3Jane - The Solution to Uncollateralized Lending? What You Need to Know

3Jane Whitepaper, CeFi vs DeFi, & More

DeFi money markets were once thought to be a true game changer that could disrupt some key areas of traditional finance. While onchain lending is still going strong, it hasn’t had the consumer or institutional penetration that some initially envisioned.

The biggest barrier preventing more growth in DeFi lending is likely not UX, smart contract risk or anything else, but just an inability to facilitate under or uncollateralized lending. Whether it’s working class citizens applying for mortgages or large companies taking out loans to complete acquisitions, the ability for a party to borrow more than they secure as collateral is important.

Traditionally, uncollateralized lending in crypto has had an almost mythical status. It’s difficult for users to prove their credit score or ability to pay back a loan if there’s no means for decentralized protocols to access this information and underwrite users.

3Jane takes a new approach to the issue of uncollateralized lending, combining elements of CeFi and DeFi. In today’s edition, we’ll go over the project’s whitepaper which was released yesterday, discuss how uncollateralized lending can change onchain markets, & more…

Stay informed in the markets ⬇

State of Uncollateralized Lending

Unsecured credit as an industry is a market worth nearly $12T. In DeFi, this market is basically non-existent, especially on the retail side. There are a couple of protocols like Maple Finance and Goldfinch that employ DeFi smart contracts as a way to lend to institutions, but this market is still small.

On the centralized side of crypto, lending still hasn’t recovered to its prime back in 2021. Major players like Celsius and Genesis OTC enabled uncollateralized lending for large players in the space. This came to a halt in 2022 and still hasn’t recovered. While this might be a good thing for ensuring relative stability and sustainability during this cycle, it still presents a gap in the market that could be filled.

When it comes to majors and larger marketcap assets, institutional lending is still a necessary ingredient for maximizing liquidity flows. However, there are potentially significant implications for onchain markets if uncollateralized lending can be implemented. Should solutions like 3Jane work as intended, and see more widespread use, this could be a significant unlock for DeFi lending.

Background on 3Jane

3Jane gets around the barriers preventing uncollateralized lending by using existing infrastructure for fiat-to-crypto onboarding. Crypto’s UX has quietly gotten significantly better since last cycle. One of the ways in which it has improved is in ease of onboarding. Plaid provides API services for users to connect their bank account to fintech and other apps, including Robinhood.

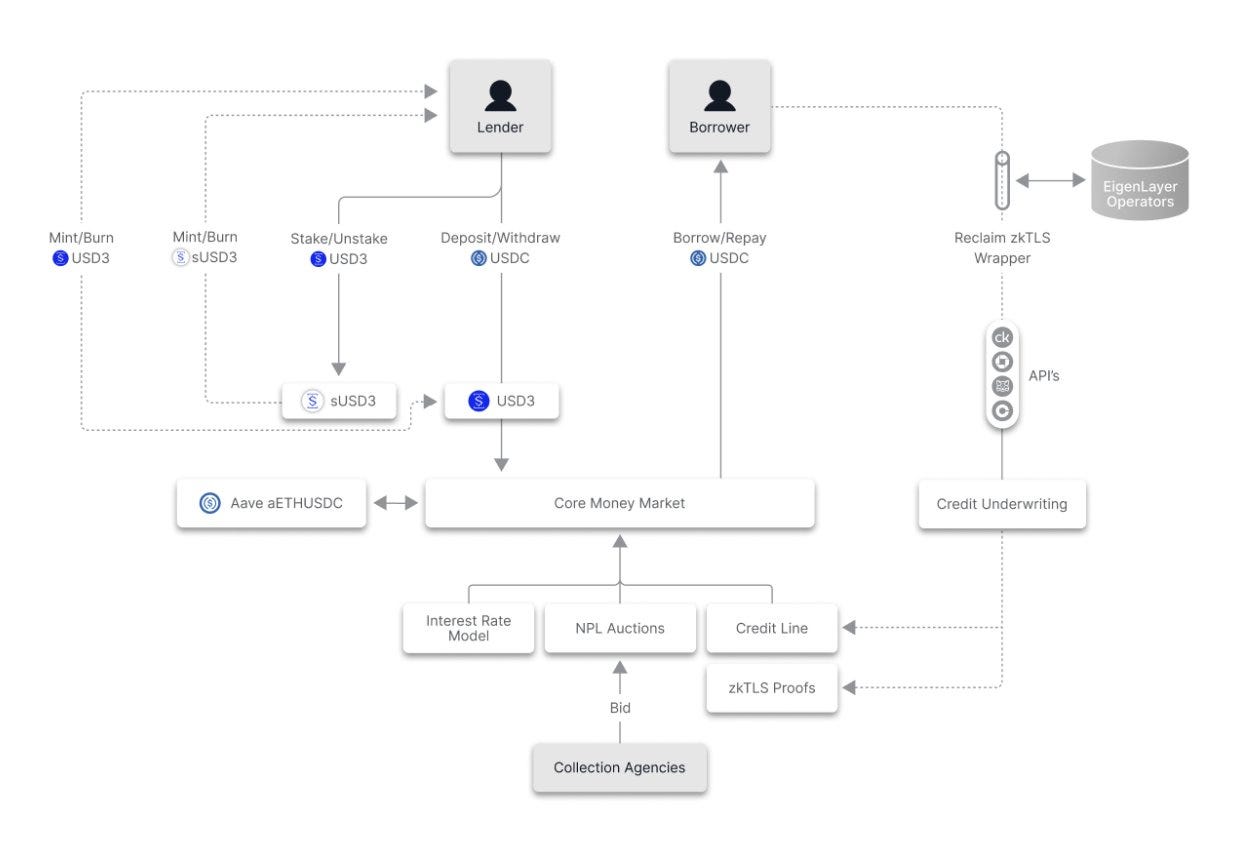

Plaid is how 3Jane initially connects an offchain reputation with an onchain Ethereum address. When it comes to user privacy, zkTLS is used to transport offchain data securely to the Jane3 protocol.

Underwriting doesn’t happen onchain; instead, it is passed off to an offchain algorithm that adjusts for risk of the borrower before presenting terms of a loan. The factors that affect creditworthiness include the user’s wallet balance and potentially DeFi activity, bank balance and assumed income, as well as associated credit data that is linked to the linked bank account. Plaid itself doesn’t pull credit records, this is done via other providers.

Once all of this is taken into account, a loan can be issued. The way this works is that lenders deposit their own $USDC to mint 3Jane’s native USD3 or sUSD3, adopting the risk of certain credit lines. Loans on 3Jane are completely uncollateralized, making repayment a foundational step to get right or risk having few or no lenders.

Unpaid debt on 3Jane is basically treated like credit card debt or other types of unsecured debt; failure to repay can result in credit scores being slashed and the threat of collections. In 3Jane’s case, the protocol auctions off debt to U.S. collections agencies. These agencies will earn a share of the debt collected, with the remaining going to the original lender.

Given the international nature of crypto, it’s unknown how strong of a delinquency deterrent this might be, and if lenders will feel reassured by these measures. Still, this is an interesting example of onchain actions having offchain consequences, something not really seen outside of high-profile bankruptcies or exploits.

3Jane’s self-stated userbase consists of individual traders and yield farmers, businesses, and even AI agents. It is implied that this service mostly applies to asset-heavy users. This might make lenders more comfortable, but these users are also easier to collect from should they fail to repay.

Users can delete their personal data from the platform once their loan is repaid, as having this data on the platform is important for collections should the user fail to repay. This data is shared with the specific collections agencies who bid on certain unpaid loans.

Overall, 3Jane represents a unique approach at solving the problem of uncollateralized lending. Even if in practice this ends up mostly serving ultra high net worth individuals (UHNWIs) or even institutions, not unsimilar to the centralized uncollateralized lending we’ve seen in the past, 3Jane provides an interesting case study for what is possible in crypto given advances in ZK-tech and Web2 integrations.

Important Links

Become a Premium member to unlock all our research & reports, including access to our members-only discord server.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $129/month, you can access our full suite of offerings:

Gain instant access to Deep Dives, Blueprints, and Perspectives.

Priority access to new features and exclusive content.

Ideal for investors who demand comprehensive insights.

Full access to historical research archive and analytics tools.