Avantis: The Universal Leverage Layer - What You Need to Know

Universal Leverage, Avantis’ Architecture, $AVNT, and More

Synthetic derivatives, decentralized oracles and composable liquidity protocols have enabled traders to access everything from Bitcoin and ETH to gold and forex using stablecoin collateral.

Since Avantis launched on mainnet in February 2024, they have become the largest derivatives exchange on Base and the largest DEX for trading and market‑making real‑world assets (RWAs).

The protocol has processed over $18 billion in cumulative volume and executed more than 2 million trades for 38,500+ traders. With a TVL of $23 million across 25,000+ LPs and over 80 markets, Avantis is solidifying its position as the hub for perps.

In this edition, we’ll explore Universal leverage, Avantis’ architecture, and the launch of the $AVNT.

Stay informed in the markets ⬇️

Intro to Avantis

Avantis is a perps DEX allowing users to trade crypto, forex, commodities and indices using stablecoin collateral. The protocol abstracts away individual order books and instead builds a “universal leverage layer” where any asset with reliable price feeds can be listed.

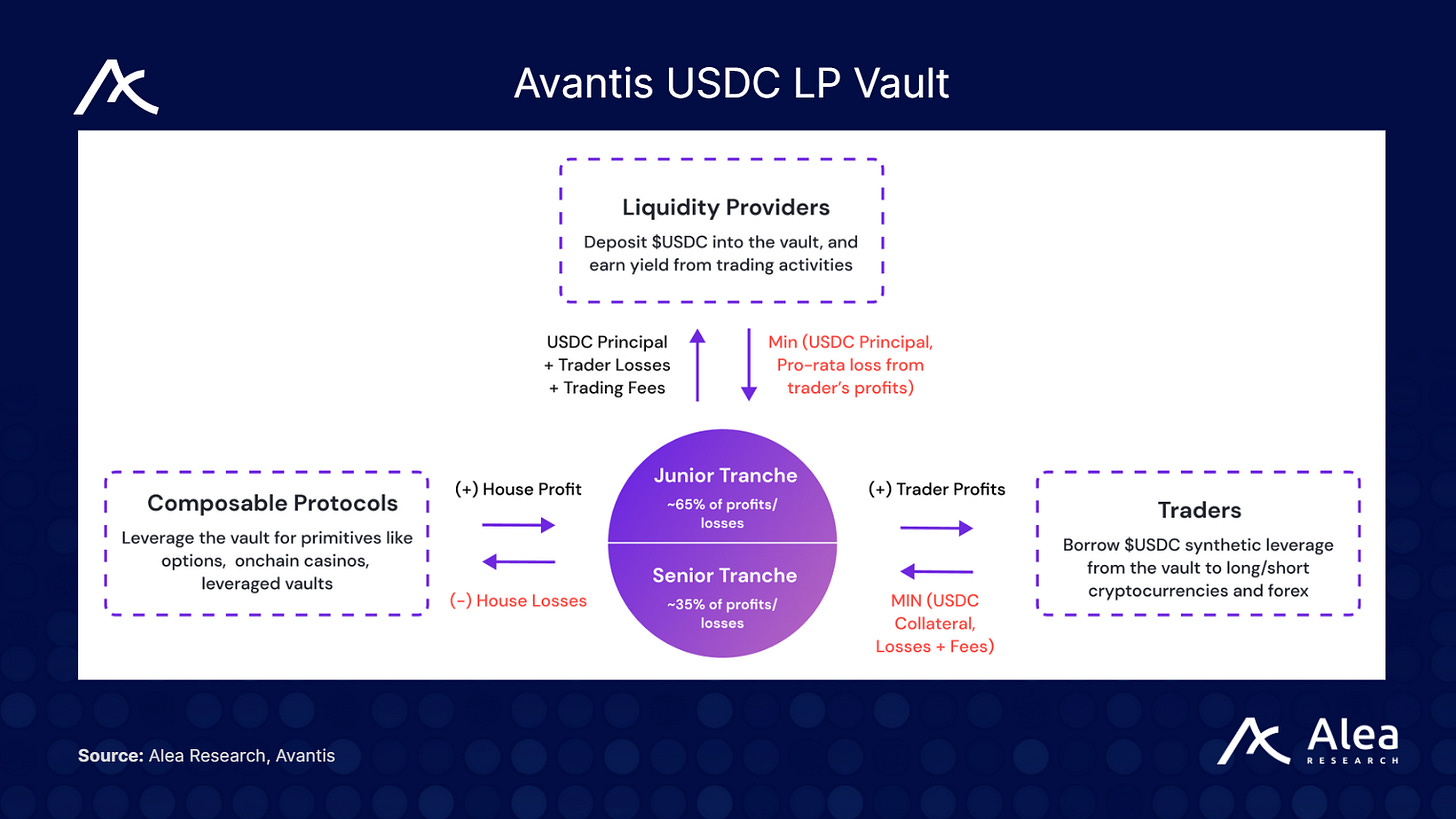

Synthetic leverage is achieved through a USDC‑based liquidity vault that acts as the counterparty to all trades, enabling capital‑efficient exposure to multiple markets. Traders can choose leverage up to 500x, making it possible to express directional views with minimal capital, while liquidity providers (LPs) earn yield by providing the USDC that powers positions.

What differentiates Avantis from other perpetuals exchanges is that users can trade non‑crypto markets like the Japanese yen, gold and U.S. equity indices alongside BTC or ETH. The protocol’s design also supports features like zero‑fee perps, loss rebates and positive slippage, which align incentives between traders and LPs by returning a portion of fees or profits back to users when they improve the protocol’s risk profile

Avantis Architecture

At the core of Avantis is a capital‑efficient synthetic engine. Traders use the protocol’s interface to open positions on supported assets. Instead of matching orders in an order book, Avantis pairs each trader with a USDC vault that assumes the other side of the trade. The vault aggregates deposits from thousands of LPs and acts as a single counterparty. This structure allows the protocol to offer deep liquidity across many markets without requiring separate liquidity pools for each pair, enabling Avantis to list more than 80 markets, including 22 RWAs.

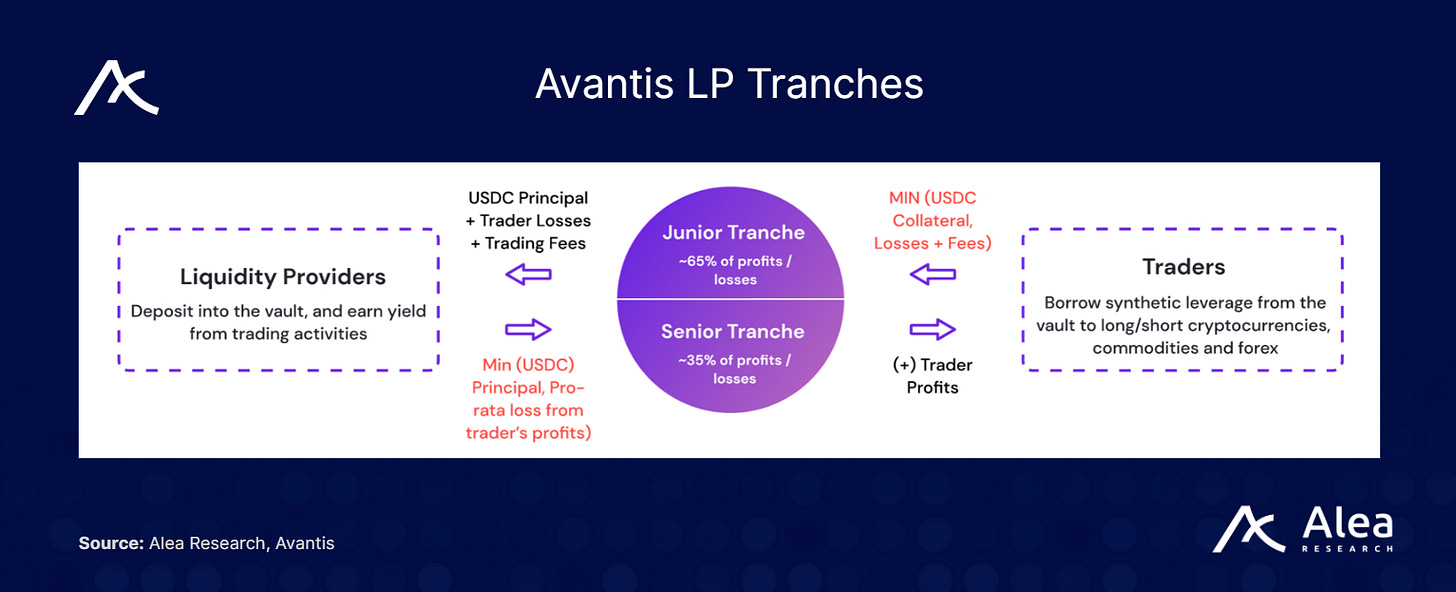

Avantis introduces risk tranches and time‑lock parameters so LPs can choose their preferred exposure. LPs can deposit passively into the senior tranche or take more risk in the junior tranche, which has higher return potential but also absorbs a greater share of losses.

Additionally, LPs select a time lock (e.g., 30‑day or 90‑day) that governs how long their capital is committed, where longer locks grant more fees. This design mimics Uniswap v3’s concentrated liquidity model while applying it to risk management for a perps exchange.

Trader <> LP Alignment

Avantis’s innovative mechanisms further align the interests of traders and LPs.

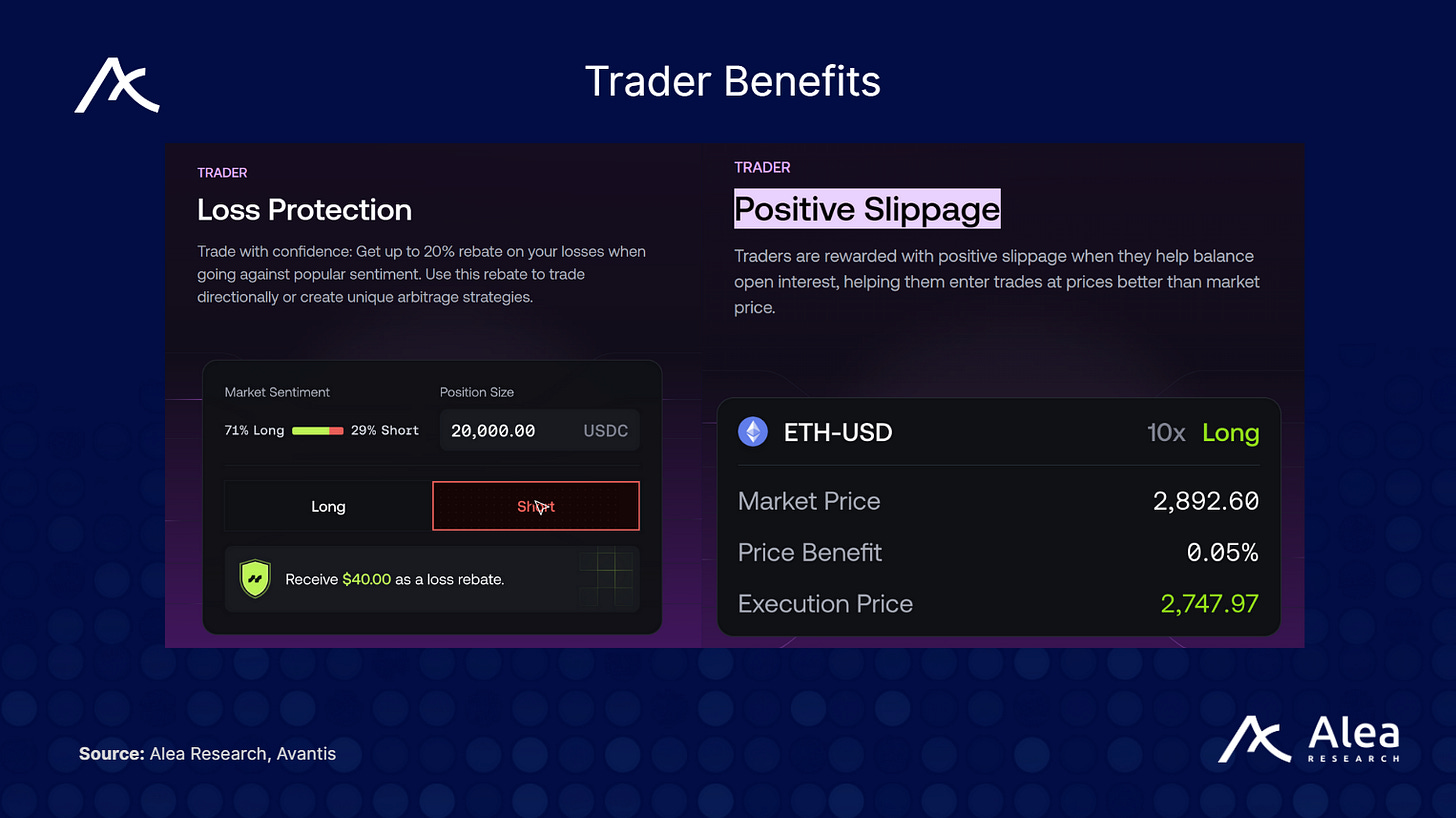

Loss Rebates: Traders who take the contrarian side of open interest (helping balance the platform’s long/short skew) receive up to 20 % rebates on losses. This encourages traders to arbitrage the open interest and stabilizes LP exposure.

Positive Slippage: When a trader’s order reduces risk for the vault (e.g., closing a position that is heavily skewed long), Avantis offers an improved entry price over the mark price. This “better‑than‑market” execution rewards traders for helping balance flows.

Zero‑Fee Perpetuals: Avantis pioneered a product where traders pay no opening, closing or borrowing fees. Instead, they pay only a share of their profits when closing a winning trade. The instrument is available on $BTC, $SOL and $ETH with leverage up to 250x and is popular among scalpers and high‑frequency traders.

Advanced Risk Management: LPs can act as passive lenders or as active market makers by selecting a risk tranche and time‑lock. Each tranche has its own share of fees and potential losses, giving LPs control over risk and return.

$AVNT: Token Launch & Tokenomics

To catalyze its next phase of growth, Avantis has introduced $AVNT, a utility and governance token. $AVNT serves several roles:

Security & Staking: Holders can stake $AVNT in the Avantis Security Module, providing a backstop for the USDC vault during extreme market moves. Stakers earn $AVNT rewards and trading fee discounts.

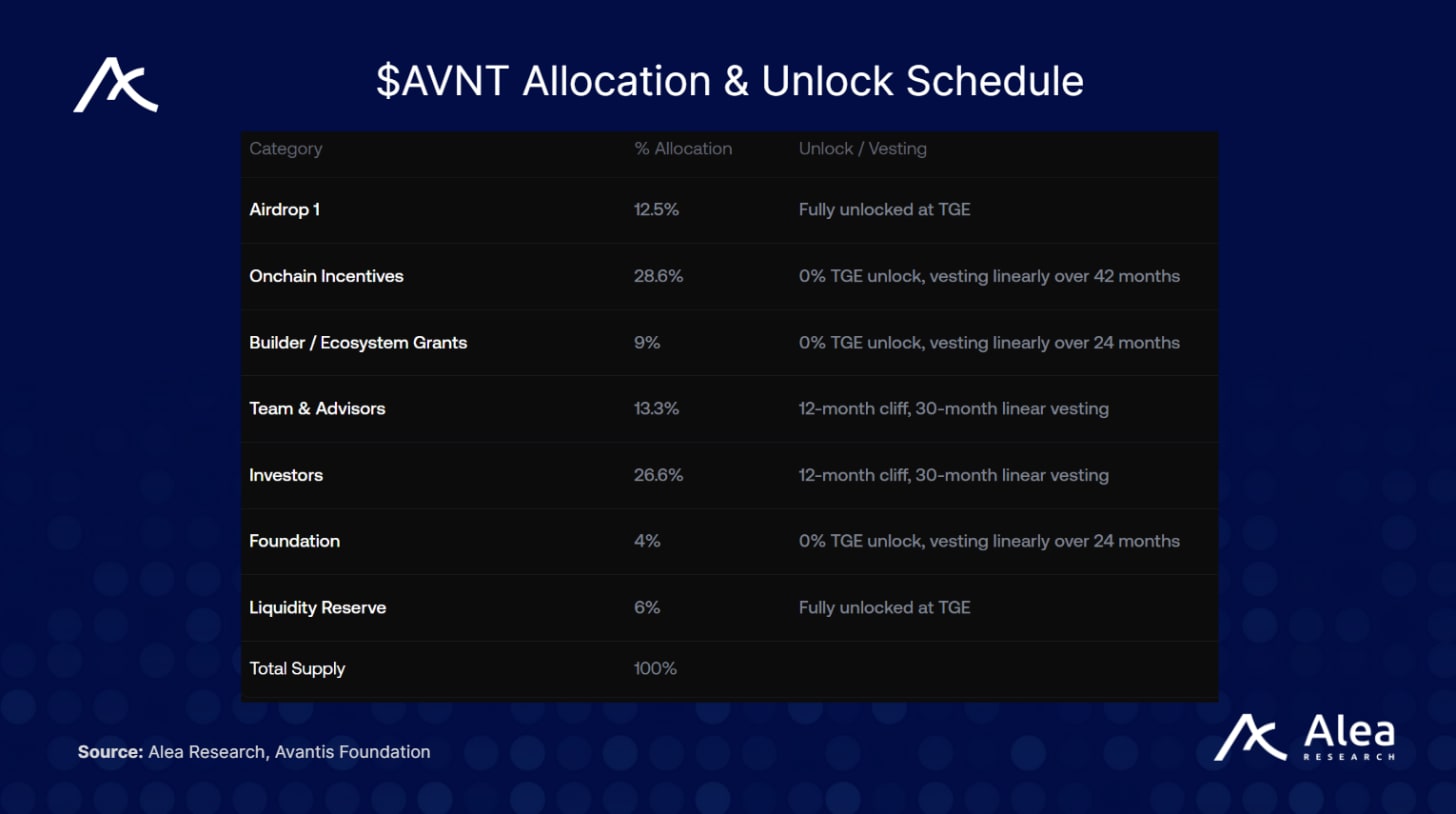

Community Rewards: 50.1 % of the total 1 billion token supply is reserved for traders, liquidity providers, referrers and builders who contribute to Avantis. Airdrop 1 (12.5 % of supply) will reward protocol activity since February 2024, while on‑chain incentives (28.6 %) will fund future XP seasons and community contributions. Builder and ecosystem grants (9 %) will support the creation of new front‑ends and trading tools such as AI agents and Telegram bots.

Governance: Token holders will be able to propose and vote on protocol decisions, from asset listings and fee structures to buy‑back programs and cross‑chain deployments.

The remaining 49.9% of supply is allocated as follows:

Team (13.3%)

Investors (26.61%)

Avantis Foundation (4%)

Liquidity Reserves (6%)

Important Links

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

Full access to historical research archive, including hundreds of long-form reports.