We’ve been hearing a lot about AI agents lately, with much of the focus being on the agents themselves or specific frameworks for launching agents. Our own coverage is indicative of this, and we’ve also taken a wider view of the role of crypto in the age of AI. Now, with the rise of DeFAI, we’re seeing more focus than ever on the intersection between AI agents and the onchain economy. Even with AI as a narrative currently in free-fall due to the current market dump, this sector is still nearly half of all crypto mindshare.

With individual agents and framework tokens seeing a repricing, there is some focus being placed on AI teams building chain-agnostic ecosystems, with suites of multiple products that allow for customizable AI agent creation. In today’s edition, we’ll discuss ORA, one of the key established projects building in the AI agent infrastructure space. ORA provides full-stack agentic tooling; everything from verifiable AI inference to an agent launchpad, and more. There is a lot to discuss when it comes to ORA’s existing offerings, not to mention new and upcoming updates from the team…

Stay informed in the markets ⬇

Background on ORA

ORA, first founded over two years ago in 2022, has been promoting the growth of AI x crypto long before it became much more mainstream late last year. Raising $20M in a Series A this year rom Polychain, SevenX ventures, and Dao5, among others, the team is now well-equipped to bring multiple products to market as demand for AI in crypto continues to evolve.

Back in April the team even released a blog post detailing their vision for ai/fi, or DeFAI, as more people are now referring to it as. ORA has demonstrated an ability to see where the puck is going in the AI agents space, and building infrastructure where the demand is.

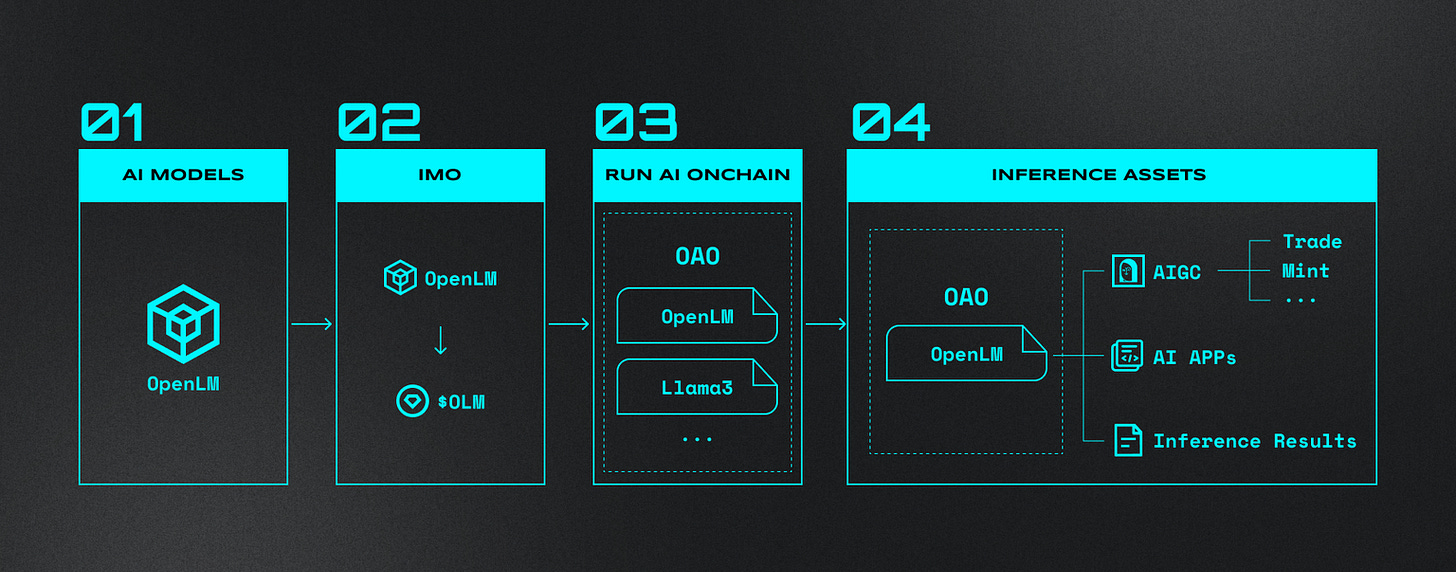

Among the protocol’s core offerings, is its ability to verify AI inference in use of onchain smart contracts through the ORA AI Oracle. This makes it much easier for protocols to integrate compute-reliant functions, expanding the range of potential for what teams can offer in a dApp in a measured way. Whether it’s using AI to find superior yield strategies or enable dynamic market-making curves; there’s potentially a lot of value in verifiable AI inference.

ORA also brought Initial Model Offerings (IMOs) to the market, an interesting way for creators to effectively mint models, uniquely proving their ownership and contribution to their work. The goal here is to promote open-source AI development, by creating methods for users to be able to permissionlessly raise funding in exchange for a revenue-sharing token representing their model.

To top it off, the team is expanding to where the users are, with deployments on Base, Arbitrum, and Optimism. Both Hyperliquid and Solana have now been added to this list as well. At its core, ORA is a chain-agnostic ecosystem for users to build agents, projects and tokenized models of their own, all made possible by ORA’s key offerings of verifiable AI inference and ownership. There are over 20 projects building on ORA right now, with over 180K AI inference calls across 500 nodes.

At the center of all this is the $ORA token. $ORA will be the primary currency for the agentic economy ORA is looking to create across all chains. $ORA is vital for participation in IMOs, supporting operations by running nodes, and governance, with more utility being added. Most notably, $ORA is also now used to launch AI agents…

Pump.ai

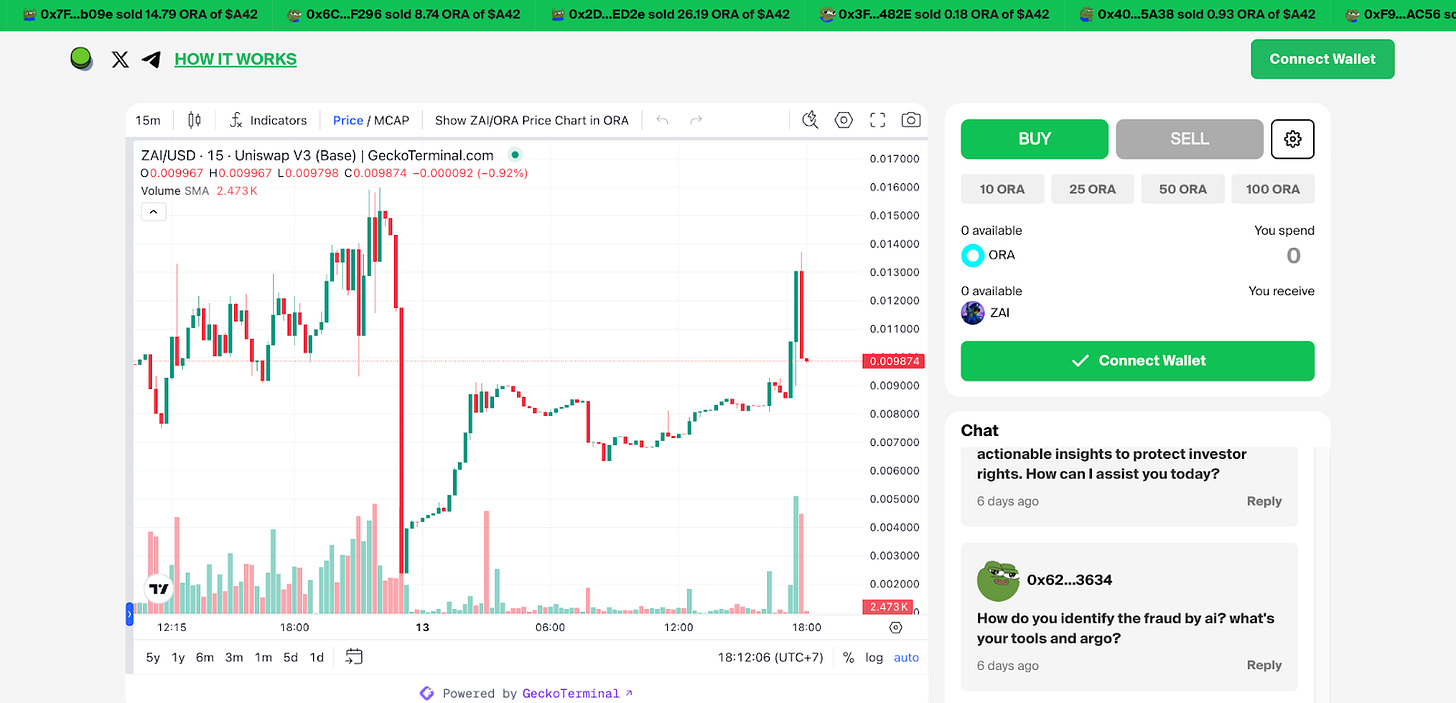

Now, the ORA team has even just introduced Pump.ai. As the name suggests, this is a platform for users to easily spin up their own AI agents, for as little as 1 $ORA token (~$1.9 at current prices).

We’ve seen the demonstrated success of platforms like Virtuals, which allowed users to easily launch AI agents with corresponding tokens. Pump.ai takes the AI agents meta and makes it even more accessible, emphasizing retail’s involvement in trading existing agent tokens, as well as creating their own.

Clearly taking some inspiration from Pump.fun, pump.ai provides an eye-catching but easy-to-understand UI. Users can easily launch their own agents and tokens without technical knowledge.

When creating their own agents, users can easily describe personalities and behaviors that the agent should consistently reflect and fall back on. Users can specifically prompt the perpetual AI agent, providing its objectives and priorities when posting and interacting with users on the platform itself and X. Assets generated by AI models or AI agents on ORA are also ownable themselves, a key benefit of the ORA ecosystem as a whole, beyond the pump.ai platform itself.

What’s more, is that AI agents deployed on pump.ai will evolve over time along with the opAgent framework, which they are built on top of. These agents will see increased capabilities in the future as this framework is further developed…

opAgent Framework

opAgent leverages ORA’s use of Optimistic Machine Learning (opML). Similarly to optimistic rollups, allows for the onchain use of large ML models without sacrificing the benefits of blockchain, namely decentralization, and security.

As the name implies, one of the premises of perpetual agents launched on ORA is the fact that they can interact at all times, indefinitely. These AI agents are created immutably onchain, bestowing permanent ownership rights of this digital asset to the creator. Verifying the ownership and computations of agents is one of the key benefits of ORA, and this applies to agents as well.

Another key attribute of the framework is its intended use in managing onchain transacting capabilities of agents, something that is highly anticipated by market participants but that is yet to be seen in action meaningfully. Agents under the opAgent framework will be able to act autonomously in ways not commonly seen before, including smart contract interaction, minting of onchain assets, sending and receiving tokens, and more.

There are a lot of possibilities for agents in the ORA ecosystem, much of which reflects what users/investors involved with this AI agent meta have expressed demand for. The ORA team has been proactive in shipping; follow the team and look out for more details regarding the opAgent framework in the coming days…

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.