In today’s edition, we’re deviating a bit from our usual DeFi coverage to cover an interesting niche area of the market in the RWA realm. The niche in question? Watch trading. For whatever reason, watches in particular seem to be a popular IRL for product for protocols to build around. Contributing factors likely include crypto’s predominantly male demographic of participants, exclusivity of certain watches, inherent collectability and ability to authenticate the products, and more. These factors make watches more exclusive and akin to a status symbol, similar to high-end NFTs. There are surprisingly a few protocols building in this area, including ZwapX, Kettle, and more.

In this edition, we’ll walk you through these projects and how they work. Watches as a luxury good to be traded onchain aren’t that special or distinct from other IRL goods. Similar mechanics and functions can be used to enable onchain financial applications accommodating all sorts of assets, luxury watches simply happen to be the first for this use case to be built for. It’s alsoarguably the most ‘real-world’ of type of assets that RWA protocols tend to operate in. Many RWA protocols focus on finding a way to bring treasuries onchain, with the underlying treasury also mostly being a number on a screen. Watches are distinct in that not only are they an actual physical asset that people collect, but they are a piece of jewelry that people often wear everyday, as opposed to something that sits behind a cabinet door.

The protocols mentioned above aren’t the first to be playing in the onchain trading of RWAs space. The WAX (Worldwide Asset Exchange) blockchain also features a unique featureset, allowing all sorts of real-world assets to be tokenized. These items could be freely traded onchain, and if a user decides he would like to own the actual asset temporarily being represented as an NFT, he could redeem and be shipped the underlying RWA. Despite the concept indeed being very interesting, this never really caught on, and the WAX blockchain mostly is used for Web3 gaming. Other protocols bringing general-use assets onchain include 4K protocol, among others. But the trading of luxury watches seems to be a specific area in RWAs that catches the attention of crypto-natives.

Kettle

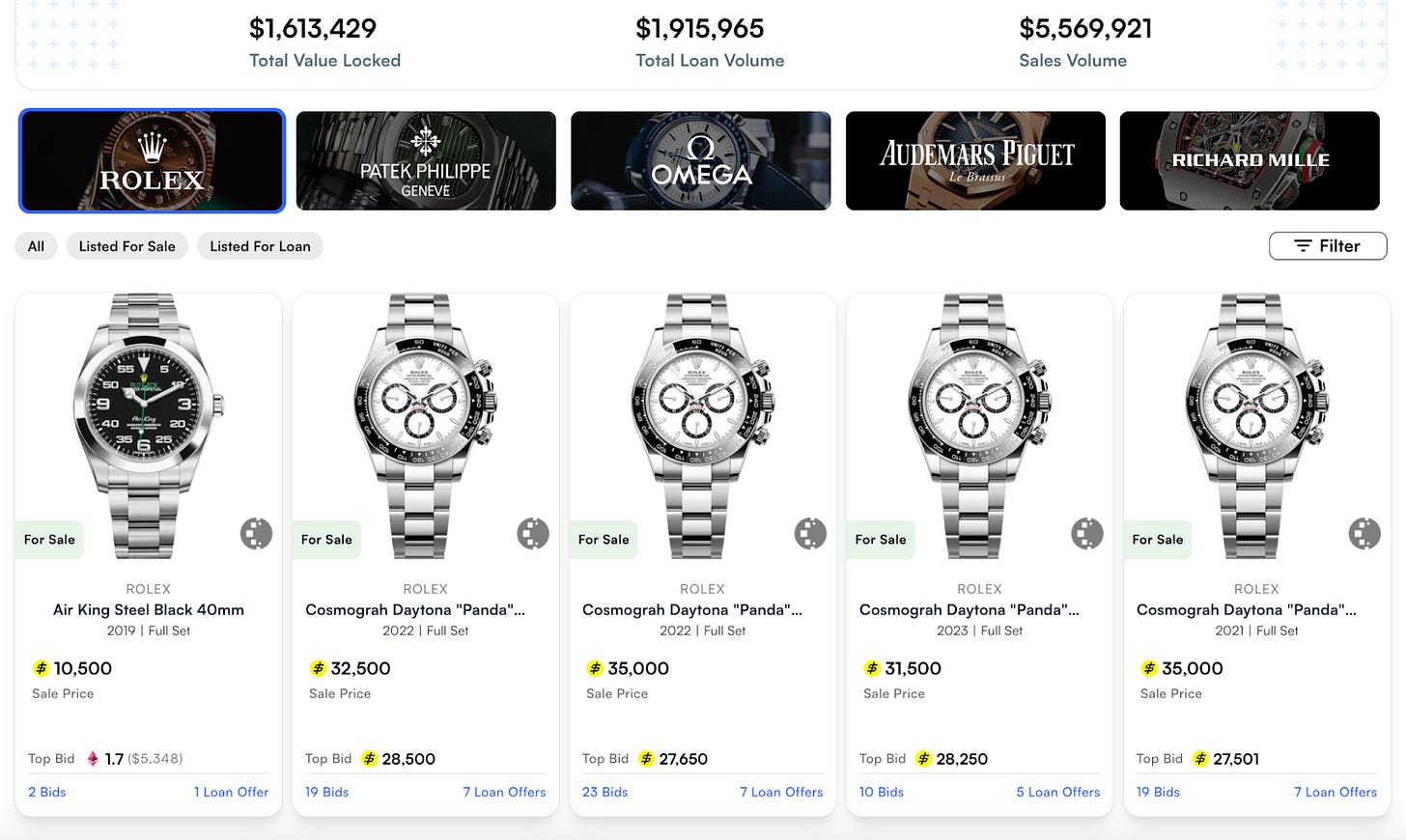

Kettle changes the watch game by taking custody to another level. While some RWAs use Coinbase or other organizations to custody treasuries, Kettle custodies physical watches in a vault, located in NYC’s diamond district (specific location undisclosed for obvious reasons). For those who care, Kettle’s docs detail the specific security measures taken and parameters of the vault. Because of this facet, which might seem like a tradeoff for some, it’s possible to authenticate the watch in question. Of course this isn’t a fully trustless model, but in this case, there can’t be, as most users wouldn’t simply trust a random onchain wallet to provide the authentic watch, there needs to be some form of formal verification.

The process of taking the original watch off of traditional markets and onto the onchain one and vice versa is fully insured, to give sellers and buyers peace of mind. The team states that watches in the vault are by no means locked, users are free to requests videos and verify details of the watch.

Users can access an array of popular watch brands, from Rolex to Richard Mille and more, with prices varying wildly. Trades and bids are denominated in $USDB, with options for $WETH or $USDB bids.

Kettle has gained some attention recently mostly to do with their deployment on Blast, as well as their introduction of mystery boxes. These boxes basically do what you would expect; users can get a mystery watch NFT, in addition to some Blast gold. Kettle was also recently awarded over 144k Blast gold, providing further incentive for users to lend, trade, open mystery boxes, or buy and redeem watches. This gold will be distributed alongside Kettle points, as part of the protocols Season 3 initiative.

ZwapX

ZwapX is a relatively new project, incubated by Alliance DAO, a crypto founder network and project accelerator. ZwapX also capitalizes on the inherent inefficiencies found when buying second-hand watches online, aiming to improve on the incumbent non-crypto marketplaces like Chrono24 and Montro.

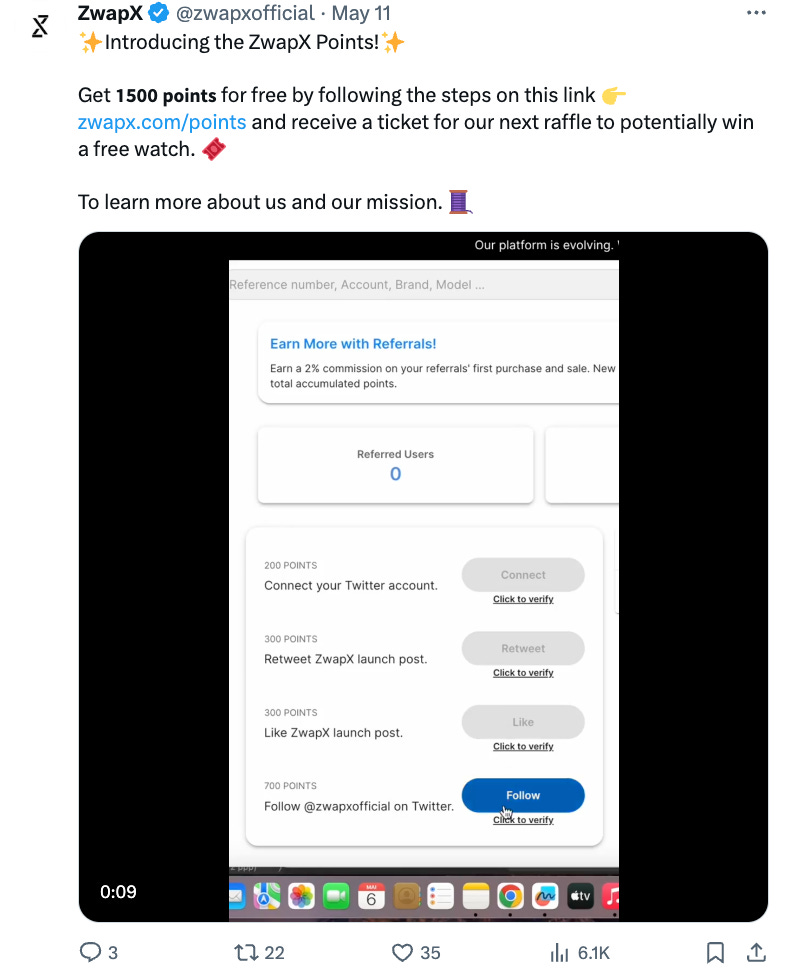

ZwapX has recently implemented a new points program as of a couple days ago, prompting users to connect their wallets and interact with the official Twitter account in order to qualify. Referrals can also boost points accrued. ZwapX will also be adding the ability for watches to be used as collateral for loans in the upcoming future, similar to Kettle. ZwapX has $1.3M in TVL, and has seen $240k in trading volume so far. ZwapX takes custody of registered watches in Switzerland, as opposed to NYC. At the end of the day, there’s only so many use cases for tokens which represent watches onchain, namely trading and lending.

Overall, the need to verify the authenticity as well as the hefty price tag of some of the watches custodied make watches perhaps more difficult to enable onchain usecases for than other assets. But the high price tag and small size compared to other assets of a similar price like automobiles, is what makes this sort of operation viable, at least for the time being until new methods emerge.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable investment reports

Industry Intel - highlighting important narratives/ trends

Project Breakdowns - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts and AMAs