Kubera Crypto Portfolio Tracking: What You Need to Know

Performance Tracking, Personal Balance Sheet, & More

If the markets have shown us anything these past few days, it’s how difficult it can be to gauge positions in a portfolio during times of extreme volatility. This is not a new problem for crypto market participants by any means; it is up to each individual to stay up-to-date on how their portfolio is faring at any given time. Of course, accessing leverage or attempting to speedrun gains adds another layer of difficulty when it comes to tracking positions.

In today’s edition, we’re going in a different direction. We’ll be covering Kubera, a tool for tracking net worth and investment portfolio performance over time. Kubera describes itself as the ‘time machine for your net worth’. Essentially, it’s an all-encompassing portfolio tracker for any assets and liabilities. Having integrated with the top crypto wallets and exchanges, this tool will be an interesting addition to many.

Stay vigilant in these markets ⬇

Background on Kubera

Kubera seamlessly connects with the most popular crypto exchanges including Gemini and many others. In addition, all major stock exchanges across the US, UK, Canada, Asia, and EU are supported. The platform even supports physical assets (not RWAs) including houses and cars, based on estimated prices and the latest market data. Heavy metals including gold, silver, and palladium are also tracked, based on the amount held and the latest spot price. Even website domain names are given an estimated market value and tracked.

Users can choose to have their portfolios denominated in their local currency or major currencies such as USD, EURO, etc. Portfolios can even be denominated in terms of Gold, BTC, ETH, and crude oil.

When it comes to importing assets to track on Kubera, users can add them manually, similar to how they might manually update an investment and asset spreadsheet, but in a more visual and organized manner. Alternatively, accounts can be connected to Kubera, including stock brokerage accounts, crypto exchange accounts, and even crypto wallets. Currently, Metamask is accepted but Rabby is not yet integrated. However, users have the option to add their wallet address. Not all chains are recognized at the moment, so this needs to be taken into consideration.

Another key feature of Kubera is the ability to track debts. This is a helpful feature, that popular and intuitive crypto wallets like Rabby (use code REVELO) have incorporated. In DeFi, debt has become a standard with many users engaging in borrowing and lending, looping, and other such strategies to get access to leverage or simply to farm more points. Now, Kubera isn’t a crypto wallet, so this DeFi-native tracking isn’t available. However, mortgages and credit card debt can be added by using third-party data integration tools, though there are still kinks that need to be ironed out as many institutions don’t play nice with modern tools.

Another interesting feature Kubera offers is its Beneficiary service which sends all information stored on the platform to a user’s loved ones upon death. Though unpleasant to think about, this service is an important one, particularly for those who hold assets that are not accounted for by traditional institutions such as physical gold and precious metals, and especially crypto.

In addition to providing portfolio information, Kubera also stores information about insurance and other important documents. This is automatically implemented via its ‘Life Beat Check’ function. During extended periods of inactivity, Kubera will automatically send information to the listed Beneficiary, but will first send multiple notifications to the user. And, should the Beneficiary not respond, an email is sent to the listed ‘Trusted Angel’.

Kubera offers many articles to help users develop a deeper understanding of how best to prepare for key financial events they might face, from the tradeoffs associated with margin loans and mortgages, to whether or not to get a prenup.

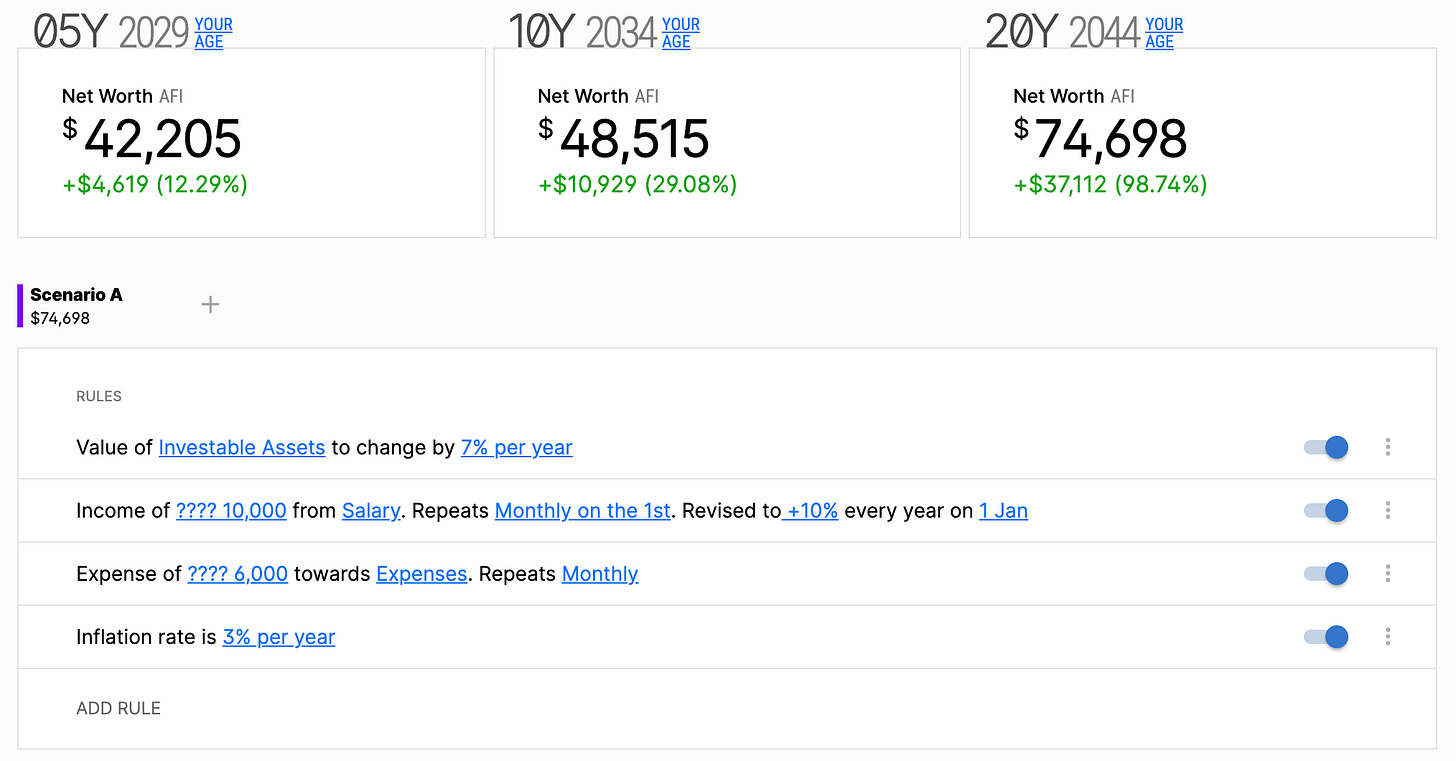

Users can view a ‘recap’ of their finances similar to a bank statement but for all financial assets, as well as liabilities. This can be viewed on a quarterly, monthly, or even daily basis. Kubera also offers a ‘fast forward’ feature, providing future projections based on user inputs, i.e., prices of given assets or tokens, growth of assets, rate of inflation, etc. Obviously, this should be taken with a grain of salt. Nevertheless, it’s a useful feature that helps users assess whether their short-term and long-term goals are realistic.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs