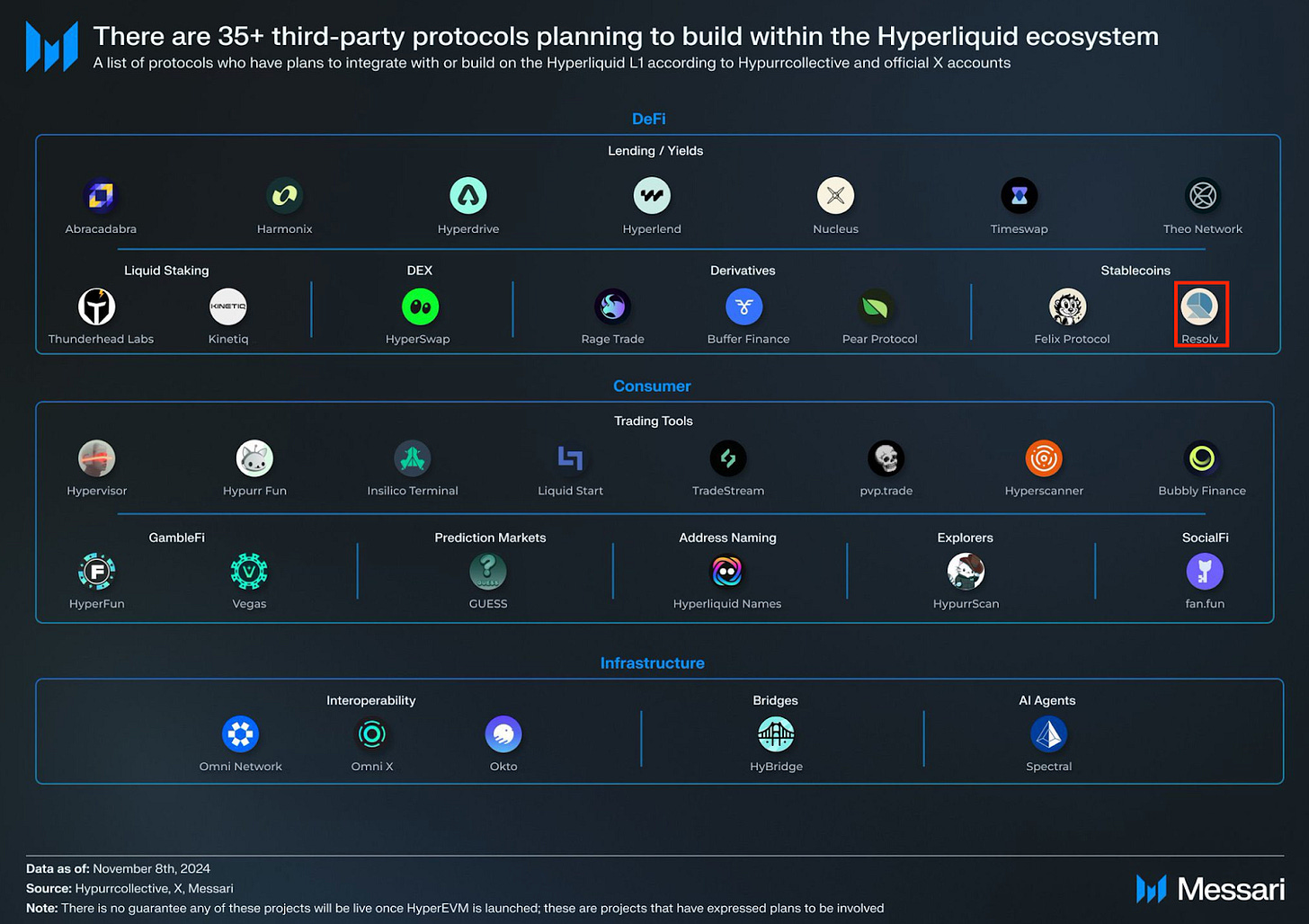

In order to improve protocol efficiency, specifically optimizing futures returns in a risk-adjusted manner, Resolv has opted to use Hyperliquid for a portion of futures exposure (~31%). At this point in time, Hyperliquid serves as the only DEX that the protocol uses, while the rest of the futures exposure is obtained on Binance (48.5%) and Deribit (19.9%). Integrating Hyperliquid is also more notable than just onboarding another venue to diversify short $ETH futures exposure. This move also places Resolv in a small but growing ecosystem, an important part of one of the most well-renowned chains around today.

In addition to the significant Hyperliquid integration, Resolv has focused on improving offerings on the $ETH staking side of things. Specifically, Resolv has partnered with Dinero, to use $apxETH as part of the collateral backing behind $USR.

Resolv has also just completed an audit by MixBytes, ensuring that the $USR stablecoin and treasury are indeed up to par security-wise. Additionally, there is an ongoing points program on Resolv. Users can receive points for simply holding $USR or $RLP, with boosts available for those who engage with Resolv sooner rather than later, as well as a referral system.

To date, Resolv has managed to secure over $21M in TVL, with over $4.5M worth of $USR liquidity in Curve pools. The majority of protocol TVL is attributed to $USR, $13M worth, earning 18.65% APR over the past seven days. Meanwhile, $RLP is currently earning 36% APR. The total yield of the collateral, consisting of staked $ETH and short $ETH perpetual futures is ~22%. The smaller size of the $RLP pool size, combined with its larger share of collateral yield in exchange for taking on more risk, gives it a significantly higher APR.

—---------------------------------------------------------------------------------------------------

If you found this newsletter interesting, we’ve recently released an in-depth Project Breakdown report distilling the entire Resolv architecture.

You can access it below for free, without an account.

—---------------------------------------------------------------------------------------------------

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns - Deep dive 50+ page protocol-specific reports