Enso Launches Community Round - What You Need to Know

4% CoinList Sale, Enso Public Rollout, & More

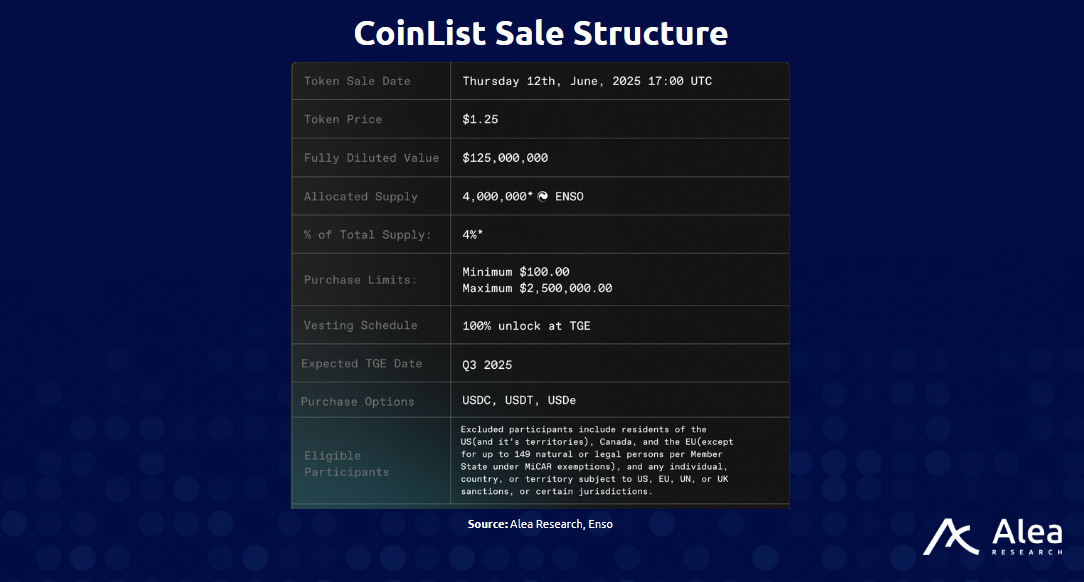

Enso, the onchain execution network powering over $15B in cumulative volume, has opened its $ENSO token sale to the public via CoinList. The sale allocates 4 million tokens (4% of total supply) at a fully diluted valuation of $125M.

Rather than retroactive airdrops or private-only distribution, Enso’s approach reframes token launches as infrastructure capital formation, aligning contributors, app developers, and users in a network where execution pathways are collectively owned.

In today’s edition, we’ll discuss the CoinList sale, Enso’s public rollout, and more…

Stay informed in the markets ⬇

Introduction

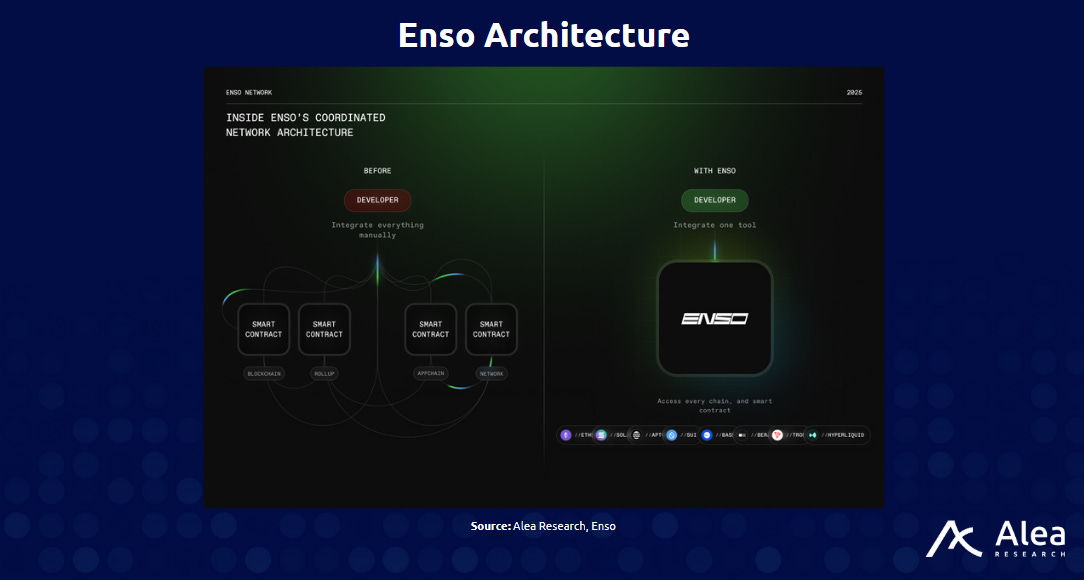

Enso is an execution-layer infrastructure network purpose-built to abstract the operational complexity of interacting with smart contracts across multiple blockchains. Enso enables intent-based transaction workflows where users vdefine the outcome they want (e.g., “lend ETH and stake the yield”) and Enso automatically routes the optimal execution path.

This is achieved through a modular architecture that standardizes smart contract interactions into reusable primitives called “Actions” and “Shortcuts,” allowing developers to compose complex multi-protocol flows without writing or maintaining protocol-specific code.

Its APIs expose a shared network state of onchain actions across EVM-compatible chains, making it possible to build natively composable applications that delegate the heavy lifting of integrations, simulations, and execution logic to Enso’s middleware. For teams building in DeFi, AI, or chain abstraction, Enso unlocks time-to-market acceleration, cost-efficiency, and execution reliability which turns a year of integration work into days while maintaining non-custodial control and security guarantees.

Now, with the launch of its native token $ENSO on CoinList, the protocol is opening its architecture to community ownership. Unlike traditional token launches or VC-led raises, the structure of this sale reflects a shift toward network-aligned distribution where public participants receive better terms than VCs, and a stake in the protocol’s long-term vision.

CoinList Sale Breakdown

Enso’s token sale is being conducted via a public community round on CoinList, with a clear emphasis on equitable access and better terms than earlier private rounds. This marks a strategic milestone in the protocol’s roadmap as it transitions from builder-focused infrastructure to a broader community-owned network.

At a valuation of $125M, the raise might be modest modest relative to its traction (>$3B in processed volume during Berachain launch week).

Unlike typical L1 or protocol token raises, where many offer the community unfavorable vesting or pricing compared to VCs, Enso’s community round offers better terms than earlier private investors. The seed round ($5M raised in 2021) and strategic round ($4.2M in 2024) reportedly took place at lower valuations but with longer vesting periods and higher lockups. Community participants, by contrast, receive earlier access with shorter lockups and public price discovery, aligning better with network launch timing.

Community Alignment

The raise structure reflects Enso’s intent to evolve into a public good infrastructure layer that supports a growing set of third-party developers, apps, and AI agents building on top of its middleware. With no fee-taking at the user layer and a focus on transparent, revenue-sharing B2B integrations, Enso is positioning $ENSO as a participation token rather than an extraction event.

For long-term ecosystem health, this is materially important as the value of the Enso network scales with participation.

Important Links

Disclosures

Alea Research is engaged in a commercial relationship with Enso as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.