HyperEVM: Asymmetric Farming Opportunity - What You Need to Know

HyperEVM Traction, Top Projects, & More

$HYPE TGE’d in November 2024 at an FDV of around $2B. Quickly hitting $35B FDV in just over a month while still experiencing significant growth. Today, Hyperliquid volumes and open interest have 5x to around $7B in daily average volumes and an OI of $10B.

With 31% of their 1B supply allocated to the genesis drop, at current prices, the total airdrop amount is worth over $10B. What most don’t realize is that there still is 38.8% of supply allocated to future emissions and community rewards, which likely includes HyperEVM usage.

In today’s edition, we’ll take a look at HyperEVM’s traction since inception, top projects on the HyperEVM, and more…

Stay informed in the markets ⬇

Background on HyperEVM

Launched on February 18, HyperEVM is Hyperliquid’s native EVM Layer 1 that is secured by the same HyperBFT consensus as HyperCore. This lets the HyperEVM interact directly with parts of HyperCore, such as spot and perp order books.

HyperEVM currently a TVL of ~$1B across native projects (this excludes the TVL on the Hyperliquid DEX itself). The top 3 protocols at the moment are: Hyperlend ($280M), Felix ($230M), HypurrFi ($140M).

HyperEVM: Underfarmed Opportunities

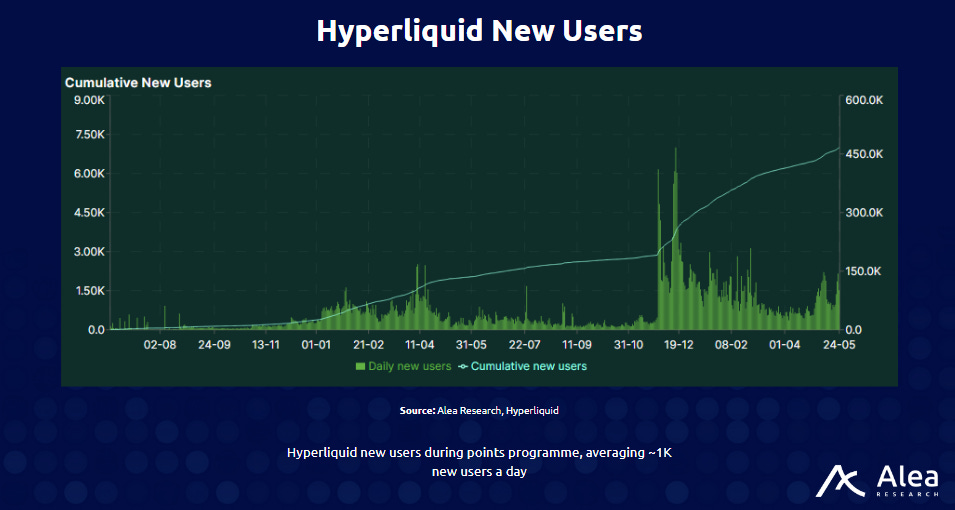

Looking at some comparable metrics to when Hyperliquid’s points programme was launched from November 2023 to May 2024, they amassed over 120K new users, averaging ~100M trades daily. Projects on the HyperEVM are attempting to replicate this usage growth through a points programme.

And being purely speculative here, potentially gets a good share of the 38.9% of $HYPE supply allocated for community rewards for early users.

Taking a look at HyperEVM’s usage now, its looking like the early days of when Hyperliquid came about, except usage is still low even with the recent spike, relative to the amount of users using Hyperliquid. 25K daily unique users represents just around 5% of Hyperliquid’s current cumulative users.

Protocols to Check Out

Hyperunit - Native Asset Tokenization

Unit is the first asset tokenization layer on Hyperliquid, enabling deposits and withdrawals of native spot majors onto the HyperEVM. They started with native BTC on the HyperEVM, seeing $500M+ in volume.

Hypurrfi - Lending

Hypurrfi is a leveraged lending market for $HYPE currently supporting native $HYPE and $stHYPE deposits. The team also plans to launch $USDXL, a Hybrid-backed stablecoin where protocol revenue is used to acquire yield-bearing assets as additional protocol security.

Hyperlend - Lending

Hyperlend is a native lending/borrowing protocol offering multiple pool types (core, isolated, and P2P) on Hyperliquid. HyperLend lets users borrow against HLP tokens as collateral, giving HLP extra utility and users extra capital efficiency to access loans.

Stakedhype - Liquid Staking

StakedHype is a liquid staking solution for$HYPE holders, enabling users to earn staking rewards while maintaining liquidity via $stHYPE. It uses a rebase mechanism to allow balances to increase in line with protocol rewards.

Felix Protocol - CDP Protocol

Felix is a CDP stablecoin project built as a Liquity V2 fork, issuing feUSD (backed by HL-based collateral like $HYPE and $UBTC (Unit BTC), along with majors). Users can generate yields by depositing feUSD into native Stability Pools. Depositors receive ~18% of the interest generated from borrows against the corresponding collateral.

SolvProtocol - Yield

Solv is bringing structured yield to HyperEVM through tokenized vaults and fixed-income products. They are well-known for Solv Vouchers, which allow users to lock assets for predefined yield returns, opening up new avenues for passive income.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.