Beraborrow - Berachain's CDP Protocol: What You Need to Know

Liquity V2 Friendly Fork, $NECT Stablecoin, & More

Some might say that we’re at a turning point in the market, where many people are starting to voice the idea that memecoins are actually more viable tokens to trade or hold than low-float tokens of applications or chains. This is a subject that deserves a newsletter of its own. No matter what way you look at it, it’s clear that the cult-like communities and unserious nature of memecoins have worked in their favor. Can this concept transfer over to DeFi? Berachain is probably the chain and ecosystem which embodies the ‘spirit’ of memecoins the most. While the chain still has yet to launch, the size of the ecosystem that the team has already built up is impressive in its own right.

It might be easy to dismiss the projects building on Berachain as playful, and perhaps lacking a solid foundational premise. From Bear NFTs to vape-to-earn projects; the Berachain ecosystem is certainly colorful. But there is definitely a fair share of teams iterating upon previous DeFi concepts, and bringing new, interesting ideas to the table. One such project is Beraborrow. In today’s edition, we’ll cover Beraborrow, a Collateralized Debt Position (CDP) protocol building on Berachain. Interestingly, the project recently secured the rights to deploy a friendly fork of Liquity V2…

Stay vigilant in the markets ⬇

Background on Beraborrow

Beraborrow enables instant liquidity for a variety of assets on Berachain. This includes native Berachain assets like $BERA and $BGT, as well as LSTs like $iBT, LP positions, & more. Users can then mint the protocol’s native overcollateralized stablecoin, $NECT. $NECT is the first fully collateralized stablecoin on Berachain, backed by native assets, primarily $iBGT. $iBGT is the LST provided by Infrared protocol.

In its current state, the Beraborrow platform allows users to deposit various Berachain assets and borrow $NECT, as well as deposit $NECT into the liquidity stability pool. These are the two main functions live. Users can borrow against multiple versions of $BERA, $iBGT, and $HONEY, as well as a $HONEY-$USDC LP position.

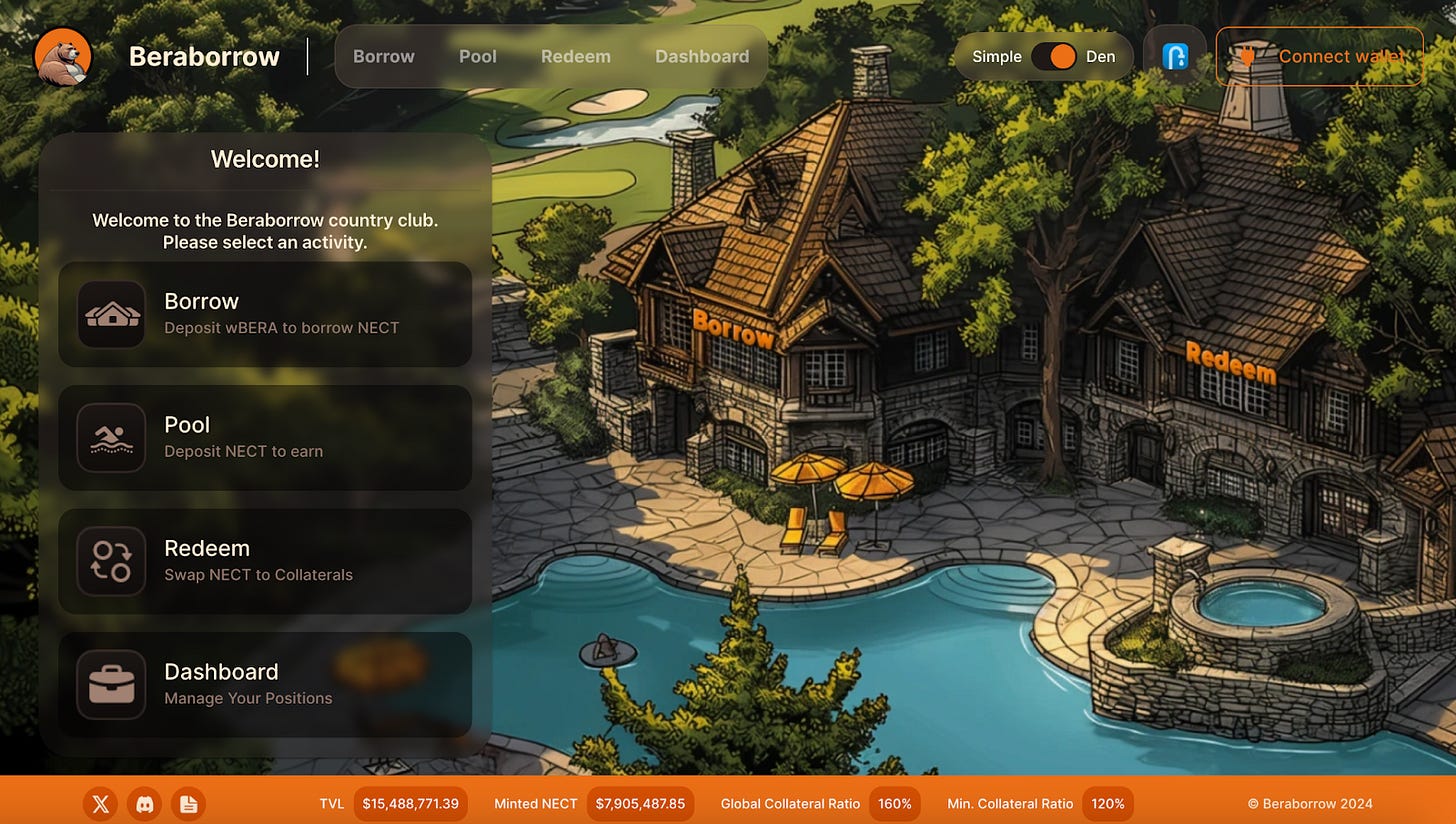

At first glance, Beraborrow represents the Berachain ethos - the app has a unique UI, with a forest theme. More importantly, the UI is well-designed, with all features and pages easily accessible and properly labeled to make things easy for users. Users can toggle between the thematic UI and the ‘Simple’ UI. The app has been live on testnet for over a couple of weeks now, giving users a chance to play around and test what Beraborrow has to offer. This includes various utilities for the $NECT stablecoin and ways to maximize exposure to Berachain assets.

$NECT aims to be Berachain’s first Proof-of-Liquidity (PoL) powered stablecoin. As a CDP protocol, Beraborrow enables users to maintain exposure to select assets, while accessing a certain amount of leverage. Beraborrow actually implements native looping, controlled with a slider, with flash loans used in the background. Alternatively, users can deposit their $NECT into the liquidity stability pool, to earn yield from protocol liquidations and fees. Users who deposit receive $sNECT, a representative token of their share of the liquidity stability pool. The pool goes another layer deep, also allowing $sNECT holders to own a share of discounted liquidated assets, opening up opportunities for arbitrage on Berchain DEXs. $sNECT also serves as a pegging mechanism, ideally creating demand for $NECT should it trade at a discount.

There are also auto-compounding dens, allowing users to have their earnings automatically swapped into $iBGT, which is deposited on the platform and counted toward collateral ratios. Finally, there are tokenized dens, where users can lock collateral via Beraborrow in Infrared vaults, and have incentives and rewards automatically compounded/restaked.

Earlier, we mentioned the fact that Beraborrow had recently secured an exclusive license to operate a friendly fork of Liquity V2 right on Berachain. There are certain modifications that must be made to adapt Liquit’s offerings to the Berachain environment, mostly with how the chain’s Proof-of-Liquidity system functions. Berabborow was heavily inspired by Liquity to begin with. One iteration that Beraborrow has included in their protocol over Liquity V1 is making the $NECT stablecoin redeeming process easier, particularly when it comes to redeeming while maintaining leveraged collateral positions. Other key changes include multi-collateral support and the inclusion of interest rates. Being able to friendly fork Liquity V2 will allow Beraborrow to implement user-set interest rates, enhanced redemption mechanics, no recovery mode, and more.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs