DeFi Saver: Smarter Execution For Aave - What You Need to Know

Rule-based Automation, Loan Shifter, 1-tx Leverage, and More

DeFi Saver is a non‑custodial dashboard that lets users create and manage complex crosschain lending and borrowing positions across DeFi protcols from a single interface.

Over the past 6 years, it has become a go‑to tool for investors who want to supply collateral, borrow assets, rebalance their positions and automate risk management without handing over control. Most of its users run positions on Aave, yet many still interact via Aave’s own UI.

In this edition, we’ll explore DeFi Saver’s toolbox for interacting with crosschain DeFi protocols like Aave, what it does, why it matters, and what Aave‑specific features you can access through it.

Stay informed in the markets ⬇️

What is DeFi Saver?

Launched in 2019, DeFi Saver inserts a smart-wallet and automation layer between the user and underlying protocols. Instead of interacting with Aave, Maker, or Morpho directly, users connect a wallet, deploy a DeFi Saver Smart Wallet, and then route all actions (supply, borrow, leverage, rebalance, migrate) through DeFi Saver’s contracts.

They provide tools for position creation, leverage management, risk monitoring and automation using its contracts that execute complex multi‑step recipes in a single transaction, even using flash loans when needed.

Using Aave Through DeFi Saver

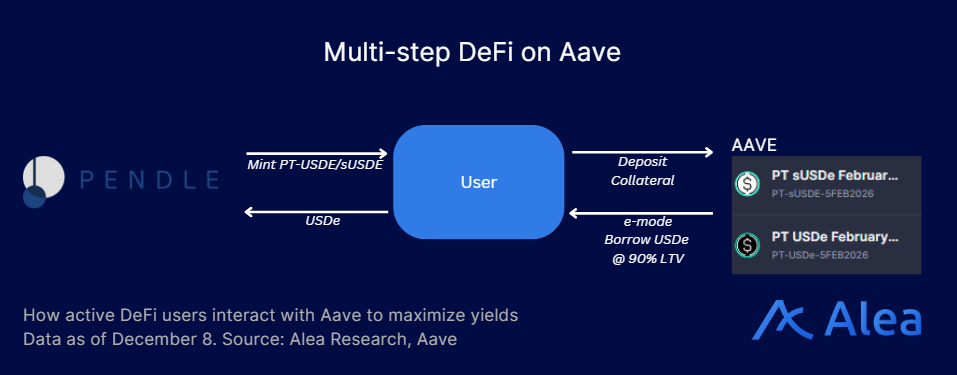

DeFi Saver aims to fill a non-custodial management layer that compresses these multi-step flows into fewer transactions and adds rule-based automation on top of existing protocols, rather than replacing them. Active users rarely hold a single static borrow. They loop leverage on LSTs and LRTs, run carry trades between stables, and rotate collateral as narratives and funding conditions change, often across multiple chains.

Each of those strategies breaks down into multiple onchain steps: supply, borrow, swap, resupply, repay, withdraw. That creates two recurring pain points when using Aave directly:

Multi-step leverage changes - Increasing or decreasing leverage requires a sequence of borrow–swap–resupply (or the reverse) transactions. Adjusting risk in fast markets can mean a lot of clicking or missed opportunities.

No native rule-based risk management - Aave exposes liquidations clearly via the health factor, but does encode conditions like “auto-repay if HF < 1.3” or “scale out once collateral rallies 20%”. Unless done via bots, users often rely on manual monitoring.

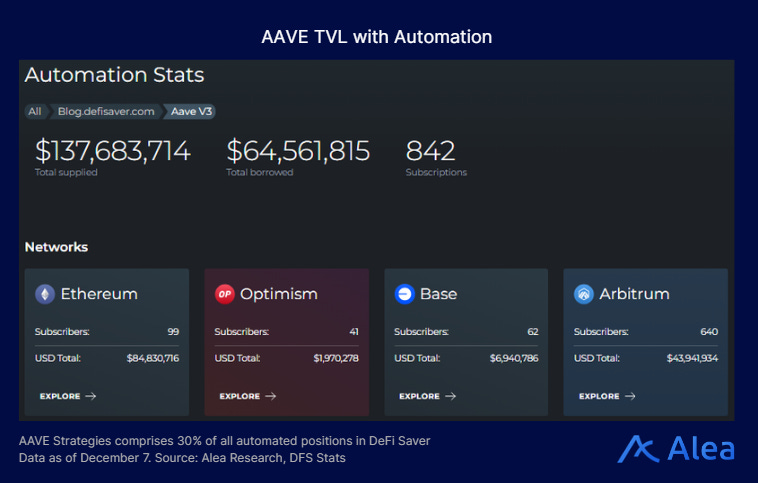

Aave is a natural focal point because it is one of DeFi’s core money markets by both usage and capital. Aave is one of DeFi Saver’s most active integrations, and much of the project’s automation tooling was built with Aave-style lending in mind. Currently, the TVL automated in Aave strategies comprises 30% of total USD ($137M).

Practical Scenarios for Aave Farmers

DeFi Saver introduces functions that enable Aave farmers to better manage their positions:

1-tx leverage - Tools like Boost & Repay and Leveraged Create & Close let users open, increase, or reduce a levered Aave position in a single transaction using flash loans, instead of chaining separate supply/borrow/swaps. Position Flip also lets users switch from long to short in 1 transaction. These are kept under the hood to abstract the complexity away from the end user.

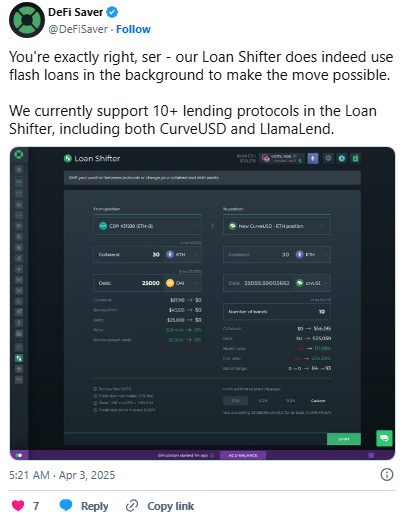

Position restructuring without closing - Loan Shifter and Collateral & Debt Switch allow users to rotate between collateral types or debt assets in one go, rather than fully closing and reopening the position. This helps to reduce downtime and execution risk as users switch between protocols, collateral or debt assets.

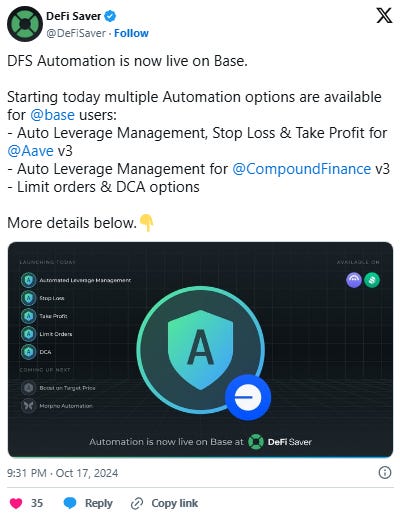

Rule-based Automation - Users can set risk and profit rules such as managing health factors, auto-repay or auto-boost at certain price levels, and set stop-loss or take-profit triggers on collateral.

Workflow tools - Features like Recipe Creator (build multi-step transactions visually), Simulation Mode (test strategies), and TxSaver (MEV-protected routing and gas handling) make it easier to design, test, and execute complex DeFi legos without changing what Aave itself does.

From a risk perspective, users still using Aave’s markets, rates, and liquidation engine but uses DeFi Saver’s transaction and automation front-end. Practical scenarios often faced by DeFi farmers on Aave include:

1. Market Drawdown on a Levered Position

You’re running a 3x levered stETH position on Aave by supplying stETH, borrowing a stablecoin, swaping back into stETH, resupply and repeat until your health factor sits at ~1.6.

Using Aave’s native UI - When ETH sells off just 20–25%, health factor drops to 1. If you’re not watching in real time, you might only notice once you log in. Even then, de-risking the position is a tedious process: withdraw collateral, swap into the debt asset, repay part of the loan… repeat if you want a bigger safety buffer. Each step is a separate transaction, all in a period where volatility and gas may be elevated. If you’re slow, you risk liquidation.

Using Aave through DeFi Saver - The same structure can be wired into DeFi Saver’s Leverage Create & Close or Automation function, where you set upper and lower health factor bounds. If the health factor lower bound is hit, an auto-repay gets triggered using flash loans. This sells just enough collateral into the debt asset, repays part of the loan and restores the target buffer in a single transaction.

2. Adjusting Leverage/Taking Profit

Say on the same stETH position but now ETH goes higher and you want to increase leverage as the price moves up or gradually lock in profit by reducing leverage.

Using Aave’s native UI - To increase leverage, you borrow more stables, swap into stETH, resupply and repeat. To take profit, you withdraw stETH, swap into the debt asset, and repeat to the desired amount. There is no native concept of a take-profit or rules that say “keep my leverage at 3x”

Using Aave through DeFi Saver - Boost & Repay and Leveraged Create & Close flows bundle those loops into single transactions. Automation allows configuration of leverage to automatically boost to add leverage if ETH rallies or repay to cut risk.

3. Rotating Collateral and Debt Assets

You hold a large Aave position backed by 1 collateral (say a specific LST). Over time you want to rotate into a different collateral, change the borrow asset (e.g. from USDC to USDe), or even move the whole position to another protocol if yields change.

Using Aave’s native UI - To switch collateral, you have to manually unwind the whole position then manually rebuild the whole position up to a desired leverage for example. Migrating between protocols adds bridging and fresh setup.

Using Aave through DeFi Saver - Loan Shifter and Collateral & Debt Switch use flash loans and routing under the hood to swap collateral or debt within Aave in a single transaction, while showing before/after collateral, borrow limit and safety ratio so you can see the effect on risk.

Closing Thoughts

Ultimately, plain Aave actions (supply, borrow, repay) routed through DeFi Saver generally follow Aave’s fee economics, while swap-heavy features like Boost, Repay, Loan Shifter and some automated adjustments add service fees on the traded notional.

For the Aave-native users who already use multi-step strategies and think in terms of health-factor bounds or target leverage ranges for managing their position, DeFi Saver helps to remove much of the mechanical friction from executing them.

Important Links

Disclosure

Alea Research is engaged in a commercial relationship with DeFi Saver as part of an educational initiative, and this newsletter was commissioned as part of that engagement. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.