Lighter: Will December be LIT?

$LIT Airdrop, Pre-market Listing, Points breakdown, and More

Lighter is an Ethereum-anchored perpetuals exchange built as a zk rollup where trades and risk actions run offchain for speed, then Lighter publishes cryptographic proofs to Ethereum showing the matching and liquidations followed the rules.

Market focus has recently shifted from product traction to distribution mechanics. The team has begun signaling an airdrop, Coinbase announced $LIT on the roadmap, and Hyperliquid’s $LIT pre-market listing has created an early price signal before spot exchanges list the token.

In this edition, we’ll look into what Lighter is, how its different from typical perp venues, and what we can (and cannot) infer from the points program and pre-market pricing.

Stay informed in the market ⬇️

Introduction to Lighter

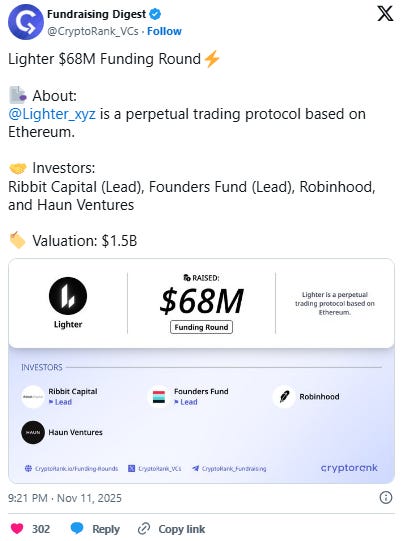

Lighter is founded by Vlad Novakovski, an ex-Harvard Math Olympiad winner and Citadel quant. They recently raised $68M at a $1.5B valuation in November backed by high-profile investors including Founders Fund, Haun Ventures and Robinhood.

Lighter’s core claim is centralized-exchange style execution with verifiability and self-custody constraints anchored to Ethereum. On the mechanics, Lighter batches “rollup transactions” (most exchange operations after deposit) through API servers to a sequencer, then submits batched state updates with proof data to Ethereum.

The important distinction for traders is that Lighter separates day-to-day trading speed from exit guarantees. It also supports “priority transactions” posted directly on Ethereum for censorship-resistant exits (closing positions/withdrawing/redeeming pool shares), and describes an “escape hatch” path if the sequencer fails to process these within a defined window.

This design attempts to reduce the trust risk in high-performance perp venues by preserving a path to withdraw even under failure scenarios.

Market Context: Lighter vs Hyperliquid

Hyperliquid has set the current benchmark for onchain perpetuals by combining fast execution with deep liquidity and a simple user loop. Lighter’s differentiator is the trust model rather than a liquidity-first rollout.

Hyperliquid’s approach is effectively “exchange performance first,” where users accept a stronger reliance on the operator and system design in exchange for speed and reliability. Lighter aims to reduce that reliance by running as a zk rollup anchored to Ethereum.

In practical terms, Hyperliquid competes horizontally on network effects: liquidity depth, product breadth, and distribution, while Lighter is trying to scale vertically and compete on verifiability and fault tolerance (i.e. making it harder for the venue to behave unexpectedly, and making exit conditions clearer under stress).

The trade-off is that markets tend to reward perp venues with the tightest spreads and deepest books, especially during volatility, so Lighter’s near-term question is whether it can attract enough market makers and sustained flow to narrow the execution-quality gap with Hyperliquid, while using its rollup architecture to appeal to users who care about a more Ethereum-rooted security posture.

Airdrop Signal: What’s Being Said

Lighter’s official X has gone without an update since Dec 7, but plenty of other channels have signaled an impending $LIT airdrop along with potential details that the market is pricing in.

On December 13, Coinbase announced Lighter is added to the roadmap.

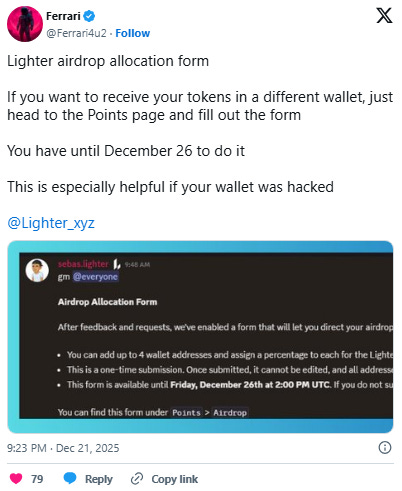

On December 21, the team released their Airdrop allocation form in Discord and to the Lighter UI.

Polymarket is also oddly pricing in a 75% chance of the airdrop being on 29 December from abnormal fresh wallets.

Large bets have also been placed in Polymarket’s Lighter’s FDV one day after launch. This market automatically resolves “No” if it doesn’t launch by December, potentially suggesting an impending airdrop in the next week or so.

Hyperliquid has also recently listed LIT on its pre-markets.

In terms of points distributed, Lighter’s documentation states Season 1 (private beta) ended on Sept 30, 2025, and Season 2 points (public mainnet) are distributed weekly (Fridays), with the team retaining discretion to adjust distributions.

For retail accounts, Lighter specifies 200,000 points per week. Market-making receives 20% of total allocated points (50,000) and is restricted to premium accounts.

This suggests a total of ~13M points that have been distributed over the course of the points program. Recent announcements by the team also indicate sybil filtering and redistribution of points to the community.

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.