re.al - Tokenized RWA L2: What You Need to Know

veRWA Airdrop, re.al Ecosystem, & More

We’ve discussed RWAs quite a lot recently. From luxury watch trading, to tokenized securities, and more, we’ve been quick to cover top developments in this side of the space. Stablecoins are being acknowledged as playing a perhaps more important role and affecting the world outside of crypto. There are more talks of 24-hour stock trading, and institutions implementing infrastructure more resemblent of blockchain technology than traditional TradFi methods. Recently we’ve seen the likes of Kinto, a KYC chain for RWAs, and others also get some more attention. It is clear that blockchain has a lot to offer TradFi in efficiency and cutting out middlemen…

One exciting protocol in this space is re.al. re.al describes itself as the first L2 for RWAs. Unlike competitors like Kinto, re.al still places an emphasis upon being permissionless and open-source, for its users as well as protocols looking to deploy on the chain. The chain is built on a custom Arbitrum Orbit stack, specifically for the purpose of tokenizing offchain assets including homes, currencies, and more. This has led to more developer activity shortly after its launch, which just happened last month. re.al has already seen over $44M in TVL inflows, after going live less than a month ago…

Stay alert, stay informed ⬇

Background on re.al

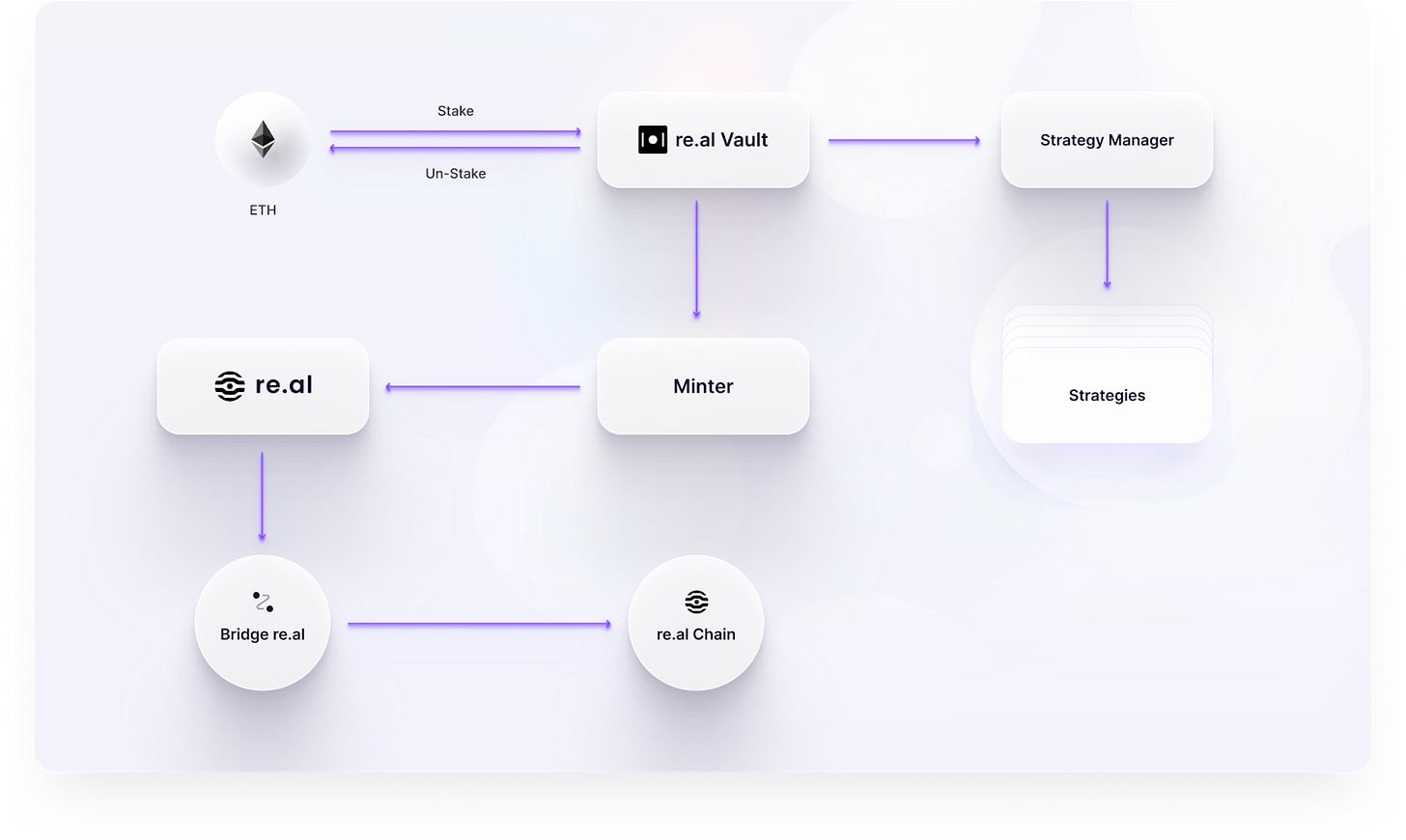

re.al takes a modular approach to the development of its chain, which uses Arbitrum Orbit to enhance its scaling while still retaining Ethereum security. While there are some efforts around building RWA rails on Ethereum mainnet, it’s become abundantly clear that most activity will be deferred to rollups or even other chains altogether. The Ethereum/EVM ecosystem looks the most dominant thus far, because these chains can still claim to use Ethereum for security, and ETH as an asset has much more provenance than other monolithic chains. re.al, being a modular protocol built from the ground up, uses Arbitrum Orbit, a framework that allows for the picking and choosing of other components to create the ultimate re.al tech stack. Celestia is used for DA purposes, as well as other blockchain infrastructure services that align with the needs and wants of re.al.

One standout feature of the chain is the fact that similar to Blast, it maintains native yield for ETH and DAI. This is a pretty significant feature, as the tailwind that this provides for Blast has been helpful, to say the least. Users are incentivized to use the chain and engage with the ecosystem, and developers are encouraged to create dApps that can do things not possible anywhere else, namely maximizing capital efficiency. There is a lot of money sitting around on L2s and elsewhere in assets (like ETH and USD stablecoins) that have viable and scalable yield applications. In re.al’s case, the chain can serve as a hub for native yield specifically catering to the needs of RWA protocols, something which doesn’t exist yet as Blast has a very different and much less defined niche.

The native token of re.al is reETH, used for gas. It is 100% backed by LSTs, enabling native yield. All ETH bridged to re.al will automatically be transferred as reETH, accruing yield from the get go. As this yield is derived from top LSTs, it will be roughly in line with the current ETH staking rate, around 3% currently. ETH and DAI both route through the native re.al bridge, which is what enables them to benefit from the native yield on the chain. Other variations of ETH and stablecoins exist but don’t receive the re.al native yield that these two assets do. Some of these stablecoins have their own yield mechanisms, including arcUSD.

RWA Tokenomics

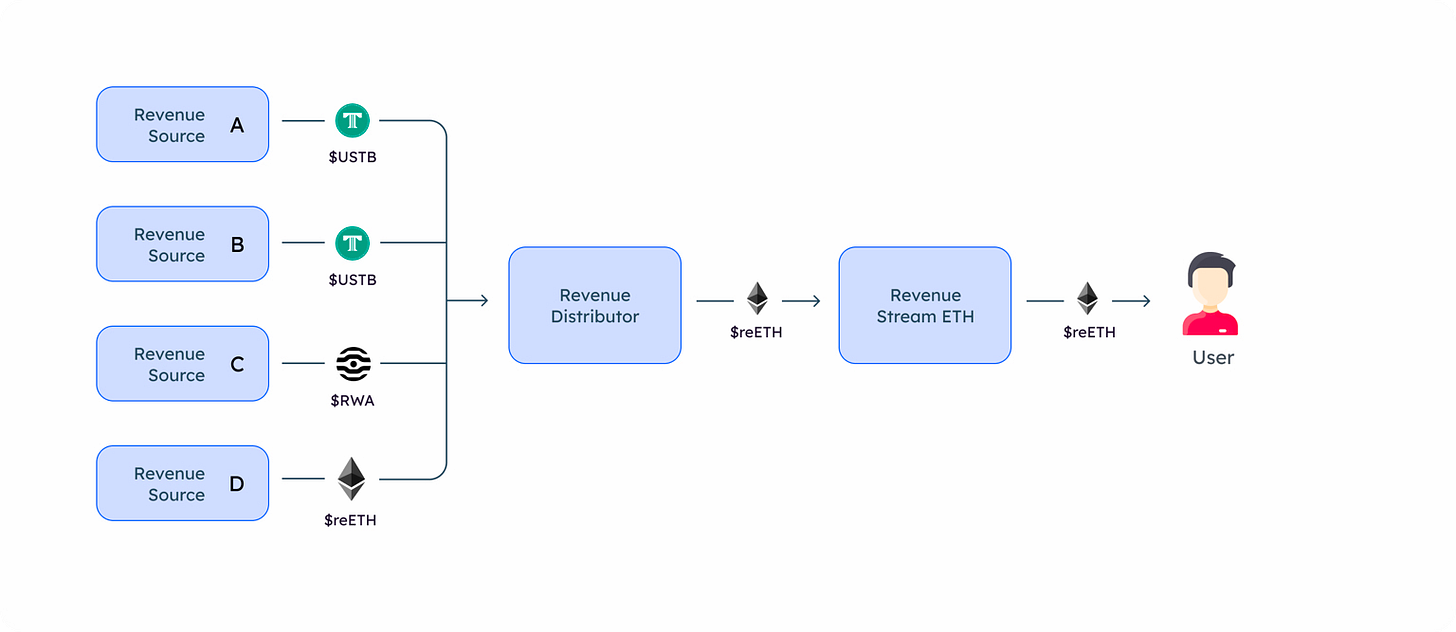

But enough about reETH; let’s talk a bit about RWA, the ‘governance’ token of re.al, which has an interesting value capture mechanism. It stands as the first L2 governance token to return 100% of revenues back to its holders, specifically those who lock RWA for veRWA. Overall, there are 8 different revenue and fee sources that stream accrued funds to RWA holders. This is made up of both chain transaction fees as well as fees from protocols deployed on the chain. This ensures that cashflow to veRWA holders increases as the chain itself gets more adoption, assuming this adoption increases revenues of the projects in the spotlight.

This token has only been live for right around a week, and the price has not seen much meaningful movement thus far. The APR remains low at just 0.27% APR currently, which is perhaps to be expected with the re.al chain itself in its infancy. Note that yields are denominated in. The token’s marketcap stands at around $29M, with over 90% being locked.

veRWA Airdrop Program

As mentioned above, re.al is a very young endeavor, with the chain going live and its airdrop program having gone live shortly thereafter. This initiative will help to bring new liquidity to the chain, as well as introduce users to the existing apps on the chain. The first season went live on May 16th, meaning that there is over a month left until it concludes and yields airdropped. There will be 3 more seasons following this, providing additional opportunities to earn.

Users can earn points in multiple ways, including a referral program. Engaging with this program is actually a requirement as all users must be referred by someone to participate in earning points in the first place. These referrals direct 10% of points earned by the referred user back to the referrer, with incrementally smaller cuts for second, third, and fourth-tier referrers. Users are rewarded for the TVL that they contribute, as well as other transaction types and activities. Certain actions that the re.al team deems as a higher priority and more important than others will be eligible for points multipliers. The team will automatically monitor the Tangible, Pearl, and Stack protocols, as well as the contracts of other new projects as they are deployed. Points are calculated in a time-weighted manner.

Protocols Built on re.al

A slew of projects have quickly deployed and gained traction on re.al, including Aracana, which puts a unique twist on the Ethena model of generating yield for stablecoin holders. For the sake of time, in this edition, we’ll focus on a few key protocols building on re.al in Tangible, Pearl & Stack.

Tangible

Tangible is a protocol that fits the re.al RWA ethos, having migrated its product offerings from Polyon to re.al. Tangible introduces the concept of TNFTs (Tangible NFTs), which is how the tokenization process works. Essentially, physical assets can be brought onchain and then redeemed through Tangible. Right now, these assets include real estate properties and gold bars.

Tangible notably has its own stablecoin in USTB, which sales on the platform are denominated in. This is a rebasing stablecoin, basically acting as a wrapper of USDM by Mountain Protocol, which backs 100% of all USTB. USDM gets its yield from short-duration Treasuries, which USTB collectively passes onto USTB holders on a daily basis.

Pearl

Pearl, also originally native to Polygon, provides concentrated liquidity for RWAs. The protocol actually serves as the go-to liquidity hub and AMM on the re.al chain. Pearl’s offerings include the Pearl exchange, which serves as a DEX for RWA assets including RWA stablecoins, real estate, and more. The platform has added concentrated liquidity to its offerings, which reduces slippage for traders/swappers while potentially optimizing yields for LPs. Trident, a sub-protocol by Pearl, provides ALM (Active Liquidity Management) services for Pearl’s concentrated RWA liquidity positions.

Stack

Stack is a CDP (Collateralized Debt Position) protocol, allowing users to deposit and lend RWA assets on re.al, including Tangible assets and USTB, with the potential for more collateral to be added down the line. Users can then borrow MORE against this capital; not more as in more borrowing power, but the protocol’s own overcollateralized stablecoin, dubbed MORE. Users can even access UI-integrated leverage on Stack, made possible via looping.

A CDP protocol, as well as the other protocols mentioned above which provide a DEX with concentrated liquidity and a prominent tokenization platform, are key ingredients to building an ecosystem for RWAs. It looks like re.al has successfully managed to attract top RWA protocols to not only deploy on their RWA-focused chains but rather migrate altogether, and form in-depth partnerships with the core underlying chain. These projects even contribute some of their revenues to the yield of the RWA token itself, creating a sort of collective co-dependence between re.al and its ecosystem, as well as aligning the price and demand of RWA with the success of the ecosystem.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $33.25/month you’ll get:

Premium access to the entire Revelo Intel platform

Investor Profiles - Analysis on top crypto investors & their investing performance

Raise Alpha- Weekly reports on interesting project raises

Sector Overviews - 90 day Reports with data and insights on key sectors

Launch Alpha - Weekly report highlighting new projects

The Trace - Real-time onchain alerts for smart money movements

Airdrop Guides - Reports on airdrop opportunities

Members Only Discord server

Analyst Insights reports - actionable trade ideas

Project Snapshots - Monthly protocol-specific performance reports

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs