Monad: Mainnet Launch and MON Token Distribution - What You Need to Know

Parallel EVM, 11% Circulating, Ecosystem and Vesting Design, and More

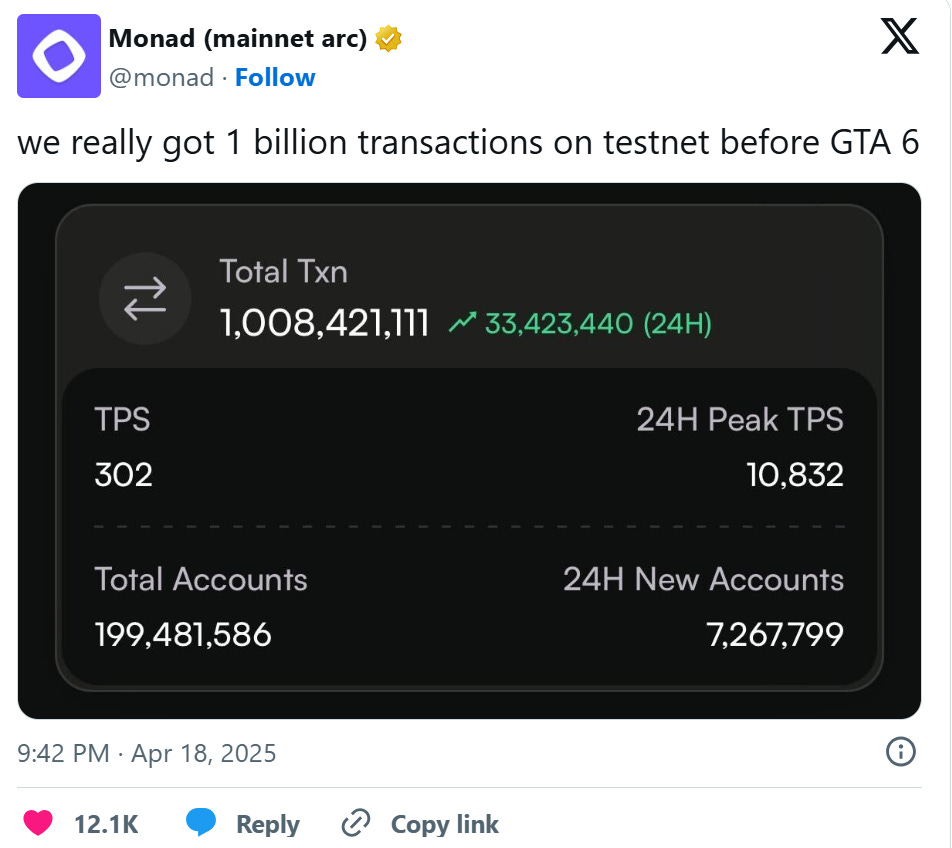

Monad has officially launched its public mainnet, bringing a high‑throughput, parallel‑execution EVM Layer 1 to market. Monad aims to deliver Solana‑like performance with Ethereum‑level programmability.

With mainnet live, Monad’s native token (MON) became tradeable with tokens being disbursed to airdrop recipients and public sale participants. Developers can deploy contracts and users can transact on a chain that targets 10K transactions per second and sub‑second finality. Many projects have also launched on Monad, seeing over $70M in TVL within a day of launch.

In this edition, we’ll explore Monad’s architecture and ecosystem, performance‑oriented EVM chains, and the MON token distribution and initial supply.

What is Monad

Monad is a high‑performance EVM Layer 1 aiming to offer a deterministic, low‑cost execution environment that remains fully compatible with Ethereum tooling and Solidity smart contracts. Recent testnet data suggests average gas fees remained below $0.007 per transaction at 10K TPS under heavy load, making Monad one of the lowest‑cost EVM chains.

Its core innovations include:

MonadBFT - An optimized Byzantine Fault Tolerance protocol that reaches sub-second finality in a single communication round and scales to hundreds of validators.

RaptorCast - Propagates block proposals to validators by dividing a block into pieces using something called erasure coding, reducing bandwidth requirements and ensuring data recovery even if some parts are missing.

Asynchronous and Parallel Execution - Consensus and execution are decoupled, allowing nodes to agree on transaction ordering and then execute those transactions in parallel. This model improves throughput and reduces latency compared with sequential EVM designs.

MonadDB - Monad’s own custom state database, built from scratch for the specific access pattern of an EVM chain that wants to run many transactions in parallel

Performance‑Oriented EVM Chains

Scaling EVM chains has been a battle since L2s were introduced and this has produced various approaches from rollups to sidechains and alternative L1s.

Traditional EVM networks often suffer from sequential execution and limited throughput. The competitive landscape includes Solana (high throughput but non‑EVM), other parallelized EVM chains like Sei or Berachain, and rollups that inherit Ethereum security but may have higher latency and fragmented liquidity. Monad introduces an EVM-compatible design that aims to combine parallel execution and deterministic finality.

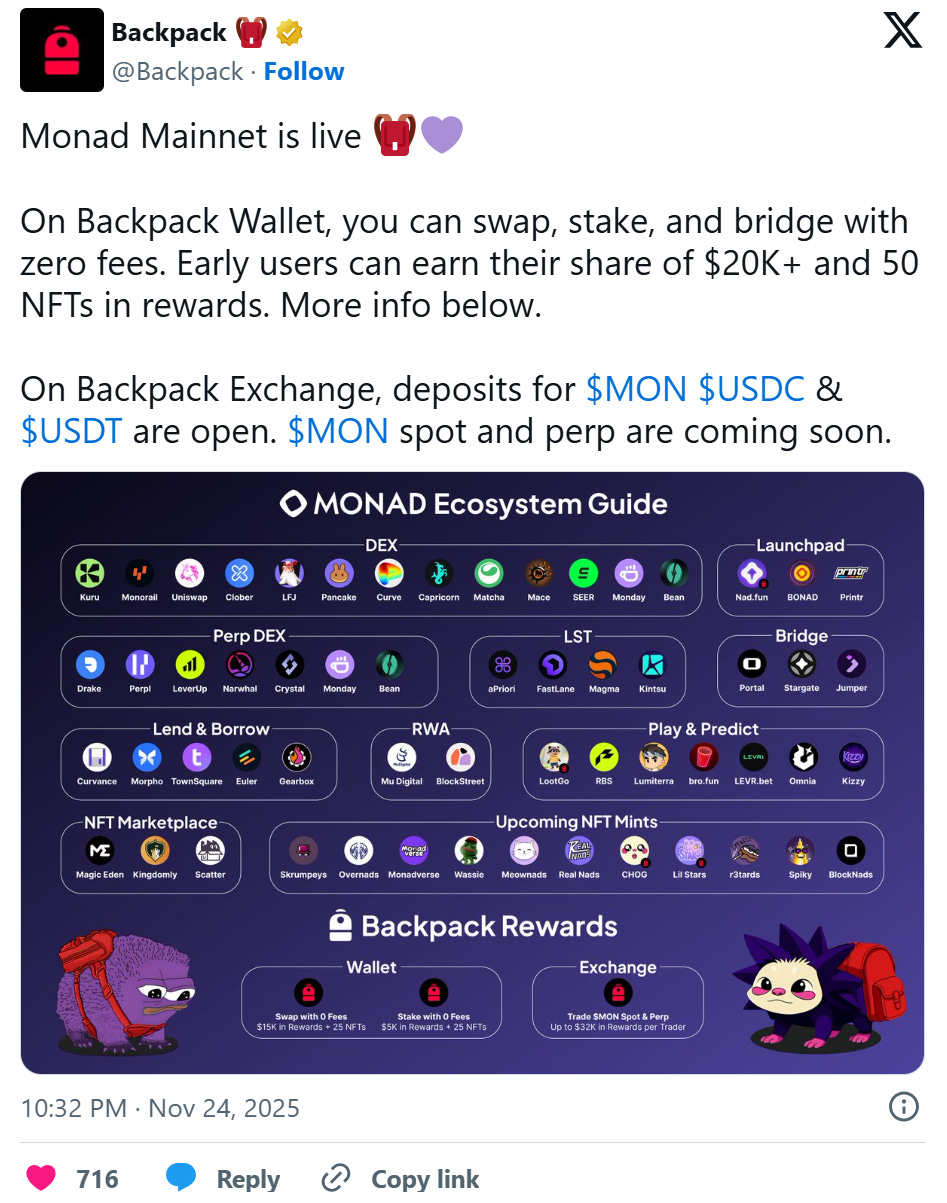

Monad has listed over 100 dApps lined up for its mainnet launch, with notable categories include staking, spot DEXs, perpetuals, lending, prediction markets, trading bots, meme‑coin launchpads, gaming, AI, NFTs, and real‑world assets.

This breadth reflects both ported DeFi protocols and projects native to Monad, indicating potential for early liquidity and network effects if the infrastructure performs as advertised.

MON Token Distribution and Initial Supply

Perhaps the largest event this week was Monad’s MON distribution. The MON token is the native asset used for transaction fees, staking, and governance.

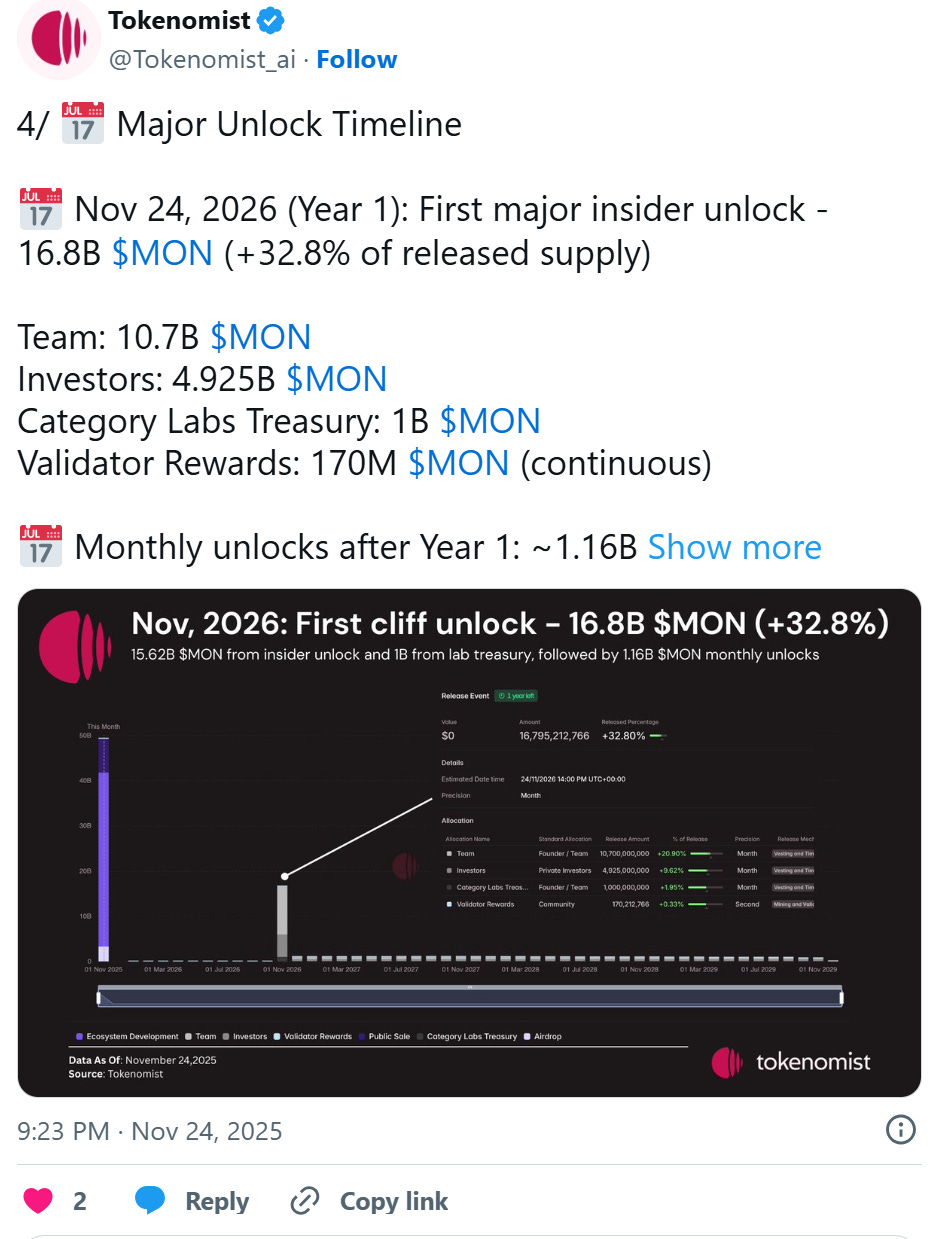

The initial token supply is 100 billion MON, allocated across several categories to support ecosystem growth and long‑term alignment.

Public Sale (7.5%) - Offered through a public sale on Coinbase at $0.025 per token.

Airdrop (3.3%) – Airdrop for community members and broader crypto users. . Out of 4.73 billion MON available across 289 k accounts, 3.33 billion (3.3%) MON were claimed. The rest went to Ecosystem Development.

Ecosystem Development (38.5%) – Discretion of the Monad Foundation to support grants, validator delegation, and infrastructure funding. A portion of these tokens will be delegated to validators via the Foundation’s Delegation Program.

Team (27%) – Allocated to team members and contractors. These tokens are locked for 1 year, with vesting schedules over 3-4 years.

Investors (19.7%) – are allocated to investors from prior funding rounds. These tokens are subject to a four‑year lock‑up with a one‑year cliff and monthly unlocks thereafter.

Category Labs Treasury (3.95%) – Formerly Monad Labs. This amount goes to future employee compensation.

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.

$70M TVL within a day of luanch is a strong start. The parallel execution approach with MonadBFT could be a real differentiator if they can maintain those transaction costs at scale. Will be interesting to see how the ecosystm develops over the next few months.