RedStone Oracles - Modular Oracle Architecture for the DeFi Landscape: What You Need to Know

Oracle Extractable Value, $15M Raise, Season 2 Expition, & More

Oracles are truly one of the more underappreciated areas within crypto, one of the foundational pieces that the apps we use of all types rely on. As blockchain usecases grow in number and more adoption is seen, having dependable oracle networks becomes even more critical. Things like RWAs, prediction markets, and any number of uses for AI as well as other hot narratives need to be provided with the best when it comes to price feeds and other onchain data delivery. A young but rapidly maturing industry like crypto leaves a lot of room for a new generation of Oracle protocols to prove their worth and compete with incumbents, namely Chainlink. It is indeed hard to gauge marketshare when it comes to the oracles landscape in crypto. Nonetheless, we’ve seen new competitors like Pyth rise to the occasion, especially for low-latency usecases in DeFi, fetching a multi-billion dollar FDV even after the latest market dump. This is just but one example of the open door providing opportunity for competitors in the oracles space…

In today’s edition, we’ll be focusing on RedStone Oracles. RedStone provides frequently updated, reliable, and diverse data feeds for dApps and smart contracts across chains, appchains, rollups, and more. In 2024 so far, RedStone has doubled its share of Total Value Secured (TVS) in crypto, from ~1.3% to ~2.7%+ according to DefiLlama. The main differentiator with RedStone is its distinct design, aiming to maximize efficiency by not avoiding constant onchain data delivery, but rather allowing users to filter for the data they actually need. Not to mention, RedStone’s use of Arweave to archive signed data, which is another one of the protocols we’ve taken a keen interest in recently. There’s a lot to unpack with RedStone, as well as several key recent announcements and upcoming events, so without further adieu…

Keep your guard up in the markets ⬇

Background on RedStone Oracles

To start off, let’s break down RedStone’s unique modular architecture. Compared to some other Oracle providers, RedStone is more high-touch, focusing on meeting a protocol’s needs and designing systems custom-tailored for them. This is done by providing 3 different ways in which RedStone Oracles can be integrated:

RedStone Core; This can be thought of as the default process RedStone users. Data is “dynamically injected” to users’ transactions. This process fits in a single transaction, maximizing UX and gas efficiency.

RedStone Classic; Using a more traditional design instead of the efficient and scalable Core implementation, the data is ‘pushed’ into on-chain storage via relayer. This makes sense for protocols that want to have full control of the data source and update conditions. Other conditions that can warrant this implementation include if the protocol doesn’t need price feeds to be updated frequently if the team wants to avoid amending already-audited code, and if gas costs are minimal. The expansive list of price feeds that can be used in the RedStone Classic model can be found here.

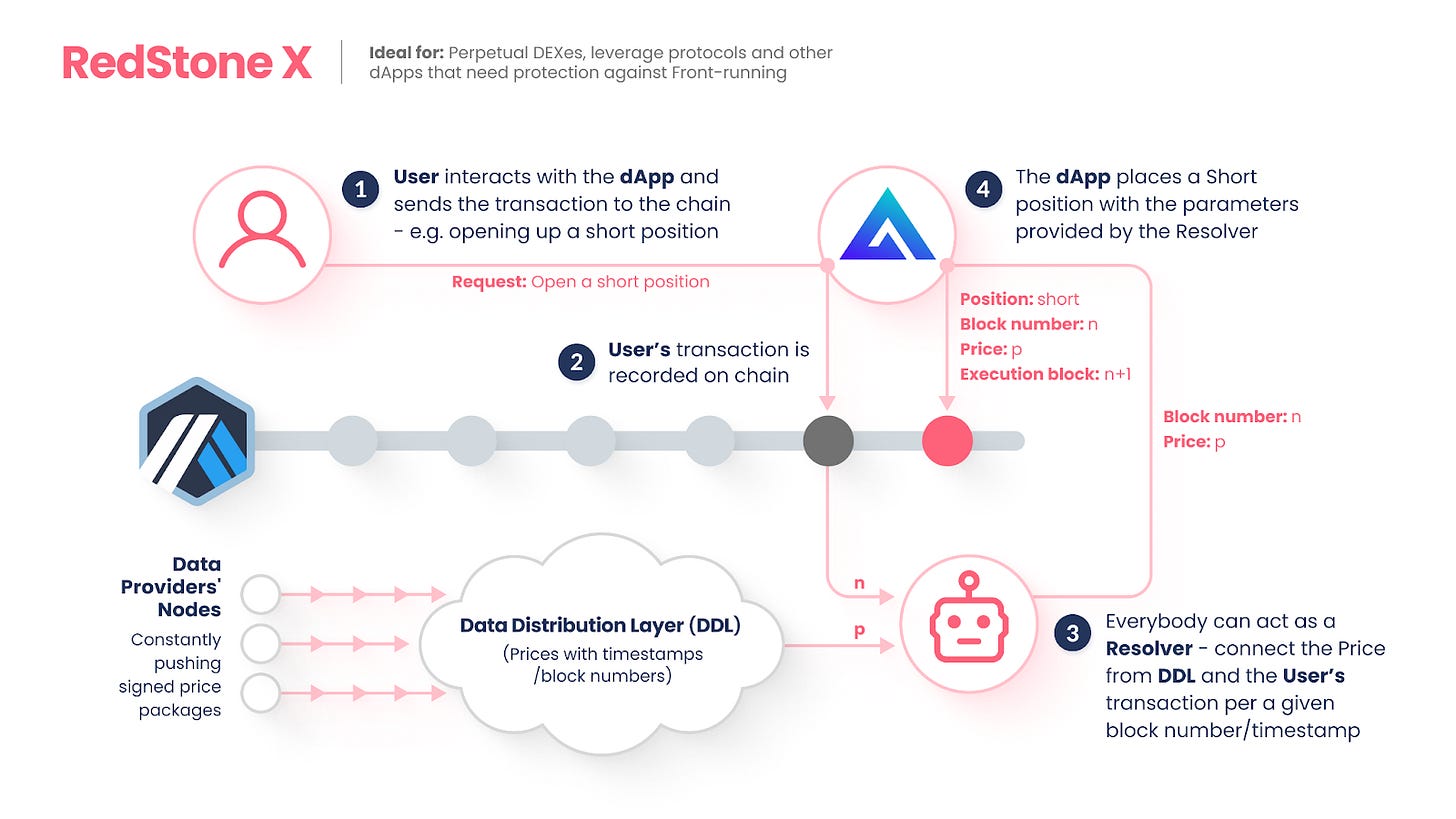

RedStone X; “An eXtreme protection against front-running”, this model is to be used for protocols with low-latency needs. Transactions are processed in two steps; an onchain intention to interact with the protocol from the user, and the price then being pushed onchain. This model is based on the one implemented by GMX, and may be fit for other trading and derivatives protocols in DeFi.

It is in these areas that RedStone’s edge shines, with the distinction from other Oracle providers becoming clear. RedStone is composable and fluid, able to adapt to protocol’s needs when it comes to price feeds, or whatever other data they might need. This is especially important in an industry like crypto where the most popular use cases of tomorrow may be completely unbeknown to the majority of users and even builders today.

“RedStone modular architecture allows supporting swiftly both new and established dApps launching on trending L1s & L2s. Combined with the best security practices and the ability to deliver non-standard data, like LP & staked tokens, puts RedStone in a perspective position ahead.”

-Stani Kulechov, Aave & Lens Founder & CEO

When it comes to RedStone’s origins, the protocol was founded by Jakub Wojciechowski, a former smart contract auditor with OpenZepplin with other experience operating as a startup CTO and advisor to DeltaPrime. Other members of the team have strong backgrounds spanning decades in Web2, as well as a crypto-native BD and marketing presence. The RedStone Oracles team is also looking to expand, as the team is actively recruiting for CMO, BD, and other roles here. The team will be at EthCC in Brussels (July 8-11), and is also one of the established companies for ETHWarsaw later this year (September 5-8).

$15M Raise, Season 2 Expitidion, & More

RedStone has come a long way since it first started, seeing key integrations with the likes of Ether.fi, Pendle, KelpDAO, Gearbox, and Morpho, among others. Earlier this week on July 2nd, the team’s latest $15M Series A round was announced. The team has found backing from Spartan Group, Selini Capital, and even Revelo Ventures, to name a few…

This fundraising announcement also included info on the protocol’s upcoming Season 2 Expidition campaign, which will culminate in the TGE of the native RedStone token. This is the sequel to the Season 1 expedition, which introduced RedStone gems, which can be earned by interacting with partner protocols, completing quests, creating content, engaging with the community, and more. It’s confirmed that Season 2 will include incoming onchain quests with both Pendle and Venus protocol. In addition, users can access some warmup Galexe quests here. New and old users alike can also claim a special gift by joining the RedStone Discord, and registering for season 2 by:

Joining the RedStone discord server,

Visiting the Warpy channel,

Registering the EVM wallet using the /linkwallet command and finally

Entering Season 2 and receiving a surprise by typing /joinseason2

RedStone: Oracle Extractable Value Solution

Just today, RedStone introduced some details on its Oracle Extractable Value (OEV) solution. To put it in the team’s own words, “OEV allows protocols to capture value leaking with liquidations, currently grabbed mostly by MEV bots.” Like the oracle models described above, the RedStone team will be working diligently with partner protocols to implement secure and scalable OEV solutions. OEV is basically a solution to cut down on MEV, specifically the type attributes with liquidation events on lending protocols, instead redirecting this extractable value to the protocol itself. RedStone’s OEV solution uses a combination of both external products and built-in features.

Data feeds from DEXs & CEXs alike provide speedy price data without a man in the middle. RedStone’s modular design and inclusion of its Data Distribution Layer (DDL) makes it so that liquidators are able to see signed price package data (approved by the protocol) before it is sent onchain, giving them the ability to act accordingly and submit a liquidation proposal. An analogous liquidation logic can be applied all of the existing RedStone models. RedStone will work with OEV providers to create a fair auction of price data upon which liquidations can act. The team is actively working on crafting new OEV strategies. In its current iteration, RedStone OEV allows the liquidator with the best buy offer to liquidate collateral, with earned funds being distributed back to the protocol and users. More details will be released on this exciting venture in the near future. Users should stay peeled for more RedStone news coming soon regarding OEV, the Season 2 expedition, a potential Monad partnership that was teased, and more…

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs