dYdX Unlimited: What You Need to Know

Permissionless Listings, Prediction Markets, MegaVault, & More

In today’s edition, we’ll discuss the state of dYdX and relevant recent updates. dYdX is a decentralized exchange for trading financial derivatives that specializes in trading perpetual contracts on digital assets. Initially powered by StarkEx, dYdX has migrated its matching engine and orderbook to become an appchain in Cosmos. The platform is renowned for its user-friendly interface, low fees, and the ability to provide up to 20x leverage on positions. These features have positioned dYdX as a leading choice for traders seeking a decentralized alternative to centralized exchanges (CEXs).

dYdX’s marketshare consists largely of institutions, made clear by the vast amount of trades made on a daily basis. On this note, dYdX is also one of the only perps DEXs that is truly competing with CEXs. While this is the stated goal of many perps protocols, very few actually yield results that indicate there is overlap between the marketshare of their protocol and that of CEXs. Most onchain perps protocols service a userbase somewhat unique to the onchain environment. Meanwhile, platforms like coinglass consistently rank dYdX as a top crypto exchange, regardless of CEX or DEX…

Stay informed, stay alert ⬇

dYdX V3 Sunset

dYdX has had several key updates recently. The first point we should discuss is the sunsetting of dYdX V3. V3 was launched in 2021 and uses StarkWare's Layer 2 solution, which makes it much faster and cheaper than previous versions. Of course, while dYdX was initially powered by StarkEx, the protocol has since migrated its matching engine and orderbook to become an appchain in Cosmos, rolling out dYdX V4.

With V4, dYdX deploys its own blockchain, called dYdX chain, in an effort to scale and further decentralize the platform. While V3 was sort of a hybrid between CEX and DEX, V4 is significantly more decentralized. Trades are verified by validators, without the dYdX foundation being able to control the protocol’s matching engine.

The migration process is relatively simple, users can simply withdraw their funds from V3 and then use the V4 app, which will then prompt them to automatically bridge and deposit their funds onto the dYdX appchain. Users will be able to withdraw their funds indefinitely, even after dYdX closes the UI, via smart contract or L2Beat, which will provide its own migration tool. This sunsetting will begin on October 28th.

The team actually planned to sunset V3 shortly after the launch of the dYdX Chain, which occurred around a year ago. Trading volumes across the board surged at that time, which, if you remember, saw the start of a bull run in late 2023. So sunsetting V3 became less of a priority, but now the team has had more time to put this process into motion. The team is simply opting to sunset V3 to focus on V4, which has a higher ceiling with more technical capabilities. On this note, we’ll now discuss some of these new initiatives…

dYdX Treasury DAO

Before getting into confirmed upgrades, we’ll first discuss a proposal to form a Treasury DAO. At its core, this proposal would introduce token buybacks. The $dYdX token has undergone some changes, now providing more utility as it is required to stake and verify dYdX Chain transactions as a validator. Token holders can also receive ‘real yield’, paid in $USDC, from trading fees.

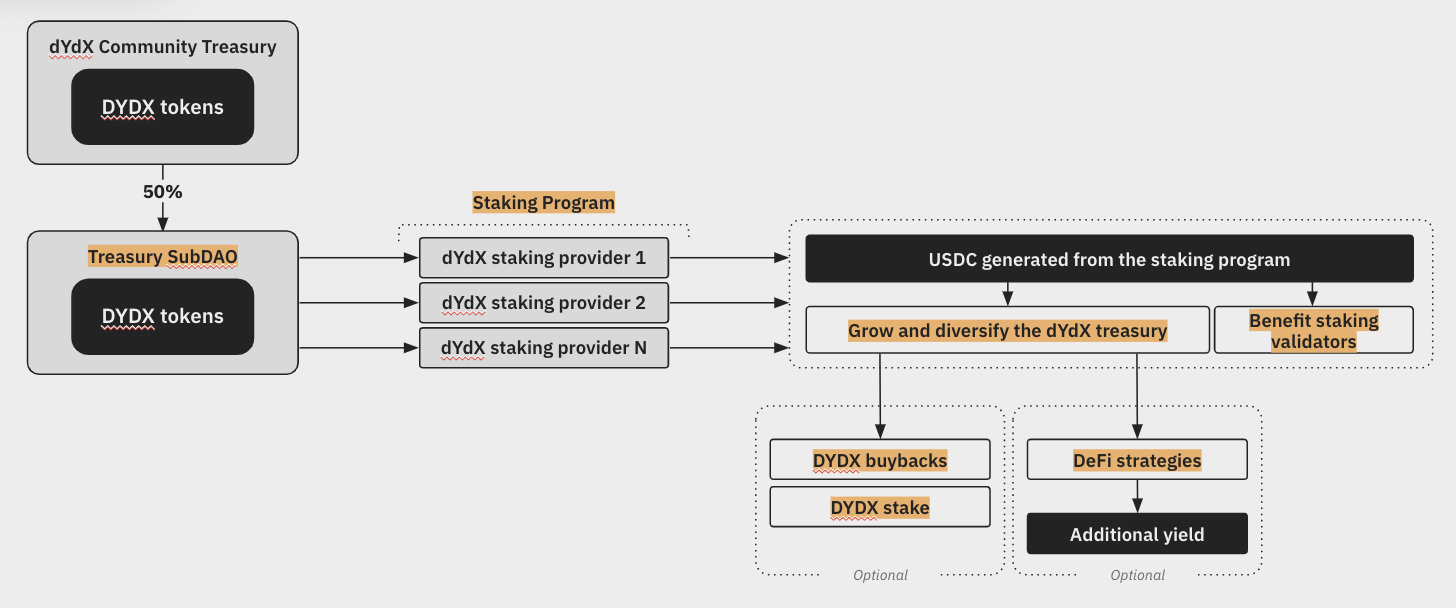

Currently, the dYdX Treasury sits idle, with the held $dYdX tokens more or less doing nothing while waiting for the community to approve various grants that can be paid for in $dYdX. It’s also worth noting that the Treasury consists completely of $dYdX. The Treasury DAO Proposal suggests that some of these tokens be staked through other parties, and used to further secure the network. It also suggests other initiatives, including holding a portion in $USDC, as well as the interesting proposition of token buybacks, using the proceeds from token staking.

dYdX Unlimited

The main initiative dYdX is pushing forward is dYdX Unlimited. Unlimited actually consists of a few different features, bundled together under one name. We’ll start with Permissionless Markets. As the name, suggests, the aim of this feature is to provide permissionless and ‘unlimited’ markets, allowing traders to get access to many more markets than the current ~140 that exist on dYdX today. The process of creating markets will be permissionless, with users able to list onchain tokens, no fees paid, or approvals required.

The current process of creating a new market on dYdX includes getting governance approval and depositing 2,000 $dYdX tokens, culminating in a ~4-day wait should the application be approved. dYdX CEO Charles d’Haussy believes the protocol has an unfair advantage when ti comes to token listings. Binance has drawn some attention lately for some of its questionable token listings, and teams have complained about CEXs requiring token allocations in exchange for listings.

As a part of the introduction of permissionless markets, comes the advent of Prediction Markets on dYdX. We’ve seen other perps protocols like Drift roll out their own prediction markets - why not dYdX? dYdX users will be able to speculate on the outcome of future events. Being able to offer perps markets for these predictions is also a unique value add that no protocol has gotten right thus far, as the idea is still very fresh with no clear market leaders. Details on how this might look are still TBD, but the idea is certainly something that could attract a new cohort of users, separate from the groups and institutions using dYdX’s current products.

On the liquidity provision side of things, MegaVault is introduced to shore up the proper liquidity needed to list various new token markets. MegaVault’s actually apply to all markets on dYdX chain, not just limited to the new permissionless markets, despite being introduced around the same time. These vaults will allow users to deposit funds, which will then be automatically used to make markets. MegaVault basically consists of an AMM, which users will provide USDC, used to fund all markets via what dYdX describes as a ‘master liquidity pool’.

Depositors can earn yield from trading fees, the P&L of the protocol across all of its markets, perps funding payments, and potentially other sources, pending governance. Governance will also designate an ‘operator’ who will be responsible for MegaVault’s manual operations, which consists of moving funds between markets and adjusting parameters. This operator may not be necessary in the future if it is decided that management can mostly be automated. Within the MegaVault lies multiple sub-vaults, representing different markets. The operator will be the one changing parameters and moving money between subvaults, users don’t have this functionality.

Another piece of the dYdX Unlimited package is the introduction of the Affiliate Program. This will allow users with >$10K in lifetime trading volume to generate their own exclusive affiliate link. Code users can access a reduction in trading fees, while referees can generate up to $3K per month per individual referral. There are future plans to create a VIP affiliate tier, which will allow these users to receive up to $10K per month in income per referral.

The final main point included under the scope of dYdX Unlimited is the introduction of Permissioned Keys. Permissioned keys are also being rolled out, which will allow users to opt for their own private key. Each key grants access to a specific wallet, which will function the same as normal accounts on dYdX, but obviously backed by its own seed phrase. These features are Other improvements the team has hinted at coming soon including ease of onboarding updates, a UI revamp, and more…

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs