PumpFun: Asymmetric Upside or The Final Extraction - What You Need to Know

PumpFun ICO, Competitive Dynamics & Future Expansion

Launchpads have emerged as arguably the strongest PMF structural narrative on Solana this cycle, directly attributed to the rise of memecoins while creating lucrative cashflows. Yet the landscape is rapidly evolving and increasingly competitive. BonkFun is aggressively positioning itself as a Solana-native alternative, and LaunchCoin, after early hype, faces questions on staying power.

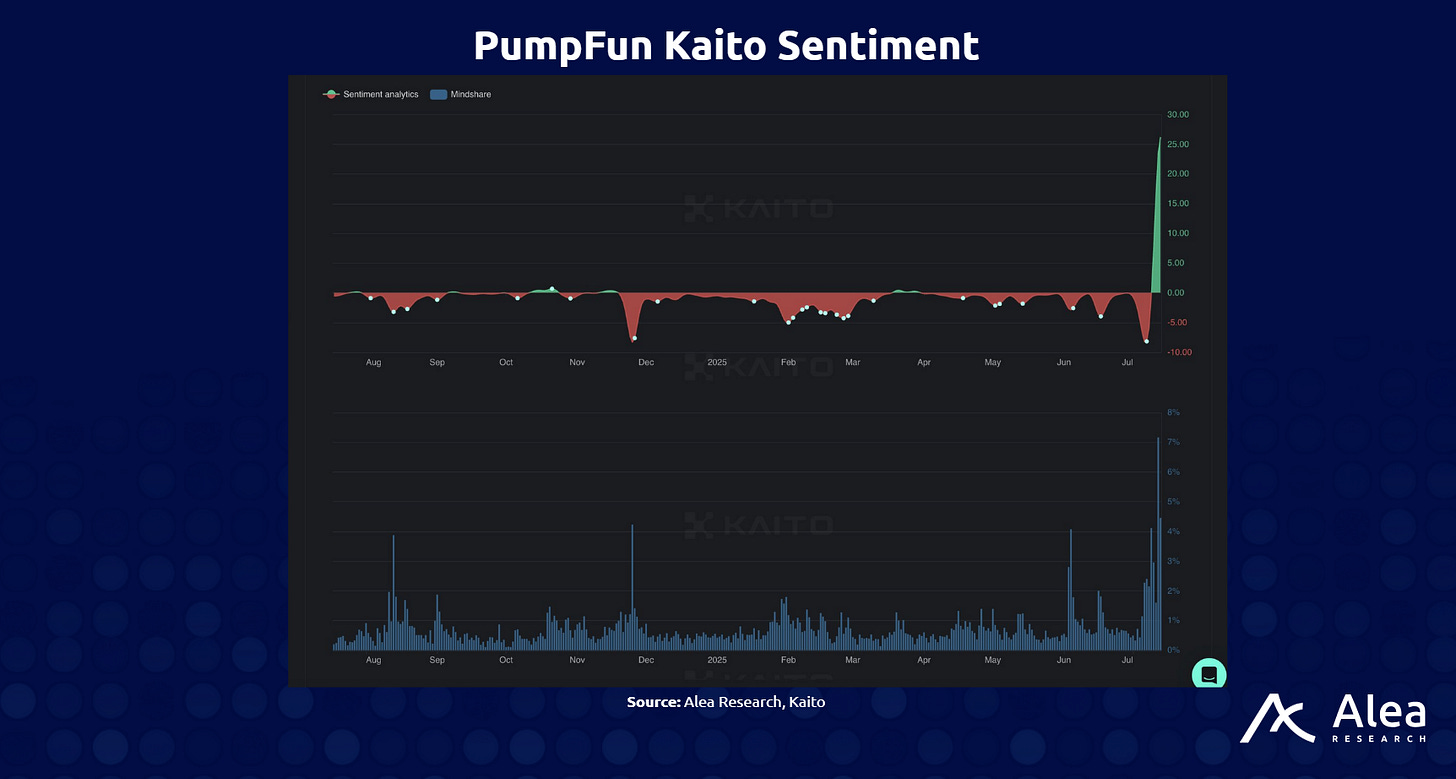

With Pumpfun’s ICO, attention has shifted back to them amidst bleeding memecoin sentiments, declining volume shares, and market share.

In today’s edition, we’ll explore Pumpfun’s current situation, their competitive dynamics, and the sentiment around Pump.fun’s ICO which tests whether these models represent the next stage of expansion or simply what many call “the great (or final) extraction”.

Stay informed in the markets ⬇

The Business of launchpads: Owning the Casino

Launchpads like Pump.fun, BonkFun and Believe achieved strong PMF by successfully institutionalizing memecoin speculation. Pump.fun effectively became the default “meme casino,” by offering one-click Solana bonding curves, abstracting away complexities like liquidity bootstrapping, AMM setups, and initial listings.

Pump.fun also made a key pivot in early 2025 by cutting out Raydium, routing all new launches through its own AMM, PumpSwap. This vertical integration meant every new memecoin’s creation, trading fees, and even initial liquidity migration consolidated under Pump.fun’s rails, effectively owning the entire lifecycle.

This model is massively profitable, with Pump.fun consistently clearing $30–40 million in monthly protocol fees, even after the parabolic Q4 2024/Q1 2025 memecoin frenzy cooled.

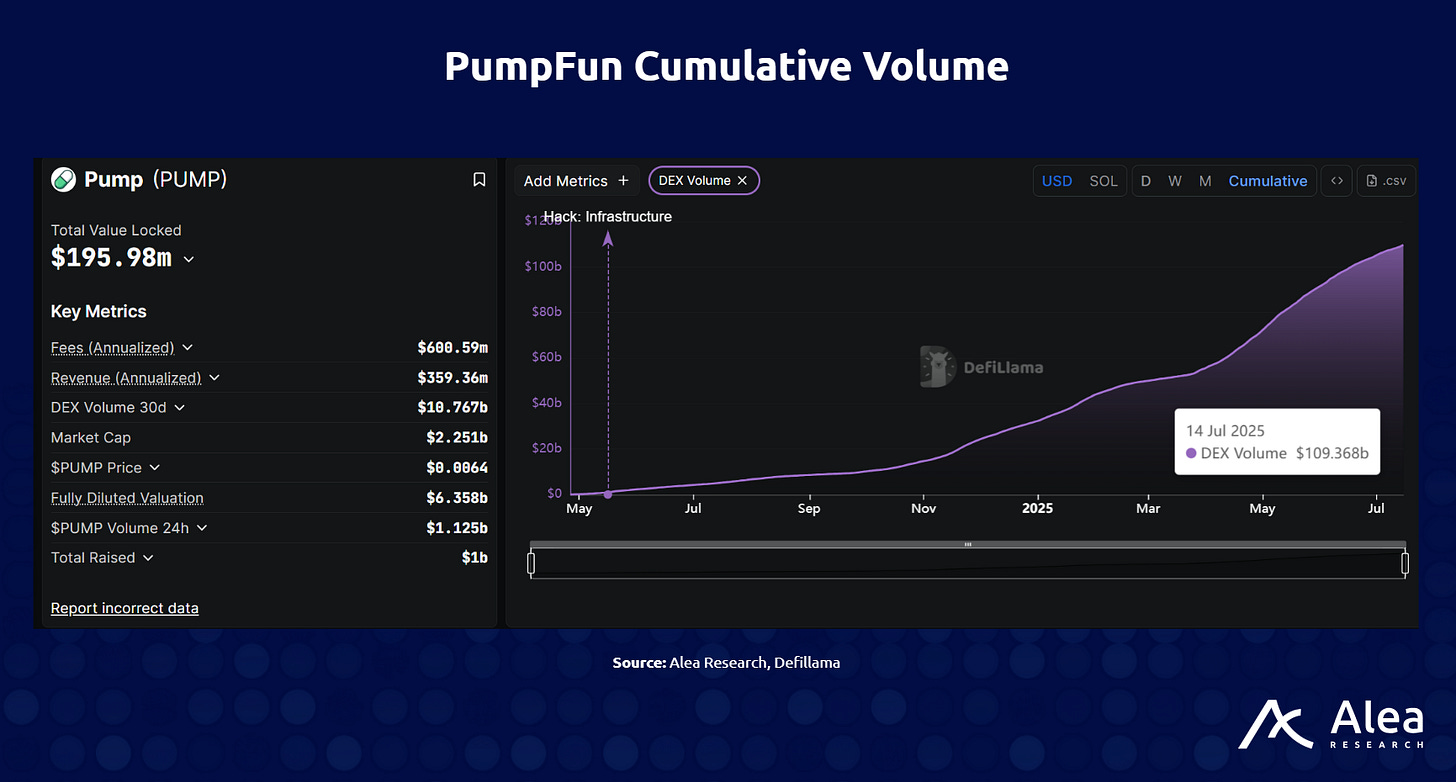

Its all-time revenues are now above $650 million, with over $100 billion in cumulative trading volume since pump.fun and pumpswap’s inception. This far outpaces many DEXs and lending protocols that were once the poster children of DeFi’s cashflow/revenue thesis.

LaunchCoin, by contrast, was early to market in positioning itself as a multi-chain, celebrity-led launch venue (via Ben Pasternak) which aimed to serve as the gateway to web3 for web2 startups. But as the mania subsided, LaunchCoin’s momentum struggled to keep up with the simpler, stickier memecoin-first UX of Pump.fun and BonkFun. BonkFun however took the same user-friendly model but embedded it with Solana-native economic flywheels, directing 58% of fees toward burning BONK, 15% to SOL staking, and explicitly rewarding creators. This is a direct bet on aligning with the retail-heavy Solana “trenches” that drive memecoin cycles.

Pump.fun TGE: The Great Expansion or The Great Extraction

Pumpfun is arguably a fundamentally strong project, boasting:

Consistent, enormous fee generation.

Strategic pivot to own swaps by launching Pumpswap, creating a full-stack cash engine.

A first-mover advantage and a brand now synonymous with meme speculation, reinforced by top-tier marketing (name, logo, ticker).

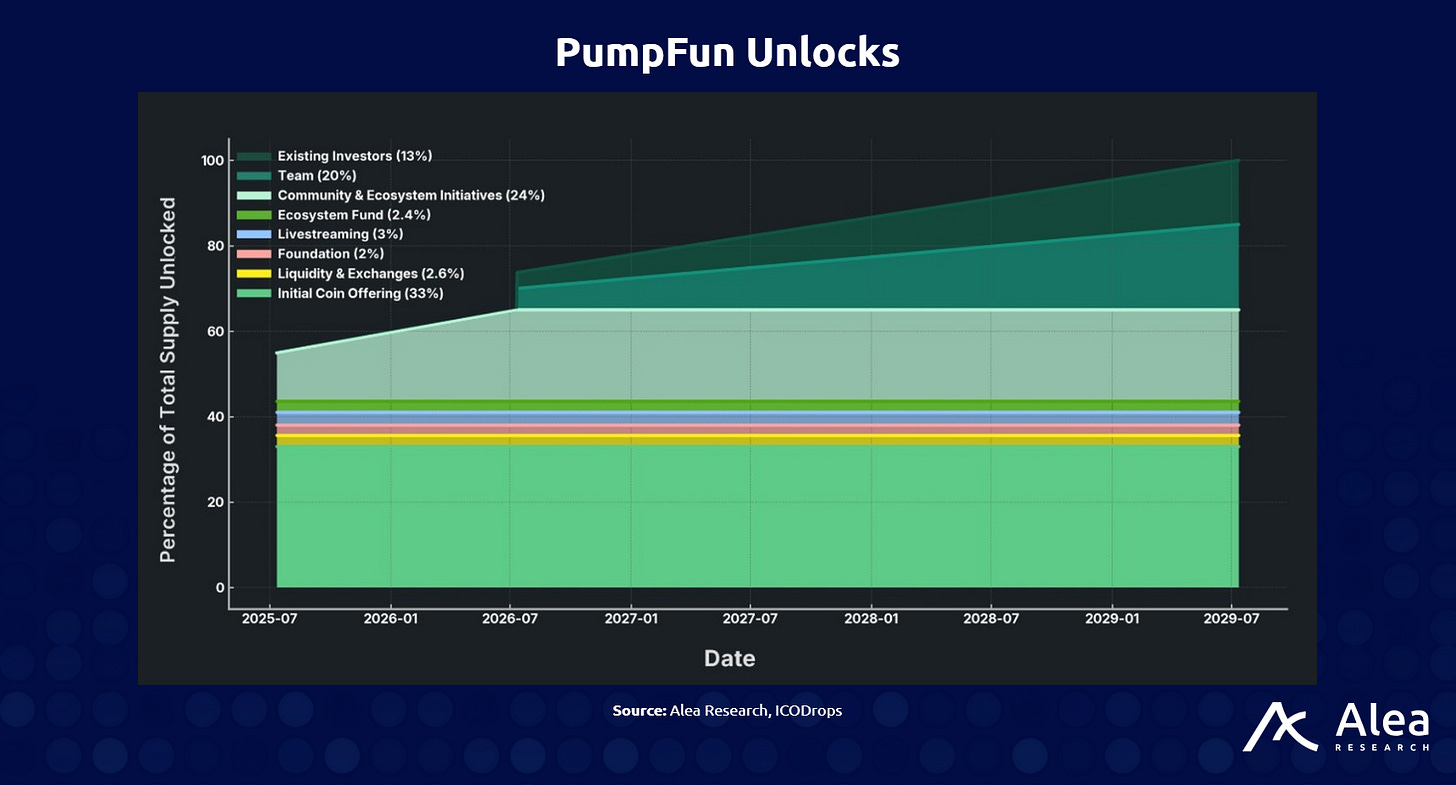

The $PUMP token is distributed as such:

The public sale sold out within 12 minutes, filling the full $600M amidst bottoming memecoin sentiments around Pumpfun, particularly leading up to the ICO as it was largely referred to as the one last “Great Extraction” by the team. This came as pumpfun continued losing market share to rivals like BonkFun and Launchcoin.

A day after the launch, it was annouonced that there will be structured buybacks, finally crystallizing protocol cashflows into tokenholder returns. Alon loaded up a wallet with $30M and has already deployed $20M into buybacks on the open market.

However, general concerns still remain that the $PUMP token launch is bad for the memecoin market in general as retail liquidity pivots to chase a major launch, existing meme markets starve. This is compounded by the size of the raise and subsequent spot/perp market chasing, largely from the same pool of hyper-rotational capital.

BonkFun and LaunchCoin: Fighting for Market Share

BonkFun has expertly positioned itself as the pro-Solana alternative. By tying revenue flows directly to BONK burns and SOL staking, it’s effectively marketing itself as the “community-aligned meme launchpad” that grows the broader ecosystem rather than extracting from it. This resonates strongly with the trenches, particularly in a market hyper-sensitive to perceived extraction after years of vampire attacks and venture siphoning.

Its volumes are still a fraction of Pump.fun’s daily throughput, but it’s grown from near-zero to now regularly capturing >50% of the daily new token launches, according to aggregator dashboards. This is especially notable given how sticky Pump.fun’s flows are.

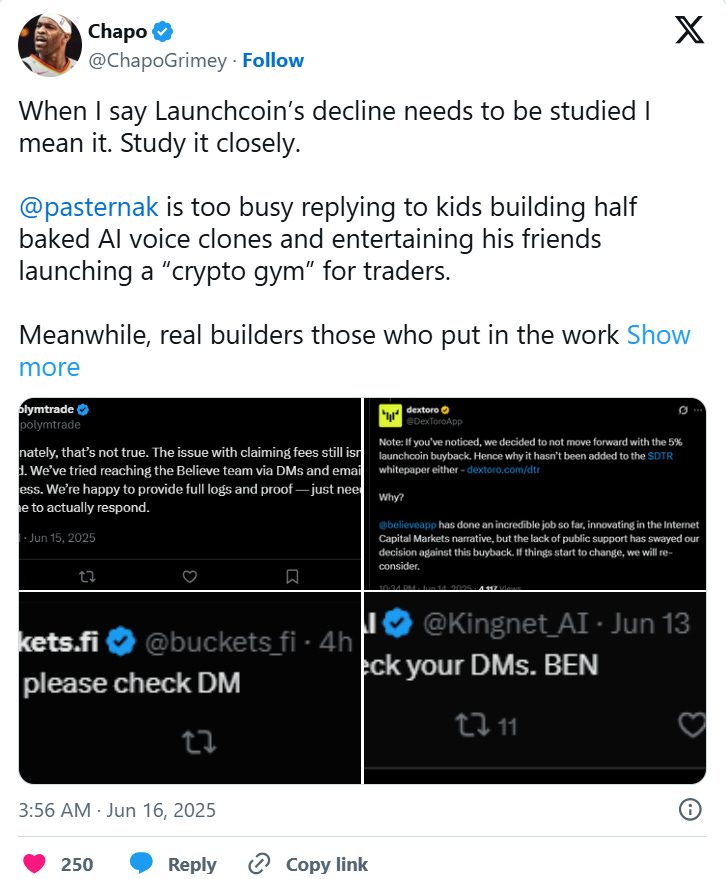

LaunchCoin, meanwhile, illustrates how quickly narratives can fade. Once hyped for its multi-chain ambitions and celebrity marketing, it’s struggled to maintain volume share as the market rotated back into Solana-specific plays.

Its fee metrics and liquidity launches are materially below both Pump.fun and BonkFun, with chatter increasingly revolving around its declining mindshare and often delayed deployments.

Bottom Line: Hype or Hate

Pumpfun’s ICO is both a magnet for capital chasing the next sustainable “revenue-generating” project’s token and a feared liquidity sink that could flatten existing meme marketcaps.

On one side, the ICO is structurally sound, pricing aligns private and public, revenue share is clear, and there is a pipeline for buybacks and expansions. On the other, it’s a polarizing launch at a market cap larger than most historical meme cycles, during a period of low conviction.

Meanwhile, BonkFun and Launchcoin continues to chip away by appealing to retail loyalty and offering a supposedly less extractive narrative, hoping that longer-term it can erode Pump.fun’s brand moat.

The bottom line is regardless of whether these platforms evolve into sustainable consumer-grade cash machines, or simply mark the top of speculative capital before rotation to the next narrative, they are currently among crypto’s most profitable businesses by raw margins. PumpFun in particular, despite all criticisms, remains the closest thing Solana has to an “app-chain success story,” vertically integrating every piece of the meme casino.

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.