BonkFun: Real Cashflows and Powerful Flywheels - What You Need to Know

Fall of PumpFun, BonkFun's Rise, $25M $BONK Buybacks, & More

BonkFun started as a launchpad for memecoins, a simple tool to mint tokens quickly and easily. But while launchpads like Boop or Moonshot burn out after the initial hype, BonkFun has quietly transformed into one of Solana’s most profitable on-chain businesses.

Launchpads are no longer just token vending machines, instead becoming a revenue-backed infrastructure layer feeding the Solana ecosystem and reinforcing the $BONK coin through buybacks and burns.

In today’s edition, we look at BonkFun’s rise in the launchpad wars, the revenue model that sets it apart, and why this corner of Solana is shifting from raw speculation to fundamentals.

Stay informed in the markets ⬇

From Meme Factory to Market Leader

The launchpad landscape exploded in 2024 when Pump.fun unlocked “mint a token in five clicks” for anyone with a Solana wallet. Pump.fun minted over 17 million tokens and dominated fees, but its edge dulled as growth plateaued and fees declined.

BonkFun emerged from the same meme wave but evolved differently. Built around the $BONK memecoin, the platform attracted creators and liquidity, overtaking Pump.fun and LaunchCoin by focusing on aligned incentives, a more transparent team and more importantly, cleaner economics.

Looking at Solana protocol revenues over 24h and 1y timeframes tell a clear story of the decaying edge of pumpfun over the year, and the recent rise of BonkFun. Today, BonkFun is solidifying its ground as the default launchpad on Solana, sitting at the intersection of retail speculation and a revenue machine.

A Revenue Engine Disguised as a Launchpad

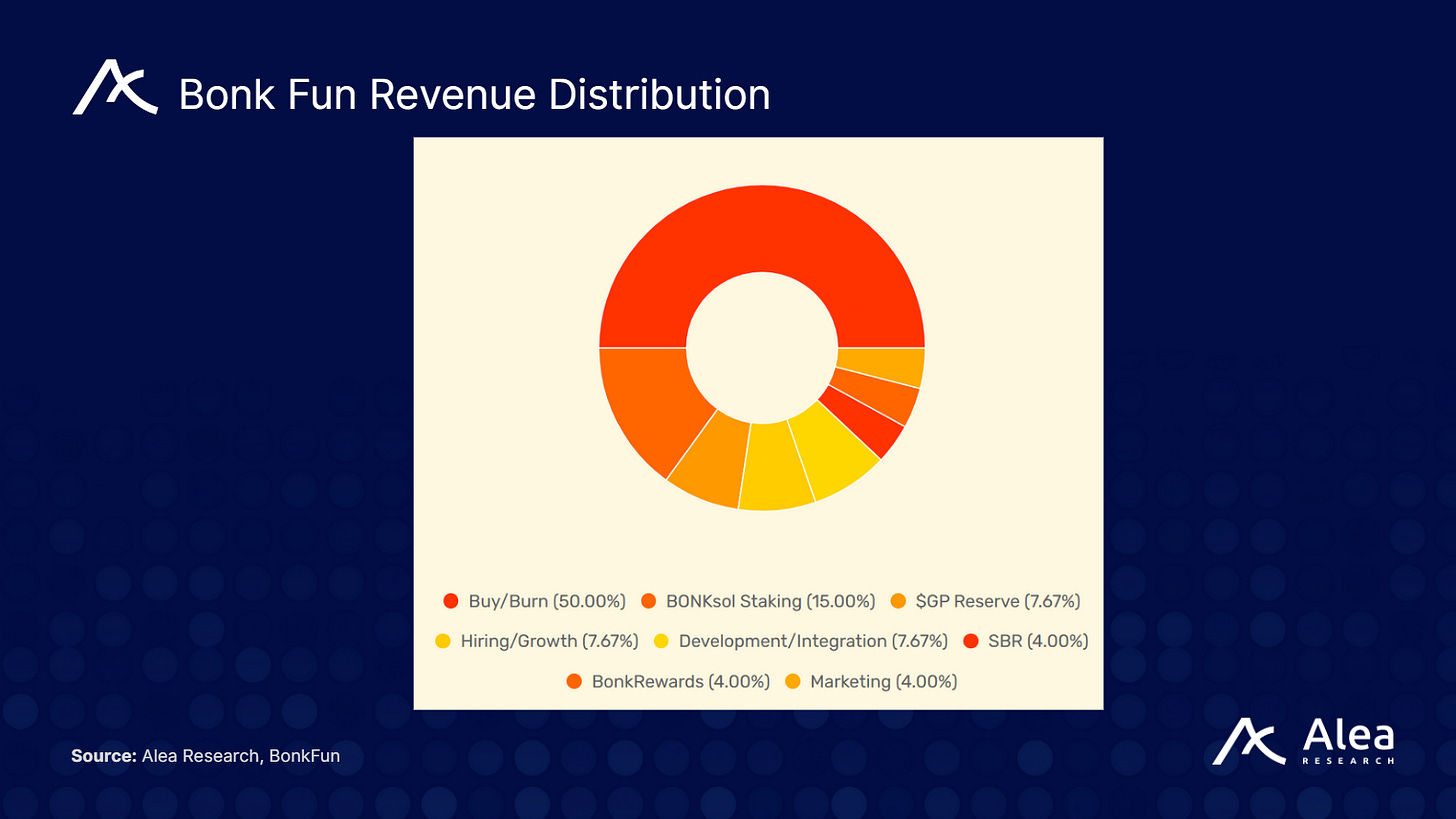

BonkFun makes money on every transaction flowing through the platform: token creation fees, liquidity provisioning spreads, and transaction volume. But what makes BonkFun distinct is how it routes that revenue back into the ecosystem, all trasnparently documented here.

A meaningful share of fees are used for $BONK buybacks and burns, turning platform activity into structural token demand. Every time someone mints or trades through BonkFun, part of that activity is recycled into $BONK, tightening supply and deepening alignment between the protocol and its base asset.

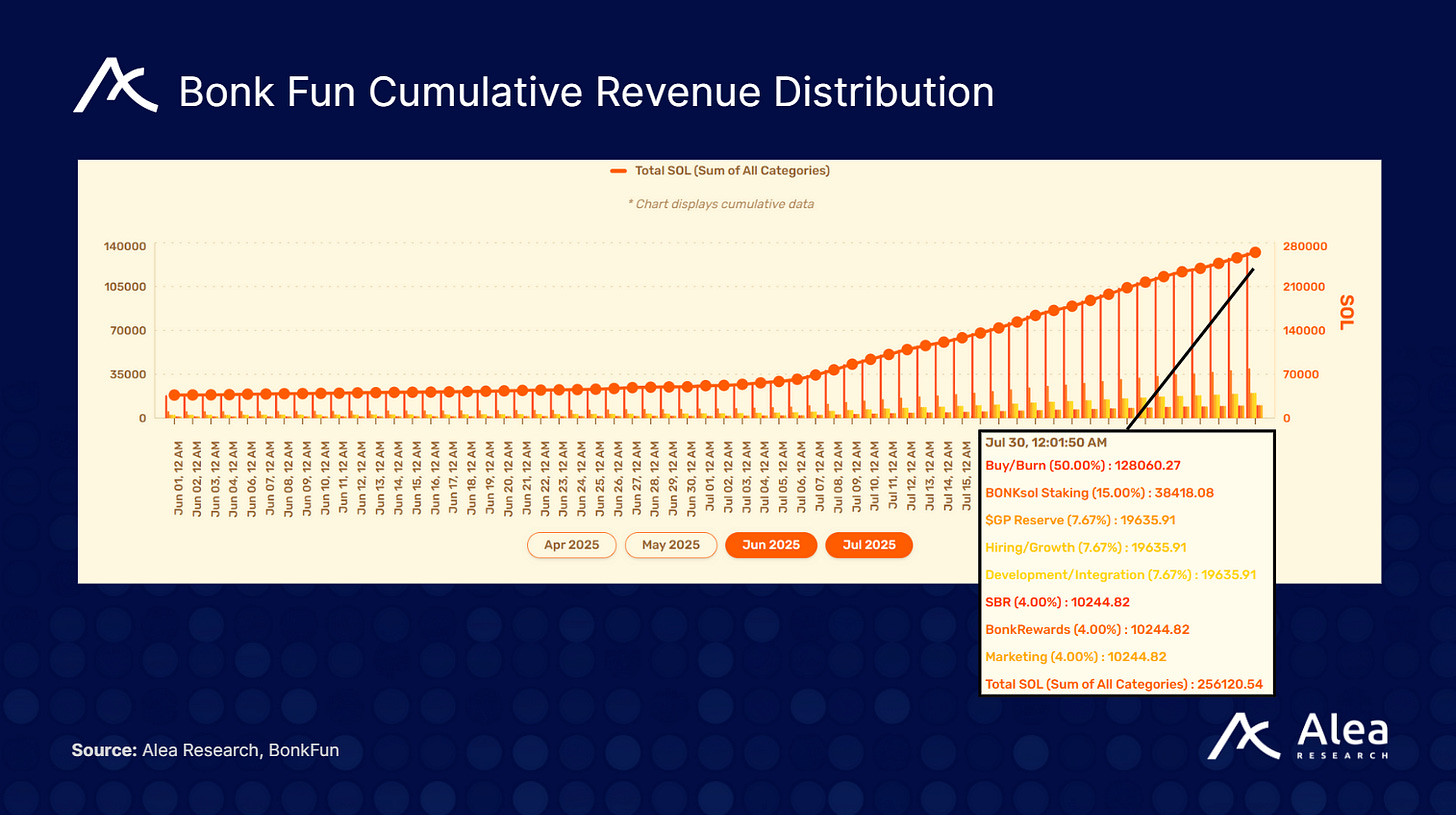

That revenue flow has become non-trivial (over 250K SOL to-date, ie. almost $50M) as BonkFun now sits in the same fee bracket (higher, even) as mid-sized Solana DeFi protocols. This is rare for something born from meme culture.

$BONK Buybacks and the Flywheel Effect

Majority of BonkFun’s revenue is allocated for Buybacks & Burns (50%), with close to $25M in SOL being used in the buyback & burn program to-date. On top of that, 15% of all fees generated by BonkFun is staked in the form of $SOL in the BONKSol validator, contributing to securing the Solana network by staking almost 40k $SOL

In risk on environments, launchpad usage generates fees → Fees fund $BONK buybacks and burns → Buybacks drive $BONK demand and attention → More attention brings more launches, feeding fees again…

This loop is why BonkFun’s design feels different from the first wave of launchpads. Instead of extracting and sitting on revenue, it converts activity into a self-reinforcing system that ties platform success directly to $BONK’s token economy.

Closing Thoughts

The first wave of launchpads was about speed and novelty and Pump.fun won that phase. But that model stalled.

BonkFun represents the second wave… launchpads with fundamentals. It generates recurring fees, ties that revenue to its ecosystem token, and even expanded into liquid staking via bonkSOL, contributing to the broader Solana ecosystem.

Rather than being a disposable meme tool, BonkFun is turning into a cashflow giant and is proof that meme-era infrastructure can compete with mid-size DeFi protocols.

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.