As markets have moved upwards this week off the back of some positive tariff news, there is more risk appetite for emerging narratives. Beyond Internet Capital Markets, which we covered yesterday, the other sector prone to drawing substantial inflows at the far end of the risk curve is AI agents. The AI agents marketcap has swelled to over $10B in recent weeks, still ~50% below ATHs.

One of the key areas of crypto where agents have an operative advantage over humans is the management of complex DeFi strategies. Agents have an edge in processing data inputs, fast decision making, and 24/7 availability, creating the potential for enhanced risk-adjusted returns.

In today's edition, we'll discuss Giza, a protocol that employs agents onchain on behalf of DeFi users…

Stay informed in the markets ⬇

Background on Giza

Giza builds on the concept of xenocognitive finance, the idea that AI agents will be able to understand and operate in financial markets. Traditional financial markets have ramped up their use of algorithmic trading in the 21st century. Onchain markets are nascent, but yield farming and capital management can benefit from algorithmic agents that can run and adjust strategies based on inputs and parameters set by their deployers.

The onchain landscape can serve as a playground for agents, giving them the freedom to operate unburdened by KYC and verifications associated with traditional finance or even CEX use. This is the market Giza looks to tap into, automating the management of capital within DeFi based on user specifications.

Agents operating within DeFi allow for self-custody on behalf of users while granting access to more advanced strategies that traditionally might have required an external team or advanced tooling to execute. Agents can be attractive to institutions as well, taking into account compliance, fund mandates, and risk controls.

Giza doesn’t just serve users, whether retail or institutional. The team emphasizes the benefits of Giza agents for protocols and chains themselves. These mainly include increased transaction volumes & TVL flows, as well as the onboarding of new users through agents.

Giza’s flagship agent is dubbed ARMA, specializing in maximizing stablecoin yield for users. ARMA specifically operates on lending protocols on Base and Mode, constantly rotating capital into the highest-yielding pools.

ARMA currently holds ~$3M in Assets Under Advisory (AUA) with $32M+ in total agentic volume. Users retain self-custody of their funds even as yields are optimized by ARMA, made possible via account abstraction. Giza charges a 10% performance fee on yield generated, with potential avenues for B2B revenue for bringing ARMA to new chains and protocols.

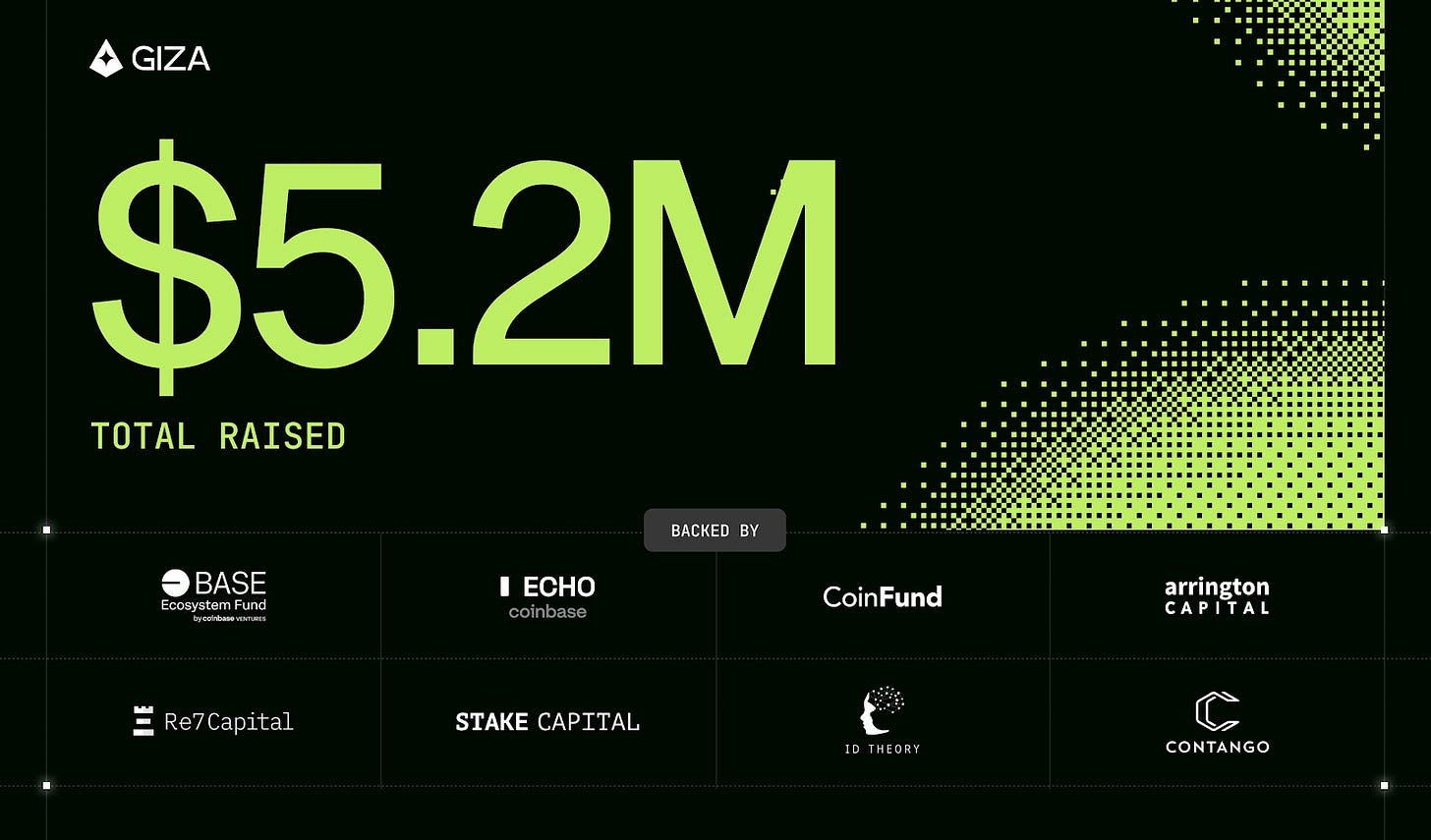

Today, it was announced that Giza raised $2.2M. Giza has also raised a $3M pre-seed round led by CoinFund, bringing total funding to $5.2M. The team has also successfully completed $1.5M via a 6.7x oversubscribed legion token sale earlier this year, confirming demand from retail investors and institutions in agent-led onchain finance.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.