MegaETH - Testnet Launch & Ecosystem: What You Need to Know

Avon CLOb Lending, Hop Decentralized VPN & More

Markets are deflated right now, but a couple of high-profile launches coming soon can boost some mindshare in the meantime. Notably, Berachain will be launching today; as the ecosystem develops, we will look to cover some of the projects within it. Another chain on the verge of launching is MegaETH, gaining a lot of mindshare yesterday with the announcement of the Fluffles NFT.

We won’t focus too much on this, but the team’s quick intake of feedback and willingness to let the community decide launch mechanics reflects the team’s combo of pragmatism and openness. This blend, coupled with the team’s adaptability to community input, addresses many common criticisms of Ethereum. A team like MegaETH can potentially even have an impact on the broader Ethereum ecosystem, in addition to the MegaETH chain itself.

In today’s edition, we’ll brush up on what MegaETH is, and go over a couple of interesting projects within the ecosystem.

Stay informed in the markets ⬇

Background on MegaETH

MegaETH brands itself as a highly performant Ethereum L2 with a focus on culture and community. Notably, the team boasts 100K+ TPS and sub 10-ms blocktimes. The team has a target of 1-ms blocktimes, aiming to be the first ‘real-time’ blockchain. But tech isn’t necessarily the main differentiator; the team’s crypto-native approach and approachability has boosted its status to compensate for a lack of raised funds compared to the other major pre-TGE chains.

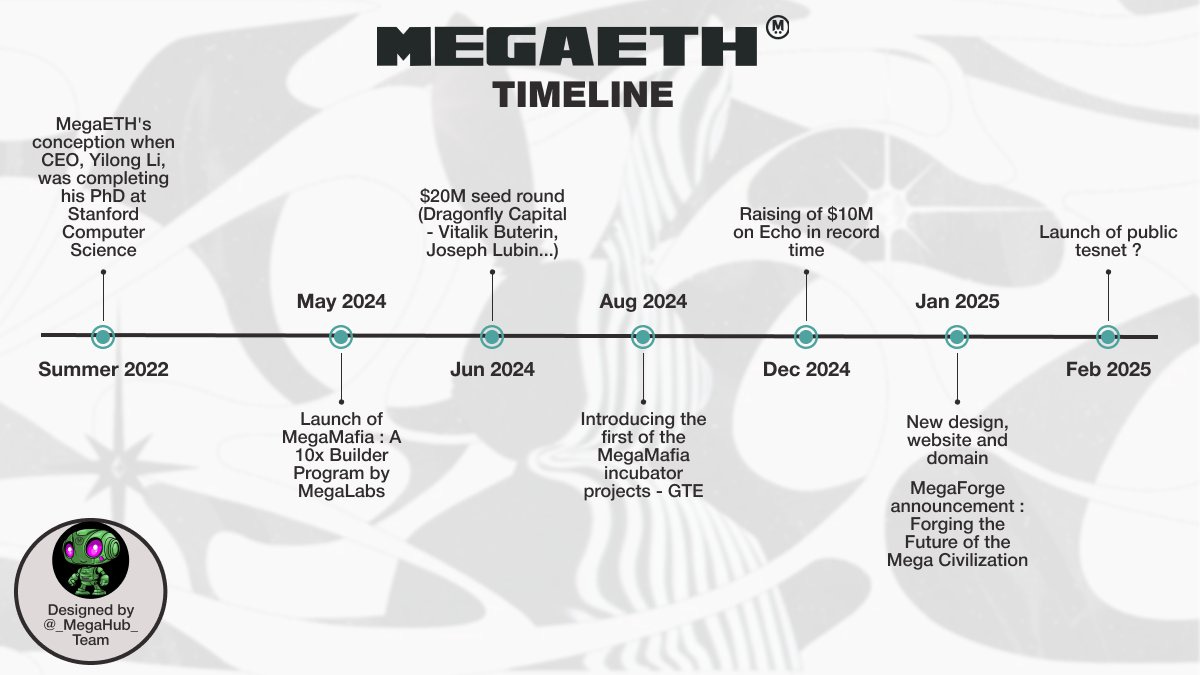

MegaETH’s Echo raise and their upcoming NFT mint, which whitelisted over 80K unique wallet addresses, show the team’s willingness to entrust a significant portion of the network with the community that they have built. But the team has raised funds the traditional way ($20M), from the likes of Dragonfly Capital, Vitalik, and others via a seed round.

Still, MegaETH likely could have raised much more without taking as cautious of an approach when it comes to rewarding their community members. Being Ethereum-aligned with a strong emphasis on community and a budding ecosystem makes MegaETH arguably the most interesting chain of the big three that have yet to TGE (MegaETH, Berachain & Monad).

We receive positive feedback on the content we put out; but it’s important to stay in touch with our evolving audience, especially in crypto.

To help us optimize our content on this newsletter, X, our platform, and more, please take a couple of minutes to a quick survey we put together ⬇

Background on Avon

Avon incorporates the use of an orderbook for lending, as opposed to DEX trading. Just announced yesterday, Avon uses a CLOB to segment lending risks and aggregate rates, matching them with users as they see fit. Users can choose between fixed or variable-rate lending. Lenders can tweak their risk/reward selection to align with their preferences; this might appeal to institutions if they can find a way to mitigate any additional risk in addition to what is undertaken by just engaging with smart contracts.

Borrowers stand to gain as well, as Avon’s ordebook matching layer gives them the power to test the market and find the lowest borrowing rates possible. MegaETH’s performant nature also make real-time asset pricing and sub 1-second liquidations possible on EVM. Avon isn’t the only lending market looking to take advantage of these attributes; Teko is another protocol aiming to provide a real-time lending experience, among other features.

Background on Hop

Hop is not a DeFi protocol or a common onchain primitive; it’s a decentralized VPN, built on MegaETH. MegaETH’s fast blocktimes and high TPS enable the creation of a native VPN that is sufficiently decentralized while not sacrificing speed. Blockchain enables a VPN that is inherently secure, anonymous, and ideally, fast.

Hop is an example of using scalable blockchains for interesting, and useful, ideas that are otherwise harder to get right without the onchain component. In this case, network contributors help to find secure paths for VPN users, as opposed to most VPNs, which might use just a few centralized servers in different locations that users could hop between.

Background on Sweep

One of the factors holding back prediction markets is an inability for more niche markets to be listed. Sweep looks to make prediction markets more immersive by integrating them with livestreaming, allowing users to wager on how a livestreamed match might play out, live.

This brings prediction markets closer to the instant gratification of more primitive forms of betting, as the market can be resolved within minutes, while the most popular polymarket markets typically begin seeing significant volume months from the actual event in question. Prediction markets on Sweep take a slightly different form, offering multiple ways to bet and more emphasis on loops to keep users engaged.

So far, MegaETH has less established DeFi names committing to deploying on the chain, something users might pick up on when comparing MegaETH to Monad and Berachain. This may or may not be important; there seems to be new teams building out the primitives users would come to expect when bridging to a new ecosystem.

At the same time, MegaETH has also cultivated a unique ecosystem of builders that stand out from your typical DeFi DEX, money market, and perps suite. The ecosystem doesn’t lack novelty–from decentralized VPNs to UGC games, livestream prediction markets, and more, the Mega Mafia team has embraced new concepts that maybe haven’t been tried on many other chains.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.