Goat Network: Unlocking Bitcoin’s $2T of Idle Capital - What You Need to Know

Real-Time Proving on BitVM2, BTC-native yield, and More

Bitcoin’s $2T market cap represents the largest pool of idle capital in crypto that is mostly cold-stored, unproductive, and for institutions, difficult to deploy without adding custodial risk. GOAT Network’s mission is to change that.

Positioned as a Bitcoin-Native ZK Rollup, GOAT enables DeFi programmability and yield generation directly in $BTC, using Bitcoin’s finality and security model. By layering a zkVM over Bitcoin consensus and bridging via BitVM2, it delivers an execution environment that feels like Ethereum L2s without altering Bitcoin’s base layer.

In today’s edition, we explore the BTC yield opportunity, launch of Real-Time Proving on BitVM2 Beta Testnet, how it unlocks faster withdrawals and a more competitive execution environment for capital-heavy applications.

Stay informed in the markets ⬇

Addressing Bitcoin’s Productivity Gap

While Bitcoin was conceived as a pristine monetary asset, its scripting limits prevent native smart contracts and meaningful onchain programmability. As a result, over 1.4M BTC in U.S. ETFs and millions more in corporate and sovereign treasuries sit idle.

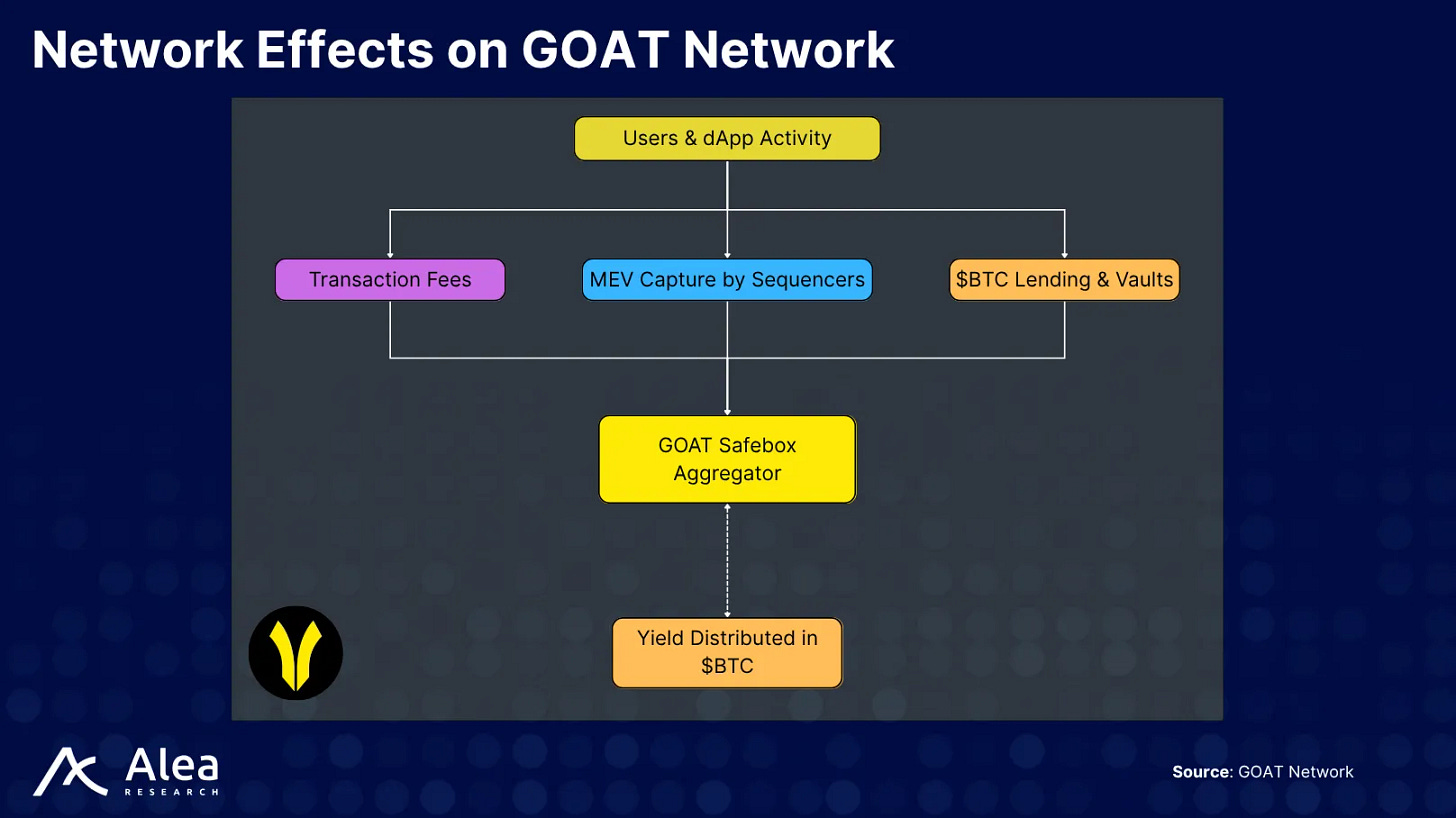

GOAT reframes $BTC utility from a passive store-of-value into a productive resource that can earn non-inflationary yield denominated in $BTC. This is not done via synthetic wrappers or custodial rehypothecation (like with $wBTC), but by making $BTC the canonical gas asset for a zkVM execution layer, then redistributing all protocol revenue including transaction fees, sequencer MEV, and lending interest back to participants in $BTC. This creates the trust-minimized $BTC cash flow that capital allocators are looking for.

Architecture: Bitcoin Security with ZK Composability

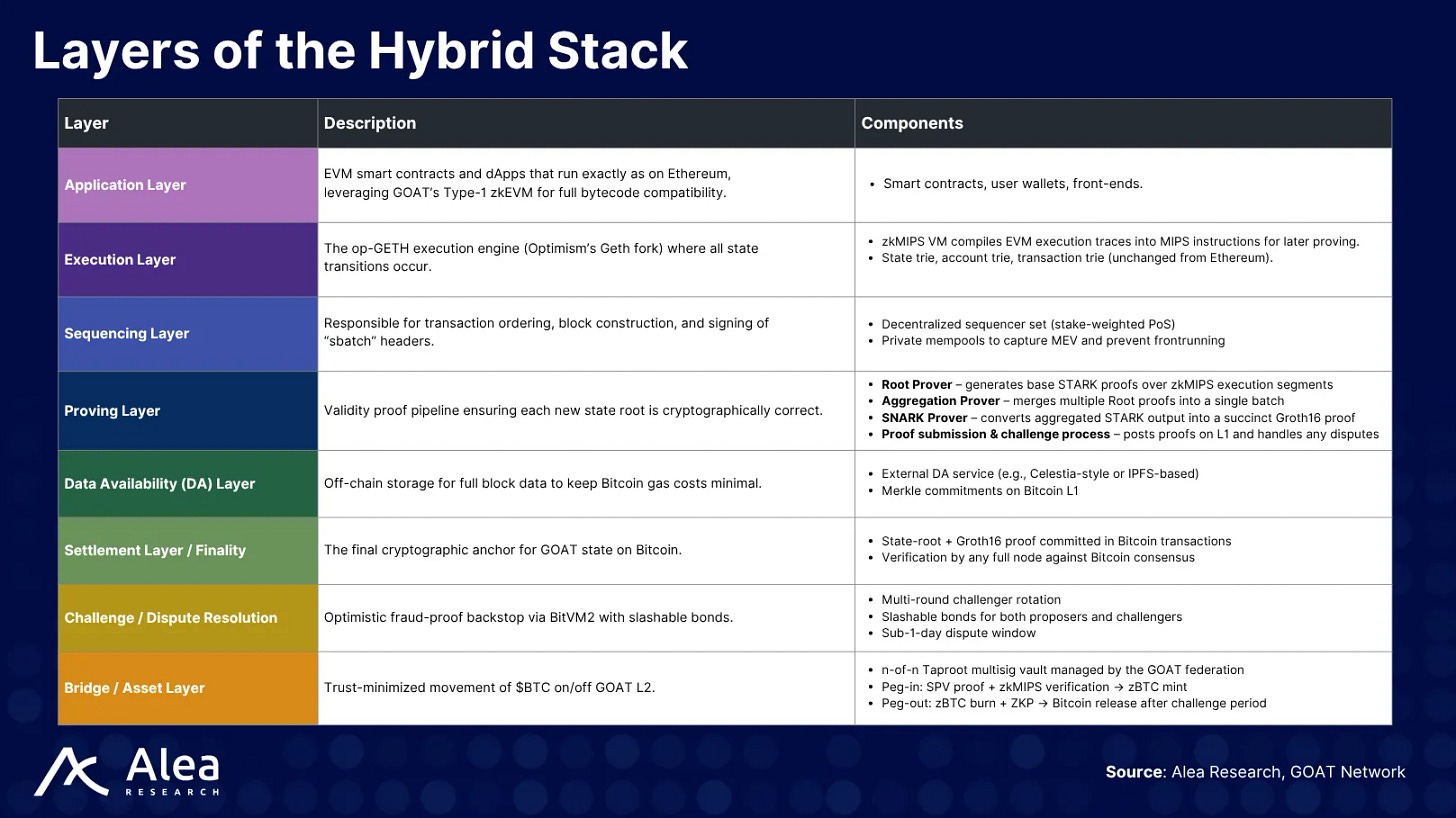

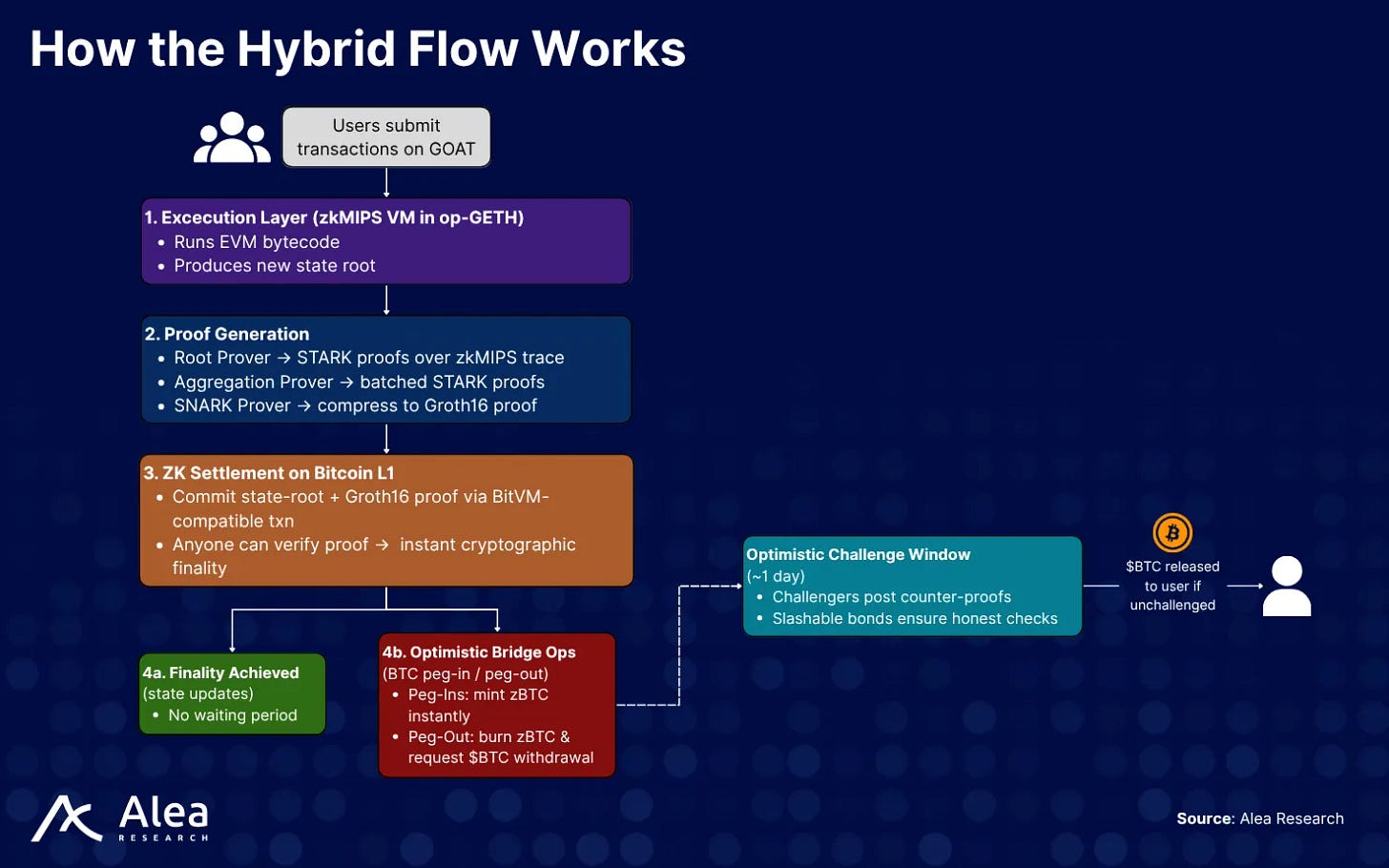

GOAT Network’s architecture is a hybrid stack consisting of Bitcoin’s censorship-resistant finality model and the composability of an EVM execution environment.

The core of it is comprised of:

Type-1 zkEVM: Bytecode-compatible with Ethereum, allowing direct deployment of existing smart contracts. This execution layer is powered by Ziren.

Ziren zkVM: A high-performance ZK prover for MIPS-compiled programs, producing proofs for every execution step.

BitVM2 Integration: A challenge–response protocol that allows Bitcoin Script to verify off-chain computation. If a sequencer posts an invalid result, challengers can force them to reveal intermediate steps and any proven fraud results in slashing of $BTC collateral.

This is reinforced by a dual-slashing model that penalizes misbehavior on both Bitcoin L1 and GOAT’s consensus layer, raising the cost of attack to prohibitively high levels.

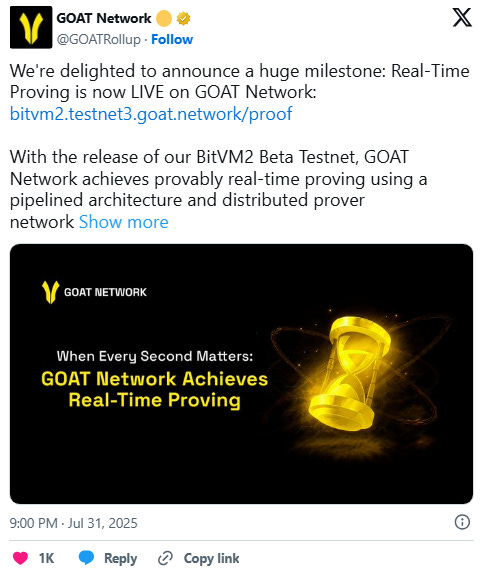

Launch of Real-Time Proving on BitVM2

Traditional Bitcoin rollups have processed proofs sequentially by execution proofs first, then aggregation, then finally SNARKs, causing latency that slows withdrawals and liquidity flow.

GOAT’s Real-Time Proving changes this by running all stages concurrently. As soon as a block’s execution proof is ready (~2.6s), it is handed to aggregation (~2.7s) while the next block’s execution proof starts immediately. Final Groth16 proofs (~10.38s) run in parallel. Groth16 is a succinct zkSNARK proving system that compresses the final output to make verification more efficient.

Native BTC Returns

GOAT’s yield model is sustainable real yield driven by network activity rather than token emissions:

Transaction Fees: Paid in $BTC, redistributed to sequencers and stakers.

Sequencer MEV: Captured and shared with the network rather than privatized.

DeFi Vaults: Lending markets and structured products generating BTC yield without wrapping or rehypothecation.

Illustrative targets based on GOAT’s economic beigepaper suggests:

Safebox (90d BTC lock): ~2% APY from sequencer fees and MEV.

Vault Strategies (BTCB/DOGEB): ~5% APY from lending and gas fees.

Sequencer PoS Pools: ~10% APY from MEV, block rewards, and fees.

Bottom Line

GOAT is building the first EVM-compatible Bitcoin-native zk rollup with native BTC yield built on Bitcoin’s security. The Real-Time Proving upgrade serves as an architectural unlock for capital-intensive BTCFi applications, reducing withdrawal latency and improving capital efficiency.

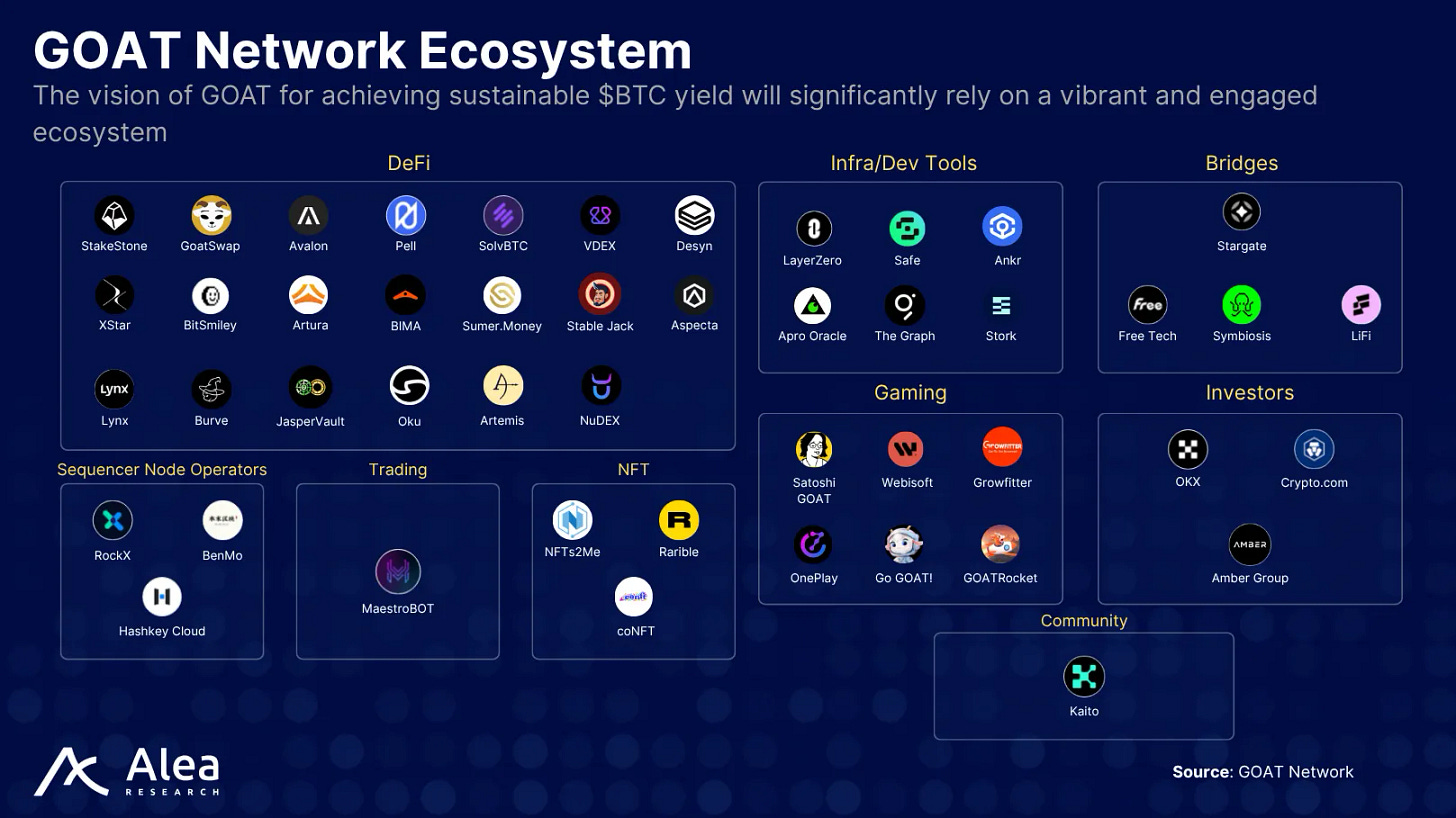

If GOAT can continue integrating top-tier dApps and sustain transaction-driven BTC yield, it will be positioned to capture a meaningful slice of the $2T in dormant Bitcoin capital now flowing into institutional hands.

Important Links

Disclosure

Alea Research is engaged in a commercial relationship with Goat Network as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.