Perennial - Intents-powered Perps: What You Need to Know

Hybrid Intents Architecture, Petals Incentives Program, & More

Speculation is the primary use case of crypto today, and access to leverage is a core component to attract speculators, whether it be individuals or institutions. Historically, perps have been the means by which crypto natives get access to leverage when trading coins and tokens, a deviation from the norm in TradFi, where options reign supreme. If the recent $HYPE TGE and widespread support for Hyperliquid has shown anything, it’s that crypto market participants value proper perps infrastructure more than almost anything.

In today’s edition, we’ll discuss Perennial, a decentralized perpetuals exchange with a focus on intents. Perennial has just launched today and even implemented its own incentives program. There may be some renewed interest in perps protocol considering the current market conditions and Hyperliquid demonstrating that users greatly appreciate a perps products done right. Beyond just incentives though, Perennial’s use of offchain order matching (intents) and an onchain AMM, to create a design that can help to create a new liquidity layer for perps trading that other projects can even build on top of…

Stay informed in the markets ⬇

Background on Perennial

Perennial describes itself as a hybrid intents/ derivatives protocol. Beyond its own perps exchange, Perennial also serves as core infrastructure that perps aggregators can integrate into their own interfaces. This can help to bring additional volumes to the protocol and stretch its reach beyond its own userbase. To go back to the recent example of Hyperliquid, this is a key part of the protocol’s value add beyond its own trading platform, and other perps protocols would probably be well served to build in this direction in order to maximize trading volumes.

Key features of the protocol include hybrid architecture, ease of integration, cash-settled trades, permissionless nature, and more. The protocol also prioritizes trading fee minimization, as well as giving LPs leverage capabilities. The platform has just launched with over 20 trading pairs, which include both crypto assets, Gold, and even some FX. More markets will be added over time permissionlessly.

As mentioned above, another key piece of Perennial's value add is its integration capabilities. The team has placed an emphasis on developers being able to add Perennial to their own interface, tapping into the protocol’s unified liquidity.

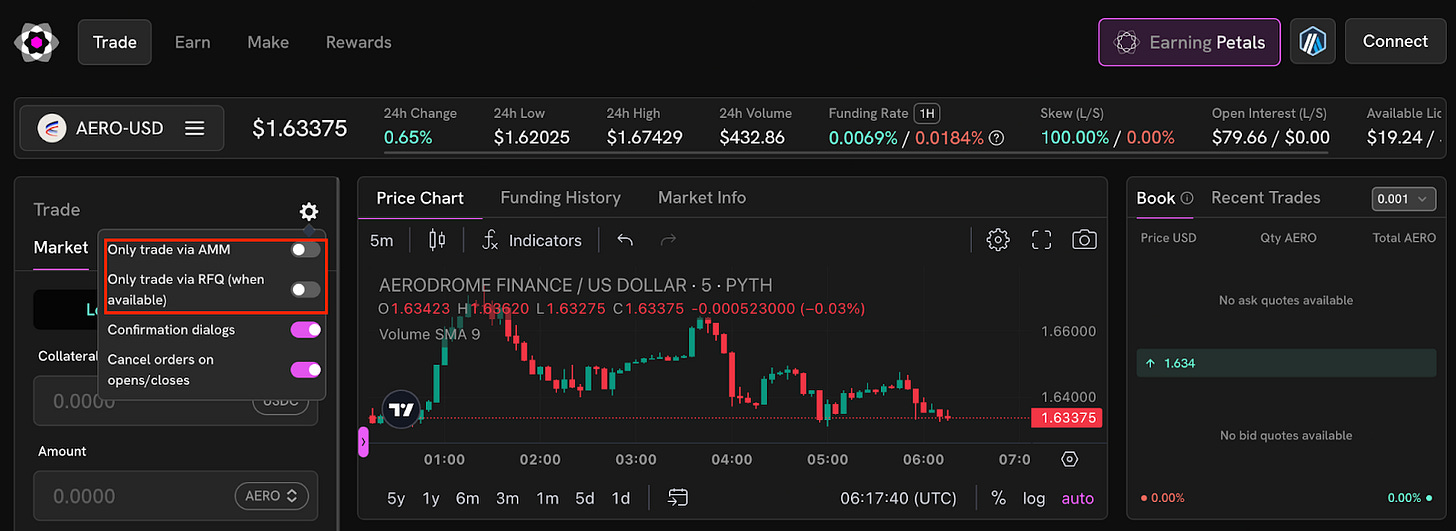

When it comes to protocol architecture, the team employs a hybrid DEX approach in order to maximize performance while retaining the benefits of DeFi. Perennial’s design allows traders to either make trades via Automated Market Maker (AMM) or Request for Quote (RFQ).

The RFQ option consists of traders specifying intents offchain. In this scenario, traders can have their trades matched by solvers. This maximizes the speed and efficiency of trade-matching, for both market and limit orders. Perennial Intents provides instant execution and guaranteed pricing, in addition to more liquidity sources beyond the AMM. Intents and the performance boost created as a result, enable the ‘one-click’ trading experience that more traders are becoming accustomed to, hoping to match the trading experience of popular CEXs.

Perennial Intents also allow solvers, acting as market makers, to manage their exposure with quotes from a single collateral pool. Solvers provide real-time quotes while preserving the positive attributes of a decentralized protocol, namely transparency as well as reliability. Solvers manage orders, ensuring competitive pricing for traders.

In the event that a trade cannot be matched for equal exposure from a solver liquidity from the AMM is used. Users can also opt to only trade against the AMM, foregoing the RFQ matching system entirely. The AMM is capitalized by onchain LPs, who assume the risk of traders. Acting as the house, LPs stand to gain when traders lose, and stand to lose when traders gain.

LPs have a couple of options when it comes to providing capital. They can deposit into vaults, effectively market-making for certain asset pairs. Currently, two vaults are live, providing liquidity to $ETH and Ethereum ecosystem assets, and another vault for $BTC and other major assets.

On the other hand, there are Advanced LPs. These have a separate UI, and allow users to get leveraged exposure to specific asset markets. Rather than more generalized exposure, makers can specify which direction they want to provide liquidity in, long or short.

Just like trading perps, Advanced LPs using leverage can also be liquidated. Perennial provides some liquidity management resources to help makers manage their leveraged LP positions. In the future, there may be multiple markets specifying different utilization curves, fee structures, and more.

Beyond protocol architecture, Perennial has designed its trading platform to come as close as possible to matching CEXs in terms of usability. This includes the use of single-collateral accounts, which can be used across various markets on the platform. These accounts also abstract away the need for gas fees and signing for each trade, users can deposit funds just as they would on a CEX. Some might say that platform usability is just as important as protocol design, and Perennial has spared no effort on this front.

Now, Perennial has launched its own points program; Perennial Petals. Starting now, users can earn petals at a 2x rate. Users can begin accumulating petals simply by making trades on the Perrenial frontend, but also on integrated frontends as well. Points will be granted retroactively to previous users, but early adopters just joining now also will receive a bonus. Traders will earn petals at double the rate for their first week of trading, incentivizing them to really stress test the platform.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs