Felix Protocol: Native Money Markets on HyperEVM - What You Need to Know

Dual-stables (feUSD + USDhl), $440M TVL, CoreWriter Integration, and More

Felix is positioning itself as the lender and stablecoin factory on the HyperEVM.

Felix allows users to earn native yield by minting a CDP stablecoin (feUSD), borrowing and lending through “Vanilla” pools and, more recently, supporting deposits of USDH on its lending markets. The codebase forks Liquity’s v2 model and the vanilla markets are built on Morpho’s lending stack while layering on risk controls such as low LTV ratios, mint caps and admin‑controlled pauses.

It has become one of the largest native money market dApps on Hyperliquid, with $440M TVL, second to Hyperlend.

In this edition, we’ll explore Felix’s core products (feUSD and Vanilla Markets), its native stablecoin USDhl, and recent developments.

Stay informed in the markets ⬇️

What is Felix Protocol

Felix runs two core primitives on the HyperEVM: a CDP market that mints feUSD against on-chain collateral, and Vanilla Markets that support variable-rate borrow/lend across assets like HYPE, UBTC, USDhl and more.

Under the hood, the feUSD system uses Liquity v2 architecture while the Vanilla Markets use Morpho’s lending stack.

CDP Market (feUSD) - Felix’s CDP system allows users to mint feUSD, a stablecoin pegged to $1, by depositing assets such as HYPE, kHYPE and BTC as collateral. The system is built on Liquity v2 code but introduces mint caps, adjustable trove parameters and the ability to pause the protocol. feUSD holders can redeem their tokens for $1 worth of collateral, and stability pools absorb liquidated positions, distributing collateral and interest to depositors. Felix sets a conservative 40% LTV ratio which is lower than many DeFi lending platforms to limit systemic risk.

Vanilla Markets - These are variable‑rate lending pools built on Morpho and they allow lenders to deposit stablecoins such as USDhl, USDe, USDT0 (and more recently, USDH), and earn interest, while borrowers post collateral such as HYPE, kHYPE or UBTC.

All positions are over‑collateralised, interest rates adjust with utilisation, and liquidations are executed automatically when a borrower’s health factor falls below 1. Felix plans to integrate liquidations directly on HyperCore once the CoreWriter upgrade is fully implemented

USDhl: Fiat-Backed, Yield-Sharing Stablecoin

Hyperliquid is creating a vertically integrated financial stack: HyperCore (perps/orderbooks) + HyperEVM (general-purpose L1) bridged by CoreWriter so apps can act across both layers.

This infrastructure allows protocols like Felix to combine CLOB liquidity with smart‑contract composability, enabling primitive lending products that rival centralised exchanges in speed and depth.

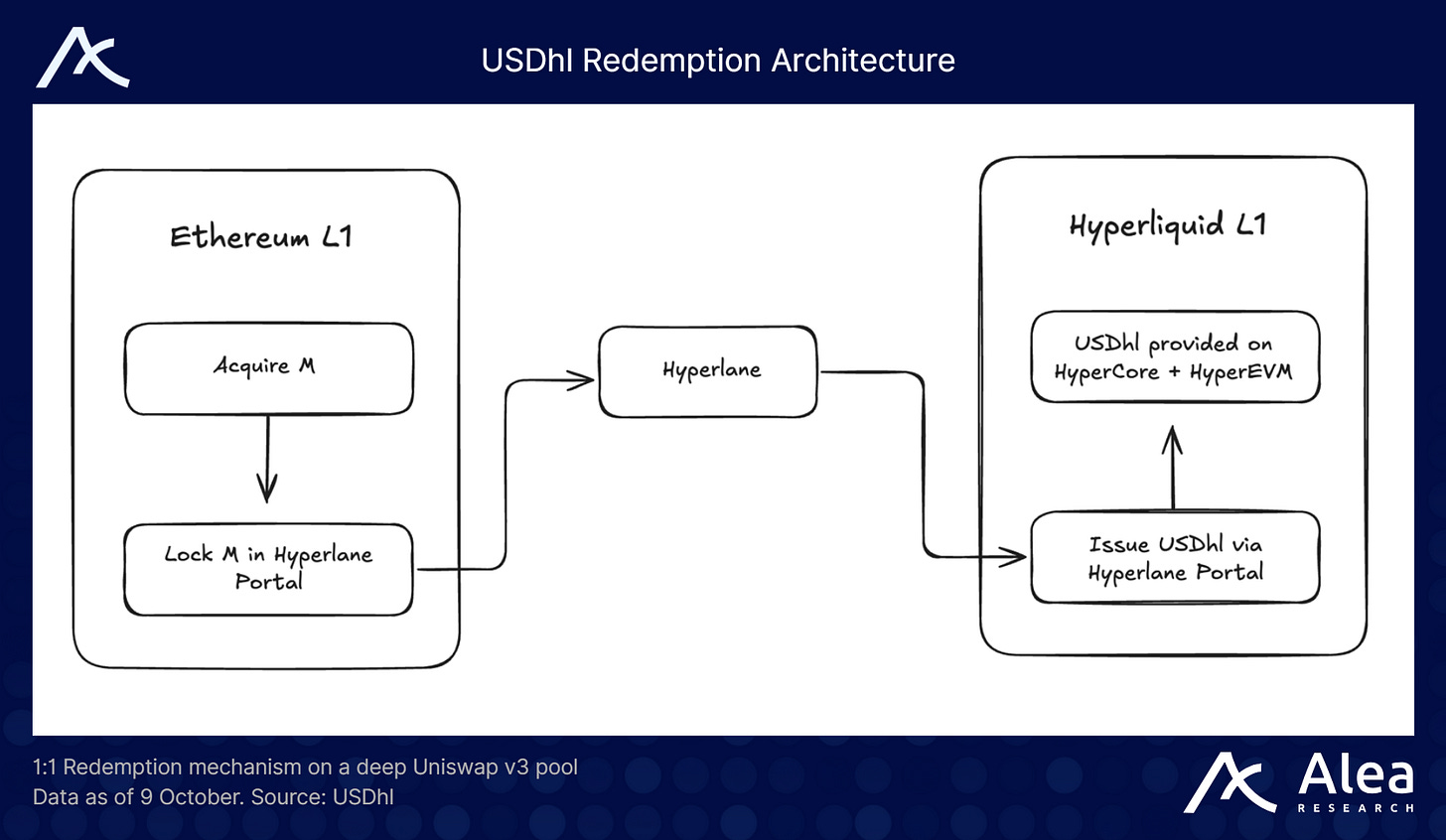

Felix also expanded its stablecoin suite by launching USDhl which is a fiat-backed and fully collateralized stablecoin launched by Felix and powered by M0 (T-bill-backed wholesale dollars) with on-chain reserve attestations.

Convertibility is enforced (M <> USD, and M <> USDC 1:1 via a maintained Uniswap v3 pool), and peg integrity relies on low-friction arb flows across Hyperlane. The end result is a fiat-backed stable that pays out its 4%+ yield back to users as Hyperliquid incentives (split across HyperCore spot and HyperEVM liquidity/Vanilla venues, re-weighted every 2 weeks).

CoreWriter Integration

The July 2025 CoreWriter upgrade enables HyperEVM dApps to write data to HyperCore, creating a bi‑directional bridge between smart‑contracts and the order book. Previously, protocols like Felix could only read market data, now they can place orders and execute liquidations directly on HyperCore.

This means that if a borrower’s collateral ratio falls below a threshold, Felix can programmatically send a liquidation order to HyperCore, matching it against the order book rather than routing through AMM pools. This approach should reduce slippage during liquidations and align Felix more tightly with Hyperliquid’s core liquidity engine.

Felix’s recent post teased a “Chapter 2” release.

While specifics remain unclear, community members expect Chapter 2 to roll out alongside full CoreWriter integration and to usher in new collateral types, refined risk parameters and an evolved points programme. The team has hinted that Chapter 2 will unify incentive structures across HyperCore and HyperEVM, rewarding users who borrow, lend and trade across both layers.

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.