Pryzm - The Appchain for Yield Tokenization: What You Need to Know

Cosmos Ecosystem Yield Trading

We’ve discussed fixed rates quite a bit recently. We had our Fixed Rates Revelo Roundtable last week, featuring Pendle, and other top teams in the yield trading space. With all this yield talk, we’d be remiss if we didn’t mention Pryzm…

Pryzm plays in the yield space, with some distinct differences between other protocols that engage with fixed and variable rates. Namely, Pryzm is an appchain built on Cosmos tech, injecting its offerings into an ecosystem that doesn’t have access to the like of Pendle. This makes all sorts of things possible, like using assets of choice to pay for transactions on the network. Cosmos itself is also an ecosystem with many app chains and L1 PoS networks, from TIA to DYM, OSMO, and more. This presents more high marketcap options and possibilities for trading or locking in yield. Being a sovereign appchain also brings its own unique benefits to the native PRYZM token.

All maturities on the Pryzm platform are also traded in the same pool, which can generate more fees for LPs and be more capital efficient as the yield curve is brought onchain. Users don’t need to rollover liquidity or have their positions spread out across different dates. With its testnet currently live, the long-awaited Pryzm product is becoming a reality. Look out for more Pryzm coverage from us soon…

Stay alert, stay informed ⬇

Background on Pryzm

Pryzm is a Layer-1 application-specific chain (appchain) dedicated to transforming yield management. By allowing for the tokenization of yield and making it tradeable on an Automated Market Maker (AMM), Pryzm aims to lay the foundations for a multi-trillion market opportunity, akin to fixed income and interest rate derivatives in traditional finance (TradFi).

The unique selling points of Pryzm derive from its ability to unlock fixed income, stability, and predictability in the current DeFi markets. By offering a permissionless and interoperable marketplace for trading yield, Pryzm addresses critical pain points observed in DeFi, such as yield volatility, asset lockup, and governance.

Deeply rooted in the founding team’s experience on interest rate and yield markets in traditional finance (TradFi), they set out to build the first and only application-specific chain (appchain) for tokenizing and trading yield. This would immediately open up the doors to the broader Cosmos ecosystem, finding synergies with other appchains and unlocking more utility for their staking assets

Opting for a community-focused funding model, Pryzm prioritizes decentralization and wide token distribution. This strategic choice reflects a dedication to ensuring broad ownership and participation within the ecosystem, steering clear of early stage private funding to avoid concentrated token ownership.

Key Points

Initially envisioned as a suite of smart contracts for deployment on an existing blockchain, the Pryzm team recognized that to authentically replicate the breadth and intricacy of traditional finance (TradFi) markets, constructing an appchain was imperative. This approach would ensure the essential features of customization, interoperability, scalability, sovereignty, and performance—attributes that are unattainable when operating atop a third-party Layer 1 blockchain.

Pryzm is a Layer-1 application-specific chain that is immediately interoperable with the Cosmos ecosystem (via IBC), and beyond (via General Message Passing protocols such as Axelar and Wormhole), focused on transforming yield management by tokenizing yield and enabling its trade on an Automated Market Maker (AMM).

Pryzm addresses DeFi pain points like yield volatility, asset lockup, and governance issues by offering a permissionless and interoperable marketplace for trading yield, aiming to parallel the multi-trillion market opportunity seen in Traditional Finance (TradFi) with Interest Rates Derivatives (IRDs).

Pryzm allows for the immediate tokenization and trading of future yields, creating a new asset class by splitting yield-bearing assets into principal tokens (pTokens) and yield tokens (yTokens), akin to zero-coupon bonds and coupon payments in traditional finance.

Amidst market saturation in sectors like lending and stablecoins, Pryzm’s yield tokenization and trading stand out, offering clear value propositions, extending token utility, and promoting collaborative and positive-sum games.

Pryzm forgoes Venture Capital (VC) funding for a community-oriented and decentralized growth model that avoids the concentration of token supply.

The chain generates revenue through yield shares, swap fees, MEV capture, and a token restaking tax rate, reflecting a diversified and innovative approach compared to traditional Layer-1 blockchains – with all of this value being accrued by $PRYZM token.

Managed by $PRYZM token holders, the Pryzm Treasury collects various tokens, empowering strategies like value preservation, buyback and burn, rewards for loyalty, and community pool contributions, governed through a democratic process.

Trading Future Earnings Today

Pryzm enables the immediate tokenization and trading of future yields, offering users the ability to unlock and trade their future yields today. This mechanism is crucial for realizing the time value of money in DeFi, where the future worth of assets can be significantly impacted by market dynamics, liquidity conditions, yields, interest rates, token inflation and token unlocks.

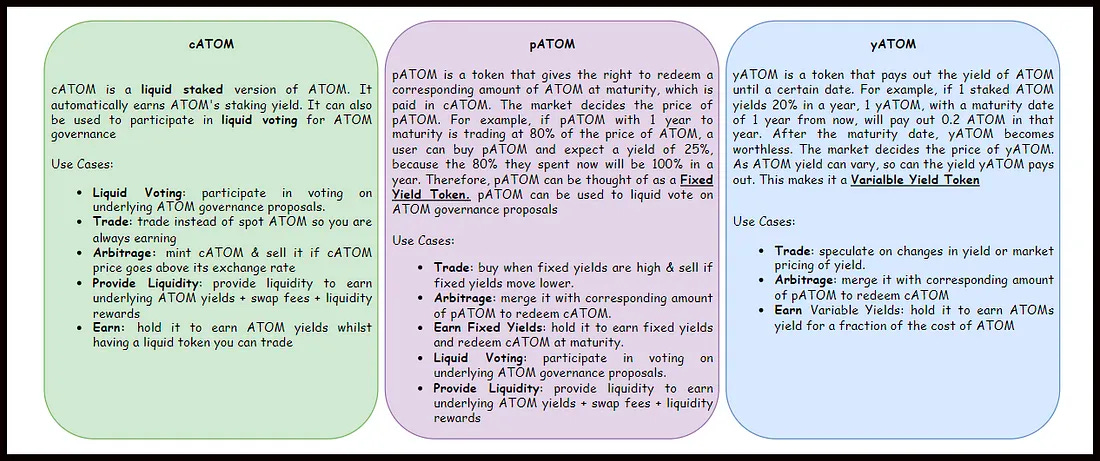

At the core of Pryzm’s functionalities is the tokenization of yield: the process of depositing a yield-bearing asset onto the platform. When users deposit such an asset, Pryzm mints a collateral token (cToken), which is then bifurcated into two distinct components with a maturity date attached: a principal token (pToken) and a yield token (yToken).

pToken: Represents the principal amount of the deposited asset and holds a 1:1 redemption value with the underlying asset at maturity. Essentially, pTokens guarantee the return of the initial principal invested after a predetermined period.

yToken: Represents the future yield that the deposited asset is expected to generate until maturity. Holding yTokens entitles the owner to the yield earnings, which can be realized without having to wait for the natural accumulation period.

By separating the principal and the yield into pToken and yToken respectively, Pryzm effectively allows users to individually manage, trade, or leverage these components based on their investment strategies, liquidity needs, or market outlooks.

pTokens are akin to zero-coupon bonds in TradFi, since they do not pay periodic interest but are issued at a discount to their face value. Since they can be redeemed at maturity for their full face value, that makes them an attractive option for investors looking for a predictable return.

yTokens can be likened to the coupon payments of a bond. In traditional bonds, coupon payments provide the holder with periodic interest returns until the bond’s maturity. Similarly, yTokens grant the holder the right to claim the real-time yields generated from the underlying asset until the yToken reaches its expiry date.

Those who prefer a guaranteed return at a future date might lean towards pTokens, mirroring the risk profile of zero-coupon bond investors. Conversely, users seeking regular income from their investments, similar to traditional bond coupon collectors, might find yTokens more appealing due to their yield-generating characteristics.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs