Manifest Finance- Using DeFi to Issue RWA Structured Products: What You Need to Know

Onchain Home Equity Investments, $USH, & More

The institutional narrative is in full swing right now, and the main sector that lends itself well to this new entrant to the market is RWAs. Stablecoins and BTC have commonly been the route by which most large organizations entered the crypto space. Tokenized treasuries opened the door for further adoption, putting asset managers and institutions on notice with simplified treasury yield.

The next step for RWAs is branching beyond tokenized treasuries. While this is a large market, it attracts a very specific breed of investors. Private credit, real estate, and other assets with trillions in value are also waiting to be tokenized, and they can receive demand from institutions and retail alike. In today’s edition, we’ll discuss Manifest Finance, an RWA protocol using DeFi to issue its own structured product based on investments in U.S. real estate…

Stay informed in the markets ⬇

Background on Manifest Finance

The U.S. real estate sector in its entirety is worth over $40T–outside of stablecoins and tokenized treasuries, it’s easy to see why stocks and real estate are some of the first places people look when thinking of non-dollar RWAs. Manifest Finance taps into this, bringing to market the $USH token, backed by U.S. home price appreciation and yielding 13% APR. $USH is not a stablecoin, the market is free to buy or sell it as it pleases, regardless of the underlying backing.

Manifest uses Home Equity Investments (HEIs) to purchase stakes in the future equity upside in homes. HEIs allow banks and institutions to essentially purchase a share of the future appreciation of the home, while the owner receives a lump-sum payment in cash. This is similar to a Home Equity Line of Credit (HELOC), though potentially riskier for the lender and more appealing for the borrower. HELOCs provide liquidity, which is borrowed, with the borrowing homeowner using their own equity as collateral. HEIs are perhaps more efficient but also riskier, as the target demographic might be less qualified. Returns are less guaranteed since they are contingent on the appreciation of a specific house.

All of these factors are what institutions issuing HEIs have to worry about. This is the utility of structured products; they allow investors to diversify across many HEIs and allocate in a timely manner. When it comes to Manifest, there is definitely underwriting risk, as the health of the underlying HEIs is dependent on the team’s due diligence. The team secures liens on the home titles of their real estate, which provides some reassurance.

Beyond actually securing the equity of the homes, Manifest also has to maximize its returns. The quoted 13% figure is quite high, the team must be selective with the homes they are purchasing and their locations to match this expectation.

In some ways, $USH can be thought of as a crypto equivalent to a Real Estate Investment Trust (REIT). This is the most common way that people go about getting exposure to the real estate sector, whether it be commercial or residential, without facing the main barriers such as illiquidity, high transaction costs, regional market dynamics, etc. Another side of $USH’s value comes from its integrations within DeFi. This can separate $USH from any of the existing high-profile REITs that are readily available to investors without ever touching crypto.

When it comes to narrative, Manifest builds on American exceptionalism, the idea that the U.S. is a hotbed for innovation and the best place to park capital. This idea has been echoed for some time, often used to justify why U.S. companies lead the world by marketcap and why equities have performed the best of any country across decades.

Manifest strongly emphasizes the American exceptionalism aspect, though it’s not a core component of the protocol. This is the angle Manifest has chosen to operate in, exemplifying the value of U.S. assets, in this case, owner-occupied real estate, and making them accessible to people around the world.

Manifest is looking to source U.S. assets and package them the same way large institutions can, but differentiate itself by using DeFi as the means of distribution for these projects. Retail investors might not have the same preference for specific REITs that large investors do, and the differentiation between HEIs, HELOCs, etc., might matter less. HEIs serve as a vehicle to efficiently build up positions specifically representing future home price appreciation, while DeFi enables a structured product to be spun up relatively quickly.

What will be key to Manifest’s success is landing integrations and listings within DeFi, and sourcing capital from non-crypto natives. Blockchain can make homes as an investment more accessible but shouldn’t limit the reach of a protocol to only the existing small crypto user base, especially for an asset like real estate.

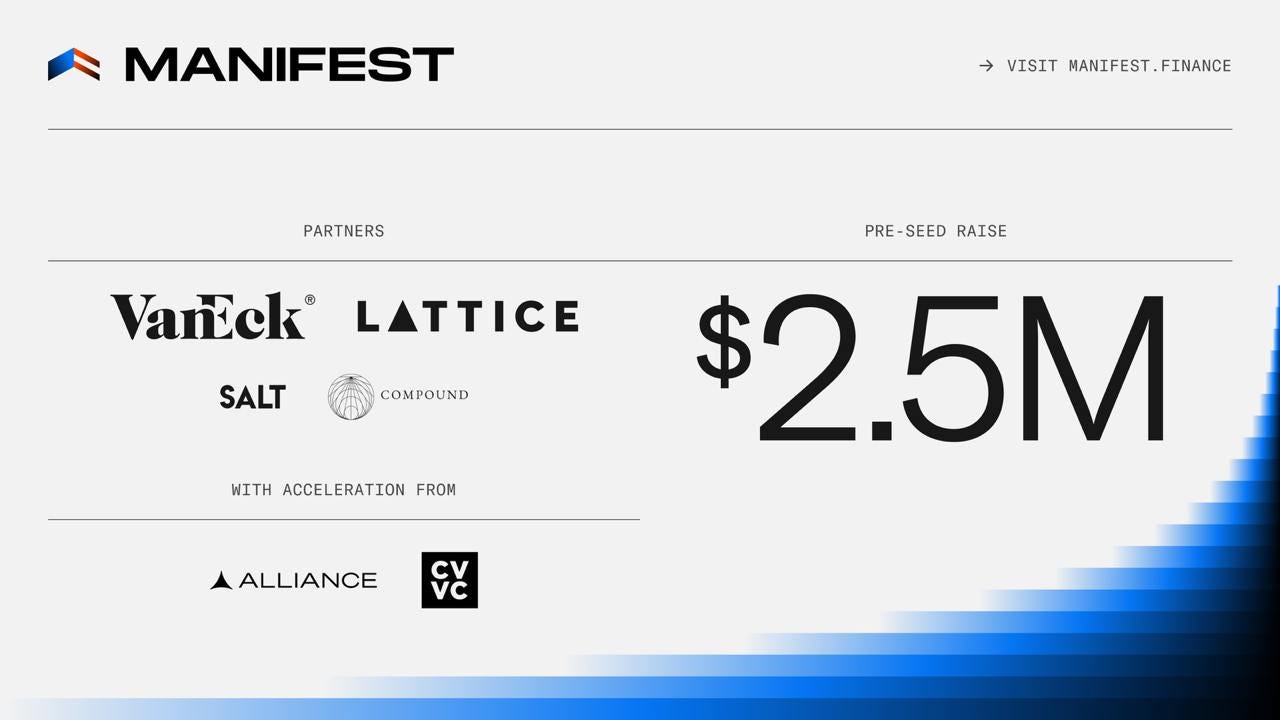

Manifest Finance recently announced its $2.5M pre-seed raise from both crypto-native firms as well as traditional institutions such as VanEck. With the excitement around institutions and RWAs in general, more upstarts in this sector might become more common, as well as more raises.

Overall, one of the challenges RWAs in general will have to grapple with is merging the advantages of both DeFi and institutional client bases. Crypto’s total marketcap is still nearly $3T, a valuable capital base worth expending the resources to tap into. But efforts also need to be made toward bringing new flows, whether it be from retail or institutions, onchain for the first time.

Important Links

Become a Premium member to unlock all our research & reports, including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.