We have another Ailea Bulletin for you this week. Last week, we instead opted to provide multiple AI spotlight editions, on Virtuals and Freysa. Between $TRUMP and crypto legislation around the Bitcoin Strategic Reserve, a lot has happened this past week that might have distracted crypto-natives from the AI agents space. But rest assured, this sector still looks to be the most dominant by far in the coming months.

In today’s edition, we’ll go over the current state of AI more broadly, recent changes in the AI agents space, and more.

Stay informed, stay alert ⬇

AI Wars

Just this past week, DeepSeek, a Chinese AI company released their R1 reasoning model, which appears to be on par with or outperforming incumbent models from OpenAI (O1), Meta (Llama), and other legacy players. DeepSeek first started as a spinout company of High Flyer, a Chinese quant trading firm that simply had a lot of GPUs on hand to train models with, which accelerated after the Chinese government became more hostile toward the financial sector. Since then, DeepSeek has found a lot of success, first with its V3 released in December, and now, R1.

What’s also worth noting is the fact that R1 was trained with far less funding and resources; some have estimated that at most, DeepSeek had access to 50,000 H100s, with total training cost in the low millions, a small fraction of what US-based companies have access to and have been expending. The costs of accessing R1 are also a fraction of OpenAI’s O1, even prompting Sam Altman to recently announce that o3-mini would be included in ChatGPT’s free version.

The advent of DeepSeek was closely followed by a pledged ~$8BB investment from the Chinese government toward AI. ByteDance, the parent company of TikTok, also set aside $20B of their own funds for AI investment, after releasing Doubao 1.5 pro. Even though Chinese firms are resource-strained, as they are restricted from purchasing advanced chips, they have been making strides and reportedly prompting Western incumbent companies to rethink their strategies.

On the US side, newly-elect President Donald Trump announced ‘Project Stargate’, with a planned $500B in funds to be deployed over the next 4 years, sparking excitement as well as skepticism from Elon Musk and others. It remains to be seen where all of these funds will be coming from, as it isn’t clear that SoftBank has nearly enough liquid funds to back the endeavor, though they are not the only large backer.

Future of Agents

Clearly, there have been fireworks in the AI space; but what about agents specifically? While something of a space race may be brewing on the LLM and hardware side of things, when it comes to the actual application of AI in daily lives, agents look to be a key focus.

Yesterday, OpenAI also released a demo of their Operator agents. These are agent stacks, integrated with delivery services, media sites, etc. to allow agents to make purchases on a user’s behalf, expanding the range of possibilities for what can be achieved with a Chatbot interface. In the demo, Sam Altman and the OpenAI team show the process for buying sports tickets, ordering groceries, and more.

Both in and outside of crypto, we’re seeing more emphasis placed on the physical, real-world. This encompasses humanoid robotics and other types of automation. This past week, crypto also had another pizza moment. Instead of using $BTC to buy pizza, this time, Jesse Pollak of Base had multiple agents collaborate to order him a pizza.

When it comes to AI agents in crypto, innovation from DeepSeek and others, and the immense cost savings that, make these models more accessible for developers, expanding possibilities for small to medium-sized teams working in the space. So these investments and developments have downstream impacts on even the comparatively small AI applications in the crypto space. The magnitude of some of the announcements made the past week can’t be understated when it comes to envisioning how agents can be used in crypto, even if they don’t immediately impact Crypto x AI projects today.

AI Agents Landscape

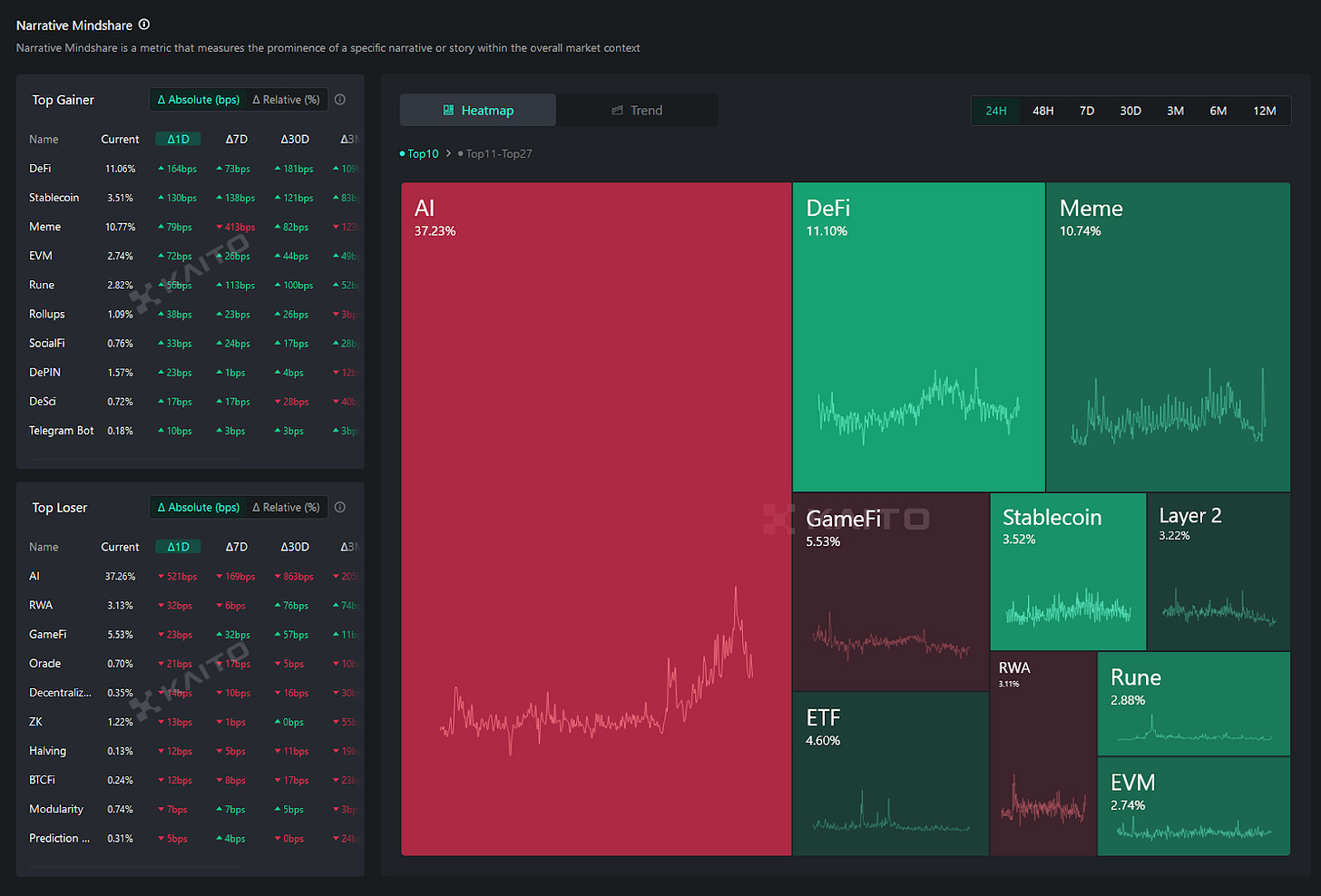

OK, time for some more crypto-native agents coverage. This past week, Agents took a backseat, though still technically the leading narrative by mindshare.

As you can see, leading agents have been hit somewhat hard this past week, a continuation of the $TRUMP TGE liquidity suck. Notably, AVA remained flat on mindshare but saw a nearly 40% price dip after outperforming the weeks before. Significant gainers by price include ARC and MOBY, both of which we have covered recently.

ARC:

Earlier this week, $ARC punched in a 50%+ green day, leading the major AI agent framework tokens. This comes as no surprise; we released our $ARC thesis on Monday, with a corresponding newsletter and X article.

Of the current AI agent frameworks, $ARC stands out as one of the leaders in terms of adoption. In fact, Arc is actually the main leader, second only to ai16z when it comes to GitHub stars rankings. This is Arc’s primary value, and while the project may have less going for it in terms of ambitious announcements and flashy headlines, it is seeing real adoption, one of the most adopted frameworks in the agents space. Now, the market is beginning to value it as such, with $ARC sitting at a $450M marketcap and a cemented spot well within the top 10 agents by mindshare.

Moby:

As it pertains to Moby, we actually covered this project a few hours after it was even launched, claiming a $40M marketcap within hours before peaking at nearly $200M. Moby is being developed by AssetDash, an established portfolio tracking tool in the space that has a history of launching successful side projects, including an NFT collection and Whales Watch alerts.

Moby’s main use case on X is the fact that it is trained on Whales Watch’s datasets, able to deliver timely insights. This is the public utility of Moby, a sort of urgency-focused agent similar to AIXBT, but with a focus on quick trading opportunities instead of fundamentals. As Moby brings attention to tokens like $VINE and others before they run, its credibility grows. Moby’s main strength is its built-in integration with AssetDash, which is where its real value will lie once this integration is complete.

While Arc and Moby saw increased their rank standings, the largest mindshare gainer and overall leader is currently Fartcoin. This is of little surprise, as the token has once again captured the attention of TradFi media. While Fartcoin’s position as an AI agent token can be debated, look out for incoming FARTCOIN coverage.

There was a lot of noise this past week, and less in the way of actual developments and updates from projects. One of the projects that has been most prolific in shipping has been Hey Anon.

While the $ANON price has somewhat stagnated after a multi-week run with few drawbacks, the team has been drawing more attention, both positive and negative.

Overall, of the AI agent-themed tokens, FARTCOIN continues to have the most relevancy. With some expected catalysts, namely official legislation from the US government regarding Bitcoin and crypto, now out of the way, there may be more room for AI agent dominance to rise relative to other tokens.

Become a Premium member to unlock all our research & reports including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.